Goodyear Tire Company Overview

The Goodyear Tire & Rubber Company (GT) is one of the largest tire manufacturing companies in the world. In addition to its massive consumer tire business, the Zacks Rank #5 (Strong Sell) company produces other rubber-related chemicals and specialty tires for off-road, aviation, and racing applications. Goodyear Tire employs nearly 70,000 people and derives the majority of its revenue (~60%) from North America. However, it develops, manufactures, distributes, and sells tires throughout the Americas, the Middle East, Europe, Africa, and the Asia Pacific.

Tariffs to Increase Costs

Though roughly half of Goodyear’s business is in North America, the Trump administration’s tariff policy is hurting the company. The company faces tariffs on consumer tires, imported raw materials, and commercial tariffs. Altogether, Goodyear estimates that these tariffs will result in an annual cost of around $350 million. Raw material costs are expected to rise by approximately $50 million in the third quarter, and they are seen as ballooning to a $180 million headwind in the fourth quarter.

Goodyear Costs are Rising

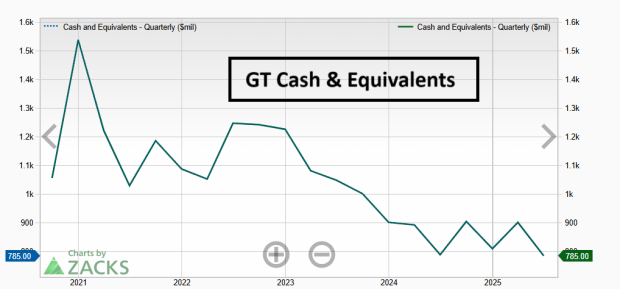

Goodyear is in the process of retooling and making necessary technology changes that will lead to 2025 CAPEX spending of ~$900 million. The increased spending, a result of more complex tire designs, is leading to decreasing cash flows.

Image Source: Zacks Investment Research

GT Suffers from Declining Sales Volumes

This year, Goodyear expects to sell fewer tires year-over-year worldwide because US wholesalers already have sufficient tires in stock. Meanwhile, demand is stagnant overseas, with a stagnant Asia-Pacific economic environment. In addition, Goodyear produced fewer tires in the second quarter, meaning that the company will have a more difficult time spreading its fixed costs, leading to an expected extra $50 million in costs.

GT Suffers from Relative Weakness

GT shares are long-term underperformers. Over the past 5 years, the stock has been down 10%, while the S&P 500 Index has nearly doubled!

Image Source: Zacks Investment Research

Bottom Line

While Goodyear remains a global leader in tire manufacturing, the company faces significant headwinds, including rising tariff costs, declining sales, and relative price weakness.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>The Goodyear Tire & Rubber Company (GT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.