The battle between Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC) has intensified dramatically in recent years. After spending decades behind the power curve, AMD took a technical lead as Intel's progress short-circuited.

However, just because Intel has fallen behind does not mean it is out of the game. Intel still generates more revenue than its competitors. It also remains a continuing force in the industry as it retains clients such as Dell, Lenovo, and HP.

Now, investors need to decide whether the emerging growth name or the longtime tech giant can upload higher investor returns. Let's look at both chip stocks to see which might better suit investors.

The state of both companies

The relationship between AMD and Intel has become defined by a dramatic role reversal. AMD long lagged Intel in the PC market and was left for dead after PCs declined.

However, under CEO Lisa Su, it has staged a dramatic comeback. It has become a formidable competitor to NVIDIA in the GPU market. Among its more notable victories is becoming the chipmaker for Microsoft's new Xbox and the Sony PlayStation 5.

Image source: Getty Images.

Still, its most dramatic victory comes in its technical lead over Intel. AMD now markets 7nm chips, while Intel will not release a 7nm chip until 2022 at the earliest. Additionally, the company that once could produce all of its own chips has had to rely more heavily on Taiwan Semiconductor's fab to meet production goals. CEO Bob Swan said he is also considering outsourcing to produce 7nm chips.

Despite these disappointments, Intel has attempted to redefine itself in today's technology market. Data centers, the Internet of Things, and autonomous cars are among its non-PC business lines. It has also embedded its technology within emerging 5G networks. Time will tell if some of these technologies can spark a revival in Intel stock.

How the financials compare

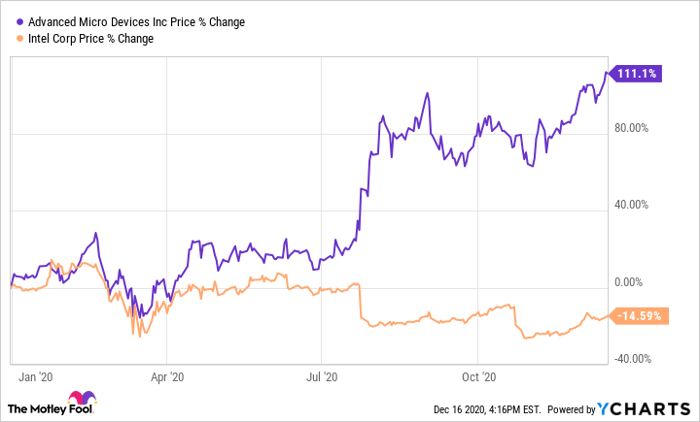

For now, an Intel recovery is not within sight. AMD stock has risen by approximately 110% this year. In contrast, Intel stock has experienced significant latency, as it is down by around 15% for 2020.

As most would probably expect, this has made AMD a more expensive stock. AMD's forward price-to-earnings (P/E) ratio is now approximately 54. This dramatically outpaces Intel's forward multiple of around 11.

Nonetheless, AMD's non-GAAP earnings came in at $0.41 per share in the most recent quarter. This is a 128% increase from year-ago levels. Conversely, Intel's non-GAAP profit of $1.11 per share was a 22% drop over the same period.

However, Intel is in better shape from a financial standpoint than some might assume. For one, it remains a much larger company. Its $18.3 billion in quarterly revenue is 6.5 times the $2.8 billion brought in by AMD. Additionally, Intel's cash flows remain robust. In the first nine months of the year, Intel generated about $15.1 billion in free cash flow.

This allows the company to pay a steadily rising dividend of $1.32 per share, a yield of about 2.6% at current prices. The payout cost the company $4.2 billion over the nine-month period, leaving ample cash to buy back shares or invest back into the company.

AMD has not performed quite as strongly in this regard. Over the same nine-month timeframe, it reported a free cash flow of $297 million. This comes after reporting negative cash flow in the same period last year.

AMD or Intel?

Still, for all of Intel's attributes, AMD is more likely to offer faster growth rates to investors.

Indeed, AMD's investors will have to pay a premium. However, it is the only one of these companies generating significant growth. Moreover, its technical lead means that AMD will remain a force in the semiconductor industry for the foreseeable future.

Intel may retain the client base and the cash flows to remain a force in the industry. Nonetheless, AMD's rising fortunes should offer stronger returns.

10 stocks we like better than Advanced Micro Devices

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Advanced Micro Devices wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of November 20, 2020

Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Will Healy has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Microsoft, NVIDIA, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.