The Boeing Company BA recently secured a modification contract for the 2nd Lot of CH-47F helicopter. The award has been offered by the Army Contracting Command, Redstone Arsenal, AL.

Valued at $24.6 million, the contract is expected to be completed by May 30, 2025.

Importance of CH-47 Chinook

Boeing’s CH-47 Chinook Block II helicopter boasts cutting-edge technologies that are most suitable for heavy-lift mission requirements. Additionally, Block II improves readiness for the U.S. Army and Special Operations warfighters, limits future sustainment costs and provides commonality across the fleet to ensure that the Chinook fleet will be available to serve for decades.

Due to its unrivaled production, maintenance and sustainment cost efficiencies, the helicopter enjoys steady demand. Impressively, its rotor design allows the Chinook to fly at up to 20,000 feet, higher than other helicopters in its class.

Thanks to such remarkable features, BA’s CH-47 helicopter enjoys a solid demand in the combat helicopter market. This can be gauged from the fact that more than 950 Chinooks are currently deployed in 20 countries.

Growth Prospects

Widespread hostilities across the globe, like the ongoing unrest between Israel and Palestine, have prompted nations in recent times to significantly increase their defense spending in an attempt to protect their borders from any sudden assault. In this context, military helicopters that play an integral part in any defense landscape are likely to witness a surge in demand.

Per a report from the Fortune Business Insights firm, the global helicopter market is likely to witness a CAGR of 3.7% over the 2023-2030 period. Boeing is poised to enjoy the perks of the expanding helicopter market due to its established position in manufacturing combat helicopters like AH-64 Apache, CH-47 Chinook and AH-6 little bird.

Other defense primes that may reap the benefits of a likely improvement in the helicopter market have been discussed below.

Airbus EADSY is one of the world's largest suppliers of advanced military helicopters. Some of its military helicopters are H125M, H135, H145M, AS565MBe, H160M, H175M, H215M, H225M, etc.

Airbus boasts a long-term earnings growth rate of 12.4%. The Zacks Consensus Estimate for EADSY’s 2024 sales indicates an improvement of 9.5% from the 2023 reported figure.

Lockheed Martin’s LMT Sikorsky business unit provides military and rotary-wing aircraft to all five branches of the U.S. armed forces, along with military services and commercial operators in 40 nations. Some of LMT’s products are Armed Black Hawk, CH-53K, MH-60R, Defiant X, Raider X, S-97 Raider, FireHawk, etc.

Lockheed boasts a long-term earnings growth rate of 4.2%. The consensus estimate for LMT’s 2024 sales indicates an improvement of 2.4% from the 2023 reported figure.

Textron’s TXT Bell business supplies advanced military helicopters and provides parts and support services to the U.S. government and military customers outside the United States. TXT Bell’s primary U.S. government programs are for the production and support of the V-22 tiltrotor aircraft and H-1 helicopters.

Textron boasts a long-term earnings growth rate of 10.1%. The consensus mark for TXT’s 2024 sales indicates an improvement of 7% from the 2023 reported number.

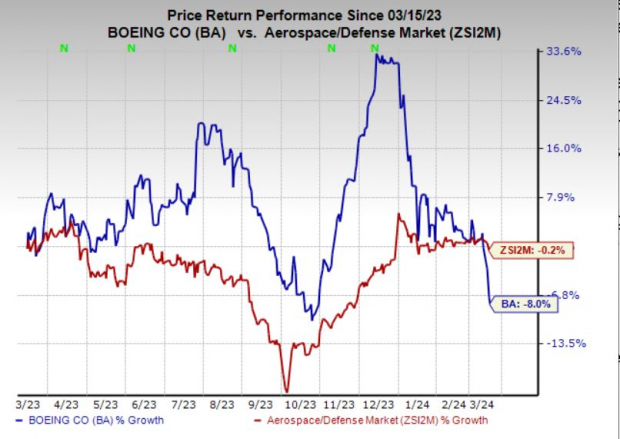

Price Movement

Shares of Boeing have lost 8% in the past year compared with the industry’s 0.2% decline.

Image Source: Zacks Investment Research

Zacks Rank

Boeing currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. They've already closed 162 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.