Key Points

Nvidia and Broadcom are each vying for AI computing unit market share.

Taiwan Semiconductor fabricates most chips used in AI.

Microsoft stock looks like a bargain following its earnings report.

- 10 stocks we like better than Nvidia ›

If you've got $5,000 ready to invest that isn't needed for monthly bills or to boost an emergency fund, I've got a list of stocks that look like excellent buys. All of them are key beneficiaries of massive artificial intelligence (AI) spending and look primed to soar throughout this year and many years to come.

I think Nvidia (NASDAQ: NVDA), Broadcom (NASDAQ: AVGO), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Microsoft (NASDAQ: MSFT) all make for excellent buys right now and should crush the market moving forward.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Nvidia

Nvidia, the world's most valuable company (as measured by market cap), has risen to this level thanks to insatiable demand for its graphics processing units (GPUs). These computing units have become the primary option for training and running AI models. Even after the company saw three years of strong growth, 2026 looks like another great one.

Wall Street analysts expect 52% growth for Nvidia in fiscal 2027 (which just began and will end in January 2027). While some investors may be worried about investing in Nvidia's stock right now because an AI bubble may be forming, the reality is far from that. Nvidia is providing the picks and shovels for the AI gold rush. It will do just fine even if the gold rush eventually peters out. With its strong projected growth over multiple years, Nvidia stock is a no-brainer buy for me right now.

Broadcom

One company challenging Nvidia's dominance in the AI chip sector is Broadcom. Instead of launching a competing GPU, Broadcom is taking a different approach. It has designed ASICs (application-specific integrated circuits) that are getting a lot of attention from AI hyperscalers. ASICs optimize the computing unit to handle specific types of workloads (like the ones needed to handle AI calculations). These specialized chips can provide superior performance to GPUs as long as the workload is configured to take advantage of the chip's design. It also helps that the chips tend to be less expensive.

With AI hyperscalers looking to maximize their unlimited spending power, these ASIC chips are starting to become more popular. For the first quarter, Broadcom expects its AI semiconductor revenue to double year over year -- far faster than Nvidia's growth rate. While Broadcom's chips won't fully replace GPUs, they could steal some of Nvidia's market share, although there is plenty of room for each company to succeed.

Taiwan Semiconductor Manufacturing (TSMC)

TSMC is a key player in the AI realm due to its leading chip foundry capabilities. Nobody has the technology and capacity that TSMC has to manufacture the chips that companies like Nvidia and Broadcom design, so it has become the go-to foundry for nearly every computing company competing in the AI arms race. This makes TSMC a great neutral way to play the AI build-out.

As long as there is increased AI spending, TSMC's stock will do well. With most projections estimating that AI spending will stay elevated through at least 2030, TSMC is in a great position. Wall Street analysts expect 31% growth this year and 22% next year as measured in New Taiwan dollars. While currency effects will affect these growth results somewhat, they are still excellent results and make the stock worth buying today.

Microsoft

Microsoft operates on both sides of the AI market, tapping into AI application use as well as infrastructure. Its cloud computing platform, Azure, is seeing solid market share growth as well as rapid revenue growth as a result. During fiscal 2026's second quarter (ending Dec. 31, 2025), Azure's revenue rose an impressive 39% year over year. Microsoft still has a $625 billion backlog in this business unit, so there is still plenty of growth in store for Azure.

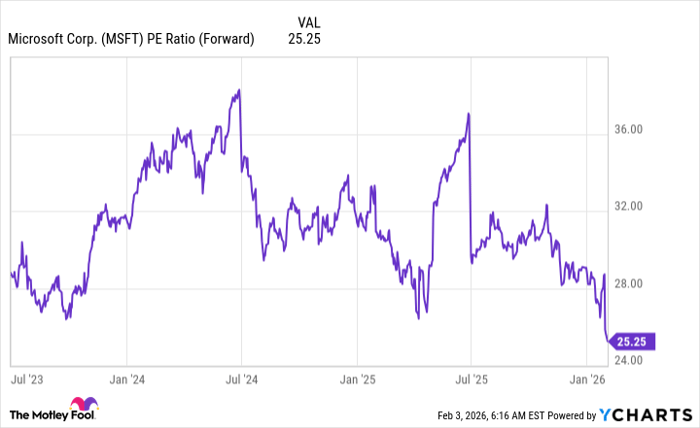

However, the market was unimpressed by some aspects of Microsoft's quarter, which caused the stock to tumble. Now it trades for 25 times forward earnings, the lowest levels it has seen in some time.

Data by YCharts.

I think this presents a rare buying opportunity for Microsoft stock, and investors should use this temporary sell-off to their advantage and scoop up shares now.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 7, 2026.

Keithen Drury has positions in Broadcom, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.