DXC Technology (DXC) has struggled to gain traction in recent years, as persistent revenue declines and a sluggish business transformation have weighed heavily on both its fundamentals and its stock price. Once a major player in IT services, the company has seen its sales fall steadily, leading to stagnation and underperformance in a sector that’s otherwise full of innovation and growth.

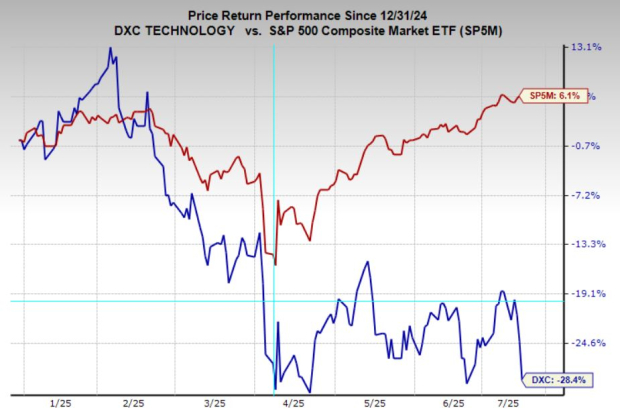

The stock has dropped nearly 30% year-to-date and is down more than 65% since 2021, reflecting a prolonged period of investor disappointment. Analyst sentiment has continued to deteriorate as well, pushing DXC down to a Zacks Rank #5 (Strong Sell) rating.

While management has laid out a strategy to pivot away from legacy infrastructure services and toward higher-growth digital and cloud offerings, the turnaround has been slow to materialize. There may be potential in the longer term, but for now, the company remains in a difficult position. Until investors see clear signs of stabilization and renewed growth, DXC is a stock best left on the sidelines.

Image Source: Zacks Investment Research

DXC Technology Stock Falls Alongside Revenue

DXC Technology's prolonged decline in revenue continues to be a major overhang for the stock. Annual sales have dropped significantly—from approximately $22 billion in 2018 to just $12.8 billion over the trailing twelve months, a nearly 42% decline that reflects the company’s struggle to transition away from its legacy business model.

Unfortunately, the outlook doesn’t suggest a turnaround is imminent. Analysts expect revenue to decline another 4.5% in the current fiscal year, followed by an additional 2.8% decline next year, indicating that demand for DXC’s core offerings remains under pressure despite management’s transformation efforts.

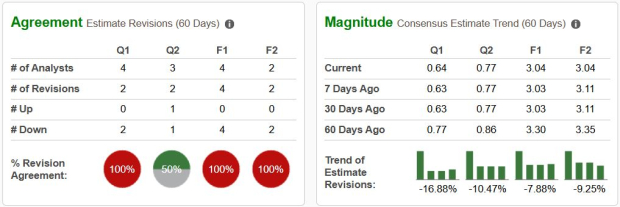

Adding to the bearish case, analyst sentiment around profitability has worsened. Over the past 60 days, consensus earnings estimates have been revised downward—current year EPS estimates have fallen by 7.9%, while next year’s projections have dropped by 9.3%. This steady erosion of expectations signals broad skepticism among analysts and institutional investors about the company’s near-term ability to stabilize or grow earnings.

Image Source: Zacks Investment Research

DXC Stock on the Verge of a Breakdown

Technical weakness is compounding DXC Technology’s fundamental challenges, with selling pressure intensifying in recent sessions. On Friday, the stock was hit particularly hard, closing sharply lower with bearing mometnum pickin up. Shares are now hovering just above a critical support level near $14.20.

If DXC fails to hold this level, it could trigger a technical breakdown, opening the door to another wave of selling. A decisive move below this support zone would confirm the downtrend and could send the stock cascading to new multi-year lows. With no strong bullish catalysts in sight, the path of least resistance appears to be lower unless a significant reversal develops soon.

Image Source: TradingView

Should Investors Avoid DXC Stock?

Given its declining fundamentals, weakening technical setup, and continued negative analyst sentiment, DXC remains a high-risk name with limited near-term upside. Until the company proves it can stabilize revenue and execute its transformation strategy more effectively, investors are likely better off staying on the sidelines.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpDXC Technology Company. (DXC) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.