The Boeing Company BA recently clinched a contract to supply long-lead items for the CH-47 helicopter. The award has been offered by the U.S. Army Contracting Command, Redstone Arsenal, AL.

Valued at $22.5 million, the contract is projected to be completed by Sep 30, 2024.

Importance of CH-47 Chinook

Boeing’s CH-47 Chinook Block II helicopter boasts cutting-edge technologies that are most suitable for heavy-lift mission requirements. Additionally, Block II improves readiness for the U.S. Army and Special Operations warfighters, limits future sustainment costs and provides commonality across the fleet to ensure that the Chinook fleet will be available to serve for decades to come.

Due to its unrivaled production, maintenance and sustainment cost efficiencies, the helicopter enjoys steady demand. 950 Chinooks are being deployed in 20 countries, thus highlighting the solid demand for this helicopter. Boeing may continue to witness a steady flow of contracts involving CH-47 Chinook like the latest one.

Growth Prospects

The tiff between Russia and Ukraine has compelled nations to increase their defense spending to fortify their defense structure against any sudden assault. Increased spending has been witnessed for defense arms and ammunition procurement. In this context, military helicopters that play an integral part in any defense landscape are likely to witness a surge in demand.

Per the GlobeNewswire report, the global rotorcraft market is likely to witness a CAGR of 4% over the 2022-2027 period. Boeing is poised to enjoy the perks of an expanding market due to its established position in manufacturing rotorcraft for the military.

Other defense primes that may reap the benefits of a likely increase in rotorcraft demand are as follows:

Airbus’ EADSY, one of the world's largest suppliers of advanced military helicopters, Airbus Helicopters principal military clients are the Ministries of Defence in Europe, Asia, the United States and Latin America.

Some of EADSY’s military helicopters include H125M, H135, H145M, AS565MBe, H160M, H175M, H215M, H225M, etc.

Lockheed Martin’s LMT Sikorsky business unit provides military and rotary-wing aircraft to all five branches of the U.S. armed forces along with military services and commercial operators in 40 nations.

Some of LMT’s products include Armed Black Hawk, CH-53K, MH-60R, Defiant X, Raider X, S-97 Raider, FireHawk, etc.

Textron’s TXT whole Bell business supplies advanced military helicopters and provides parts and support services to the U.S. government and military customers outside the United States.

TXT Bell’s primary U.S. government programs are for the production and support of the V-22 tiltrotor aircraft and H-1 helicopters.

Price Movement

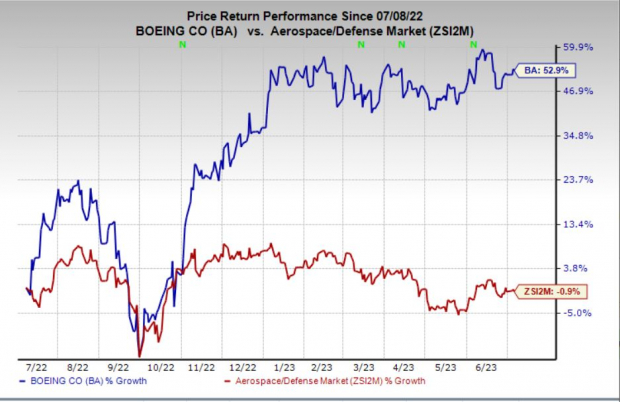

Shares of Boeing have rallied 52.9% in the past year against the industry’s 0.9% fall.

Image Source: Zacks Investment Research

Zacks Rank

Boeing currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>The Boeing Company (BA) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.