Ratings for NVIDIA (NASDAQ:NVDA) were provided by 33 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 15 | 13 | 4 | 0 | 1 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 6 | 6 | 1 | 0 | 0 |

| 2M Ago | 2 | 2 | 0 | 0 | 1 |

| 3M Ago | 7 | 4 | 3 | 0 | 0 |

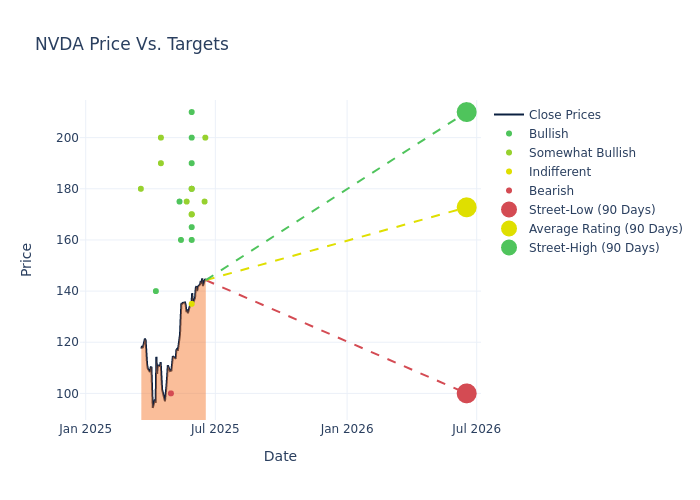

Analysts have set 12-month price targets for NVIDIA, revealing an average target of $166.06, a high estimate of $210.00, and a low estimate of $100.00. This current average represents a 1.52% decrease from the previous average price target of $168.62.

Interpreting Analyst Ratings: A Closer Look

The perception of NVIDIA by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tom O'Malley | Barclays | Raises | Overweight | $200.00 | $170.00 |

| Rick Schafer | Oppenheimer | Maintains | Outperform | $175.00 | $175.00 |

| William Stein | Truist Securities | Raises | Buy | $210.00 | $205.00 |

| Srini Pajjuri | Raymond James | Raises | Strong Buy | $165.00 | $150.00 |

| Harsh Kumar | Piper Sandler | Raises | Overweight | $180.00 | $150.00 |

| Vijay Rakesh | Mizuho | Raises | Outperform | $170.00 | $168.00 |

| Atif Malik | Citigroup | Raises | Buy | $180.00 | $150.00 |

| Joseph Moore | Morgan Stanley | Raises | Overweight | $170.00 | $160.00 |

| Tom O'Malley | Barclays | Raises | Overweight | $170.00 | $155.00 |

| Gil Luria | DA Davidson | Raises | Neutral | $135.00 | $120.00 |

| Kevin Cassidy | Rosenblatt | Raises | Buy | $200.00 | $178.00 |

| Cody Acree | Benchmark | Maintains | Buy | $190.00 | $190.00 |

| Quinn Bolton | Needham | Maintains | Buy | $160.00 | $160.00 |

| Matt Bryson | Wedbush | Maintains | Outperform | $175.00 | $175.00 |

| Vivek Arya | B of A Securities | Raises | Buy | $160.00 | $150.00 |

| Timothy Arcuri | UBS | Lowers | Buy | $175.00 | $180.00 |

| Jay Goldberg | Seaport Global | Announces | Sell | $100.00 | - |

| Joseph Moore | Morgan Stanley | Lowers | Overweight | $160.00 | $162.00 |

| Blayne Curtis | Barclays | Lowers | Overweight | $155.00 | $175.00 |

| Timothy Arcuri | UBS | Lowers | Buy | $180.00 | $185.00 |

| Mark Lipacis | Evercore ISI Group | Maintains | Outperform | $190.00 | $190.00 |

| Kevin Cassidy | Rosenblatt | Lowers | Buy | $200.00 | $220.00 |

| Gil Luria | DA Davidson | Maintains | Neutral | $120.00 | $120.00 |

| Srini Pajjuri | Raymond James | Lowers | Strong Buy | $150.00 | $170.00 |

| Matthew Prisco | Cantor Fitzgerald | Maintains | Overweight | $200.00 | $200.00 |

| Harsh Kumar | Piper Sandler | Lowers | Overweight | $150.00 | $175.00 |

| Matt Bryson | Wedbush | Maintains | Outperform | $175.00 | $175.00 |

| Vivek Arya | B of A Securities | Lowers | Buy | $160.00 | $200.00 |

| Gil Luria | DA Davidson | Lowers | Neutral | $120.00 | $125.00 |

| Atif Malik | Citigroup | Lowers | Buy | $150.00 | $163.00 |

| Joshua Buchalter | TD Cowen | Lowers | Buy | $140.00 | $175.00 |

| Gil Luria | DA Davidson | Lowers | Neutral | $125.00 | $135.00 |

| Cody Acree | Benchmark | Maintains | Buy | $190.00 | $190.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NVIDIA. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of NVIDIA compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for NVIDIA's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of NVIDIA's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on NVIDIA analyst ratings.

Delving into NVIDIA's Background

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

Financial Insights: NVIDIA

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining NVIDIA's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 69.18% as of 30 April, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: NVIDIA's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 42.61%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): NVIDIA's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 23.01%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): NVIDIA's ROA stands out, surpassing industry averages. With an impressive ROA of 15.85%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: NVIDIA's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.12.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Latest Ratings for NVDA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jun 2025 | Barclays | Maintains | Overweight | Overweight |

| Jun 2025 | Oppenheimer | Reiterates | Outperform | Outperform |

| May 2025 | Truist Securities | Maintains | Buy | Buy |

View More Analyst Ratings for NVDA

View the Latest Analyst Ratings

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.