Biohaven Pharmaceuticals BHVN recently announced that the phase II/III HEALY ALS platform study evaluating verdiperstat for treating Amyotrophic Lateral Sclerosis (ALS) failed.

ALS is a progressive, rare and life-threatening neuromuscular disease characterized by the loss of motor neurons in the brain, brainstem, and spinal cord that leads to progressive muscle weakness and difficulties in speaking, swallowing, and breathing. Per the company, the disease affects approximately 30,000 people in the United States. Presently, there are no approved treatment options and no cure for ALS.

The HEALY ALS study is an adaptive study evaluating multiple investigational treatments simultaneously for the easy and accelerated development of treatment options for ALS patients.

Biohaven evaluated verdiperstat in the study participants with ALS for a period of 24 weeks. The candidate did not exhibit any statistically significant difference in the prescribed primary efficacy outcome, disease progression measured by the ALS Functional Rating Scale-Revised or survival in patients who received the drug compared with a placebo. The candidate also did not exhibit any improvements in the key secondary efficacy measures of the study.

The initial data from the safety analysis of the study was in line with the candidate’s previous studies.

The company continues to conduct additional analyses of the candidate and expects to report results from the complete results at an upcoming scientific meeting.

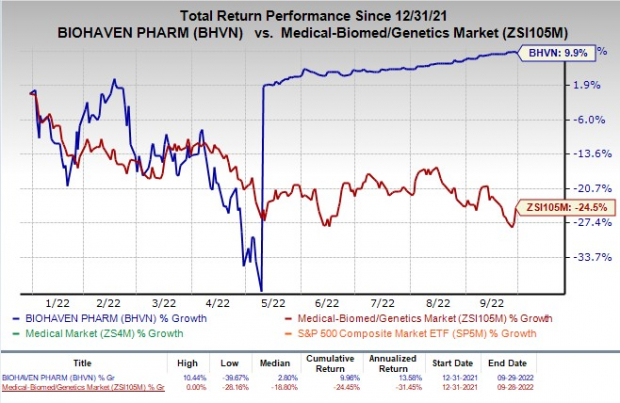

Shares of Biohaven have returned 9.9% in the year-to-date period against the industry’s decline of 24.5%.

Image Source: Zacks Investment Research

Biohaven is a commercial-stage biopharma company focused on developing and commercializing therapies for rare neurological and neuropsychiatric diseases.

Biohaven is also conducting a phase III study evaluating taldefgrobep alfa in Spinal Muscle Atrophy (SMA). In July, the company initiated the enrollment of participants in the SMA phase III study.

Biohaven is among a handful of companies exploring the ALS market. Notably, in the ALS space, there are two companies, namely Amylyx Pharmaceuticals AMLX andIonis Pharmaceuticals IONS, who have made progress in the target market.

Amylyx Pharmaceuticals recently announced that the FDA approved its pipeline candidate, Relyvrio (sodium phenylbutyrate and taurursodiol), for treating ALS in adults. In a randomized placebo-controlled study, Relyvrio significantly slowed down the loss of physical function in adult ALS patients.

Ionis is also developing several candidates for different forms of ALS, including ION363 for ALS, with mutations in the fused in sarcoma gene, or FUS (FUS-ALS), and tofersen, in partnership with Biogen, for superoxide dismutase 1 amyotrophic lateral sclerosis (SOD1-ALS)

In July, the FDA accepted the new drug application (NDA) for Ionis/Biogen’s tofersen in the treatment of SOD1-ALS. The application has also been granted priority review and a decision is expected by Jan. 25, 2023.

Biohaven Pharmaceutical Holding Company Ltd. Price

Biohaven Pharmaceutical Holding Company Ltd. price | Biohaven Pharmaceutical Holding Company Ltd. Quote

Investors should note that Biohaven entered into a definitive contract with Pfizer PFE in May 2022, wherein the latter will acquire the former for an all-cash transaction of $148.50 per share or a total equity value of $11.6 million.

Per the terms of the transaction, Pfizer will acquire Biohaven’s calcitonin gene-related peptide (CGRP) pipeline. With regard to the non-CGRP pipeline, all existing shareholders of Biohaven (including Pfizer) will receive half a share of a new publicly traded company that will retain the company’s non-CGRP programs for every one common share of Biohaven. The new company will continue to operate under Biohaven’s name. The transaction is expected to be complete by early 2023.

Biohaven currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pfizer Inc. (PFE): Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS): Free Stock Analysis Report

Biohaven Pharmaceutical Holding Company Ltd. (BHVN): Free Stock Analysis Report

Amylyx Pharmaceuticals, Inc. (AMLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.