Fintel reports that on June 1, 2023, BERENBERG upgraded their outlook for DiaSorin (MTA:DIA) from Hold to Buy .

What is the Fund Sentiment?

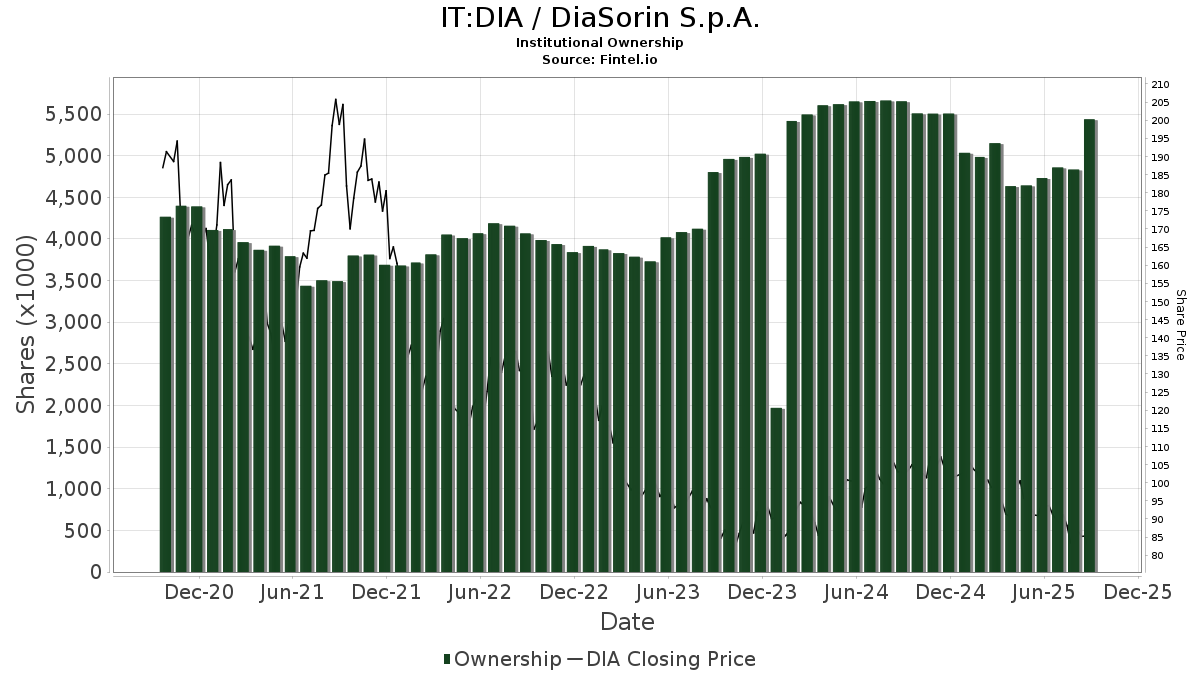

There are 218 funds or institutions reporting positions in DiaSorin. This is a decrease of 7 owner(s) or 3.11% in the last quarter. Average portfolio weight of all funds dedicated to DIA is 0.15%, a decrease of 13.24%. Total shares owned by institutions increased in the last three months by 4.92% to 4,019K shares.

What are Other Shareholders Doing?

PRITX - T. Rowe Price International Stock Fund holds 641K shares representing 1.20% ownership of the company. In it's prior filing, the firm reported owning 555K shares, representing an increase of 13.37%. The firm decreased its portfolio allocation in DIA by 10.32% over the last quarter.

VGHCX - Vanguard Health Care Fund Investor Shares holds 552K shares representing 1.03% ownership of the company. No change in the last quarter.

AIM INTERNATIONAL MUTUAL FUNDS (INVESCO INTERNATIONAL MUTUAL FUNDS) - Invesco Oppenheimer International Small-Mid Company Fund Class R6 holds 334K shares representing 0.62% ownership of the company. In it's prior filing, the firm reported owning 391K shares, representing a decrease of 16.81%. The firm decreased its portfolio allocation in DIA by 20.55% over the last quarter.

SMCWX - SMALLCAP WORLD FUND INC holds 309K shares representing 0.58% ownership of the company. In it's prior filing, the firm reported owning 2K shares, representing an increase of 99.39%. The firm increased its portfolio allocation in DIA by 11,448.14% over the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 291K shares representing 0.54% ownership of the company. In it's prior filing, the firm reported owning 297K shares, representing a decrease of 2.00%. The firm decreased its portfolio allocation in DIA by 16.82% over the last quarter.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.