Tractor Supply Company TSCO is seeing pressures on the rural consumer. This Zacks Rank #5 (Strong Sell) is expected to see single digit earnings growth this year.

Tractor Supply is the largest rural retailer in the United States, serving the needs of recreational farmers, ranchers, homeowners, gardeners and pet enthusiasts. In addition to Tractor Supply, it also owns Petsense by Tractor Supply, a pet specialty retailer, and Allivet, an online pet and animal pharmacy.

As of Dec 27, 2025, it operated 2,395 Tractor Supply stores in 49 states and 207 Petsense by Tractor Supply stores in 23 states.

Tractor Supply Missed on Earnings in the Fiscal Fourth Quarter 2025

On Jan 29, 2026, Tractor Supply reported its fiscal fourth quarter 2025 results and missed on the Zacks Consensus Estimate by $0.03. Earnings were $0.43 versus the Zacks Consensus of $0.46.

This was the second miss in the last four quarters.

Fourth Quarter sales rose 3.3% to $3.9 billion with the all-important comparable store sales staying positive, rising 0.3%. But this was slower growth than in the prior year’s fourth quarter, where comparable sales rose 0.6%.

There were positives and negatives in the comparables. The consumable, usable and edible products saw continued strength which was only partially offset by the lack of emergency-response-related demand and ongoing pressure in discretionary categories including big ticket products.

“Our fourth quarter results came in below our expectations and reflected a shift in consumer spending, with essential categories remaining resilient while discretionary demand moderated,” said Hal Lawton, CEO of Tractor Supply.

Tractor Supply Gives Disappointing Fiscal 2026 Guidance

The company is looking for positive comparable sales in fiscal 2026 of 1% to 3%. Comparable sales were up 1.25% in fiscal 2025.

Net sales are expected to be up in the double digits, in the range of 4% to 6%.

Fiscal 2026 earnings are forecast to be between $2.13 and $2.23. This was under the Zacks Consensus Estimate.

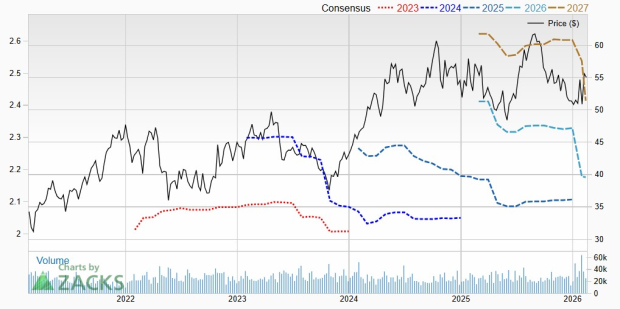

As a result, the analysts cut their earnings estimates to get in line with the Company’s guidance.

Eleven estimates were cut for fiscal 2026 in the last 30 days, with one estimate even cut in the last seven days. The Zacks Consensus has fallen to $2.18 from $2.33.

That’s earnings growth of 5.8% as Tractor Supply made $2.06 in fiscal 2025.

Seven estimates were also cut for fiscal 2027 in the last month, with one cut in the last week as well. The fiscal 2027 Zacks Consensus Estimate has fallen to $2.41 from $2.60 in the last month.

That’s still earnings growth of 10.6%.

The Zacks Rank of Strong Sell occurs when analysts are in agreement and are cutting their earnings estimates. With Tractor Supply, no analysts are raising their estimates. They are only cutting.

This is what it looks like on the price and consensus chart.

Image Source: Zacks Investment Research

Is Tractor Supply a Deal?

Over the last month, Tractor Supply shares have been on a wild ride. If you’ve held on, they are up compared to the S&P 500.

Image Source: Zacks Investment Research

Over the last year, however, the shares have fallen 3.4% while the S&P 500 is up 11.8%.

Is TSCO a deal?

Tractor Supply trades with a forward price-to-earnings (P/E) ratio of 25.2. A P/E under 15 usually indicates a company is a value. It’s not a cheap stock.

Tractor Supply is shareholder friendly, however. It has a share repurchase program and expects to do $375 million to $450 million in fiscal 2026.

On Feb 11, 2026, Tractor Supply announced that its Board of Directors had increased its dividend by 4.3% year-over-year, or $0.04, to $0.96 per share annually.

This was the company’s 17th consecutive year of a dividend increase. It’s yielding 1.7% after the increase.

Tractor Supply’s fiscal 2026 outlook was disappointing. With all the questions about the consumer, investors might want to wait on the sidelines until the earnings estimates turn around.

Beyond Nvidia: AI's Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren't likely to keep delivering the biggest profits. Little-known AI firms tackling the world's biggest problems may be more lucrative in the coming months and years.

SeeTractor Supply Company (TSCO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.