BlackRock MuniYield Fund said on May 1, 2023 that its board of directors declared a regular monthly dividend of $0.04 per share ($0.44 annualized). Previously, the company paid $0.04 per share.

Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend. Shareholders of record as of May 15, 2023 will receive the payment on June 1, 2023.

At the current share price of $10.45 / share, the stock's dividend yield is 4.19%.

Looking back five years and taking a sample every week, the average dividend yield has been 4.92%, the lowest has been 4.09%, and the highest has been 6.49%. The standard deviation of yields is 0.51 (n=196).

The current dividend yield is 1.42 standard deviations below the historical average.

The company's 3-Year dividend growth rate is -0.35%.

Learn to Harvest Dividends

Buy Stock. Capture Dividend. Sell Stock. Repeat. This is the essence of dividend harvesting and you can do it easily with Fintel's Dividend Capture Calendar.

What is the Fund Sentiment?

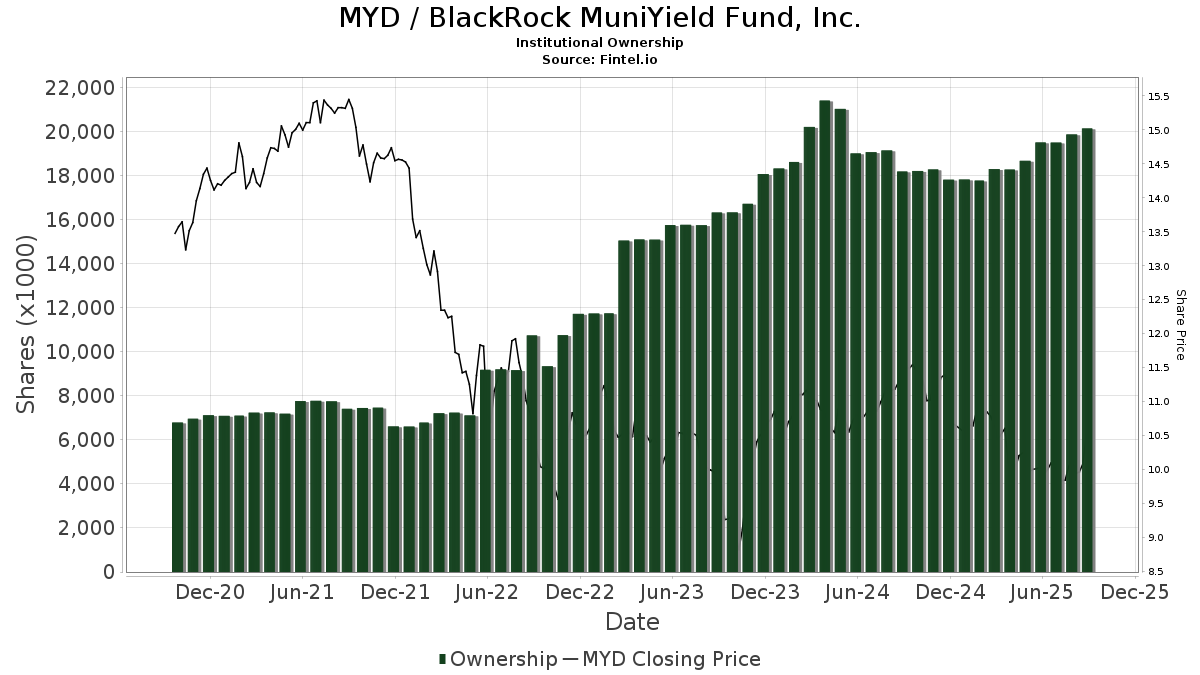

There are 110 funds or institutions reporting positions in BlackRock MuniYield Fund. This is an increase of 13 owner(s) or 13.40% in the last quarter. Average portfolio weight of all funds dedicated to MYD is 0.36%, an increase of 6.09%. Total shares owned by institutions increased in the last three months by 29.48% to 15,095K shares.

What are Other Shareholders Doing?

Karpus Management holds 2,555K shares. In it's prior filing, the firm reported owning 491K shares, representing an increase of 80.77%. The firm increased its portfolio allocation in MYD by 425.10% over the last quarter.

Rivernorth Capital Management holds 1,246K shares. In it's prior filing, the firm reported owning 1,347K shares, representing a decrease of 8.06%. The firm decreased its portfolio allocation in MYD by 2.68% over the last quarter.

Guggenheim Capital holds 873K shares. In it's prior filing, the firm reported owning 774K shares, representing an increase of 11.27%. The firm decreased its portfolio allocation in MYD by 9.76% over the last quarter.

RiverNorth Flexible Municipal Income Fund II holds 662K shares. No change in the last quarter.

Fiera Capital holds 436K shares. In it's prior filing, the firm reported owning 451K shares, representing a decrease of 3.48%. The firm decreased its portfolio allocation in MYD by 47.82% over the last quarter.

BlackRock MuniYield Fund Background Information

(This description is provided by the company.)

MuniYield Fund, Inc. seeks to provide shareholders with as high a level of current income exempt from federal income taxes as is consistent with its investment policies and prudent investment management by investing primarily in a portfolio of long-term, investment-grade municipal obligations the interest on which, in the opinion of bond counsel to the issuer, is exempt from federal income taxes.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.