Xerox Company Overview

Zacks Rank #5 (Strong Sell) Xerox (XRX) is a Fortune 500 company recognized for its groundbreaking contributions to the printing, scanning, and photocopy technology industry. Beyond its digital printing machines, Xerox also provides document management solutions, workflow automation and IT support to help companies optimize their operations.

Xerox Suffers from a Digital World

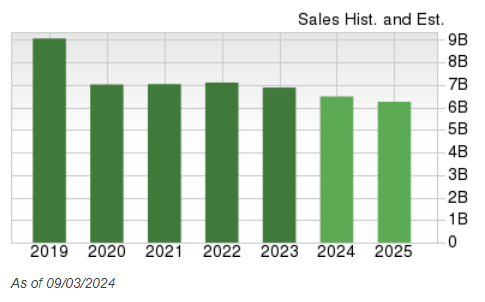

Xerox was once so dominant in the photocopy and scanning business that the company’s name became a verb. Instead of saying that they would fax something, people began to say they would “Xerox” it over. Though Xerox is still a leader in the traditional print, copy, and scanning business, it has consistently shrunk in recent years due to technological advances. The world has gone digital, and technology has advanced precipitously over the past twenty years.

Gone are the days of needing a bulky machine to scan documents. Today, anyone can quickly scan a document within seconds using their Apple (AAPL) iPhone or Google (GOOGL) Android devices. Meanwhile, software services like DocuSign (DOCU), which allows companies and individuals to manage electronic agreements with electronic, have cropped up and continue to eat into Xerox’s business. Finally, digitization has only increased as more employees work from home following the fallout of the COVID-19 pandemic. As a result, the company’s sales have been stagnant for several years.

Image Source: Zacks Investment Research

Xerox’s Business has Been Commoditized

Several companies, such as HP (HPQ), Canon, and Lexmark, have entered the printing business and are proving formidable competition for XRX. Investors can recognize the impact of competition by viewing a chart of Xerox’s gross margins, which have steadily decreased over the past few years.

Image Source: Zacks Investment Research

Xerox Continues to Fall Short of Wall Street Expectations

Xerox is suffering from “caretaker management,” which occurs when an older (and often successful) company is run by a management team that is content with the status quo and is risk averse. The lack of innovation coupled and the slowdown in Xerox’s one-dimensional business is evident in the company’s earnings surprise history. XRX has fallen short of Zacks Consensus Estimates for three out of the past four quarters, with an average surprise of -25.39%. In other words, expectations are low, yet the company continues to fall short of them.

Image Source: Zacks Investment Research

Relative Weakness & Opportunity Cost of Holding XRX

If you purchased XRX 25 years ago, you would be down more than 80% (the S&P is up nearly 800% over this period). With 25 years of lackluster price action, relative weakness, and a lack of bullish catalysts, there is little to be excited about.

Image Source: Zacks Investment Research

Bottom Line

Xerox suffering from new technology, increased competition, falling sales, and shrinking margins. To make matters worse, management is doing little to innovate and the company continues to fall short of Wall Street Expectations.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>Apple Inc. (AAPL) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Xerox Holdings Corporation (XRX) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Docusign Inc. (DOCU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.