Fintel reports that on August 9, 2023, Benchmark maintained coverage of HNI (NYSE:HNI) with a Buy recommendation.

Analyst Price Forecast Suggests 22.72% Upside

As of August 2, 2023, the average one-year price target for HNI is 35.70. The forecasts range from a low of 34.34 to a high of $37.80. The average price target represents an increase of 22.72% from its latest reported closing price of 29.09.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for HNI is 2,188MM, a decrease of 1.00%. The projected annual non-GAAP EPS is 1.66.

HNI Declares $0.32 Dividend

On May 15, 2023 the company declared a regular quarterly dividend of $0.32 per share ($1.28 annualized). Shareholders of record as of June 9, 2023 received the payment on June 23, 2023. Previously, the company paid $0.32 per share.

At the current share price of $29.09 / share, the stock's dividend yield is 4.40%.

Looking back five years and taking a sample every week, the average dividend yield has been 3.62%, the lowest has been 2.66%, and the highest has been 5.89%. The standard deviation of yields is 0.68 (n=235).

The current dividend yield is 1.14 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.78. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.05%, demonstrating that it has increased its dividend over time.

What is the Fund Sentiment?

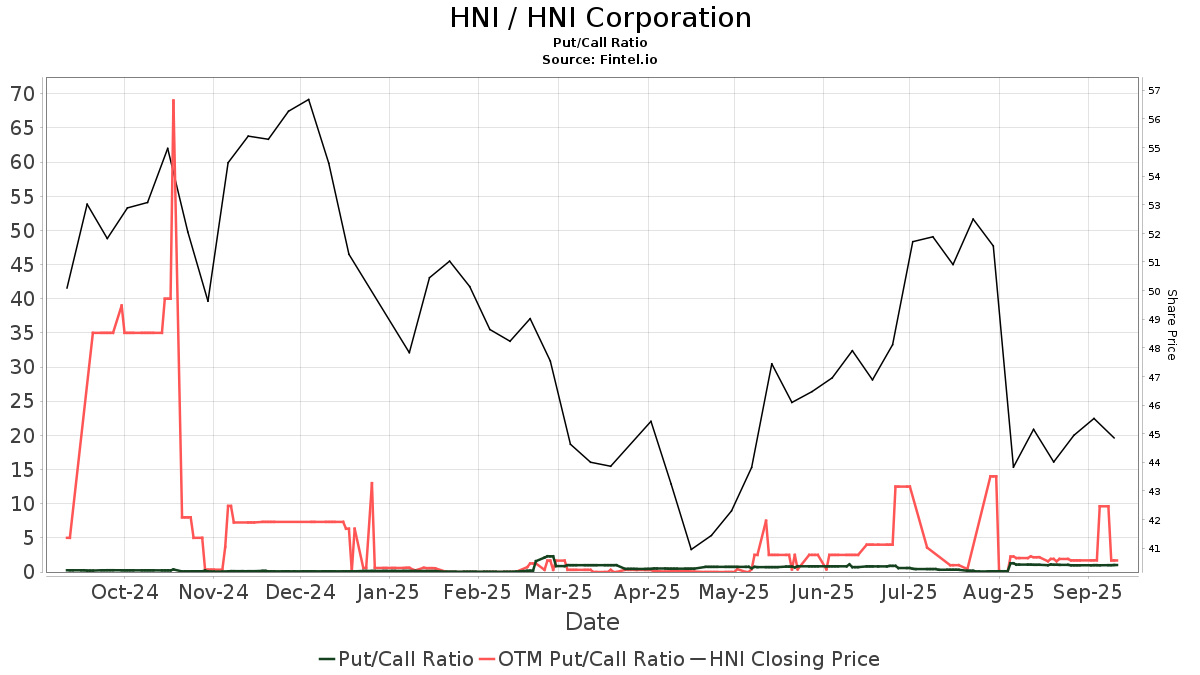

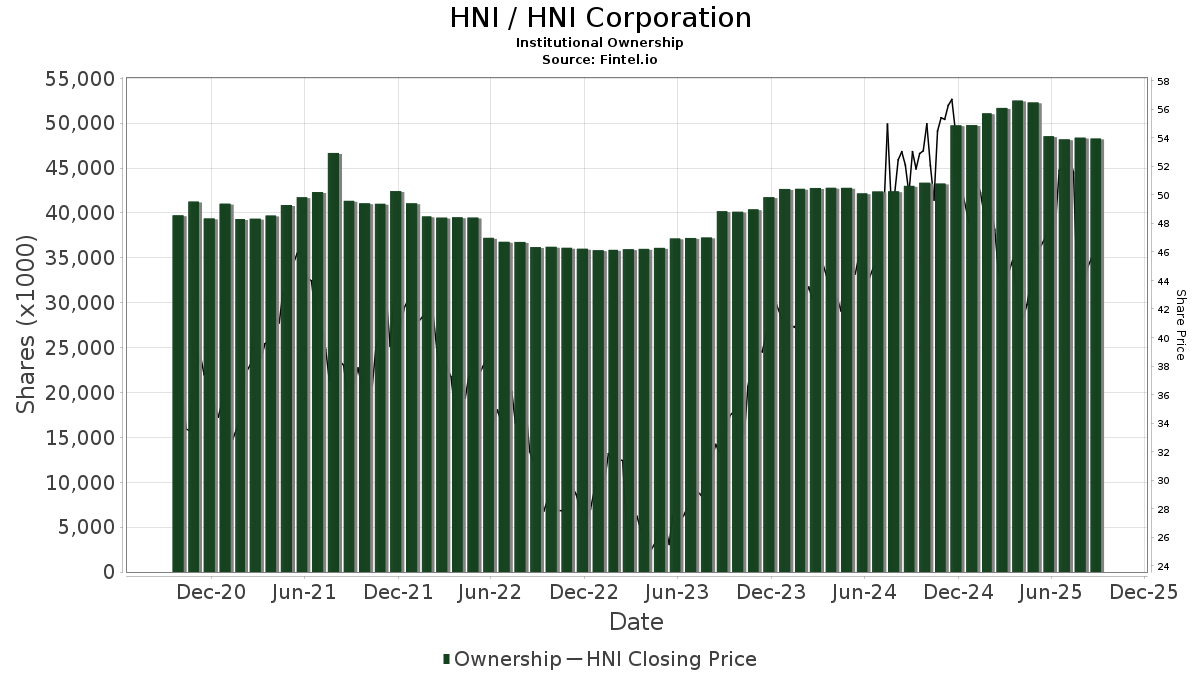

There are 451 funds or institutions reporting positions in HNI. This is an increase of 7 owner(s) or 1.58% in the last quarter. Average portfolio weight of all funds dedicated to HNI is 0.08%, a decrease of 11.19%. Total shares owned by institutions increased in the last three months by 3.13% to 37,386K shares.  The put/call ratio of HNI is 2.89, indicating a bearish outlook.

The put/call ratio of HNI is 2.89, indicating a bearish outlook.

What are Other Shareholders Doing?

State Farm Mutual Automobile Insurance holds 4,030K shares representing 9.66% ownership of the company. No change in the last quarter.

IJR - iShares Core S&P Small-Cap ETF holds 3,017K shares representing 7.23% ownership of the company. In it's prior filing, the firm reported owning 3,065K shares, representing a decrease of 1.62%. The firm decreased its portfolio allocation in HNI by 6.37% over the last quarter.

Northern Trust holds 2,206K shares representing 5.29% ownership of the company. In it's prior filing, the firm reported owning 2,155K shares, representing an increase of 2.31%. The firm decreased its portfolio allocation in HNI by 5.30% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 1,275K shares representing 3.06% ownership of the company. In it's prior filing, the firm reported owning 1,149K shares, representing an increase of 9.84%. The firm increased its portfolio allocation in HNI by 0.29% over the last quarter.

Invesco holds 1,202K shares representing 2.88% ownership of the company. In it's prior filing, the firm reported owning 283K shares, representing an increase of 76.46%. The firm decreased its portfolio allocation in HNI by 63.32% over the last quarter.

HNI Background Information

(This description is provided by the company.)

HNI is a leading global provider and designer of office furniture and the nation's leading manufacturer and marketer of hearth products. HNI sells the broadest and deepest selection of quality office furniture solutions available to meet the needs of every customer through an extensive portfolio of well-known and trusted brands. Its hearth products are the strongest, most respected brands in the industry and include a full array of gas, electric, wood and biomass burning fireplaces, inserts, stoves, facings and accessories.

Additional reading:

- HNI Corporation 600 East Second Street, Muscatine, Iowa 52761, Tel 563 272 7400, Fax 563 272 7347, www.hnicorp.com

- HNI CORPORATION UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF OPERATIONS FOR THE TWELVE MONTHS ENDED DECEMBER 31, 2022

- FIRST ADDITIONAL LOAN AMENDMENT TO TERM LOAN CREDIT AGREEMENT

- Execution Version FIRST ADDITIONAL LOAN AMENDMENT TO FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

- HNI Corporation 600 East Second Street, Muscatine, Iowa 52761, Tel 563 272 7400, Fax 563 272 7217, www.hnicorp.com

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.