There tends to be an abundance of opportunity for construction sector stocks during the peak summer season, but Champion Homes SKY may be one with more downside risk ahead.

As a designer of manufactured homes and recreational vehicles (RVs), Champion Homes has a proven niche in its space but is facing increased competition from other modular housing companies like Clayton Homes and Cavo Industries’ CVCO Fleetwood Homes.

This, coupled with higher interest rates, has led to lower margins that have started to deflate investor sentiment. Keeping this in mind, Champion Homes stock lands the Zacks Bear of the Day, with it noteworthy that its Zacks Building Products-Mobile Homes and RV Builders Industry is in the bottom 4% of over 240 Zacks industries.

Lackluster Q4 Results & Short Interest Surge

Echoing cause for concern, Champion Homes most recently missed top and bottom-line expectations for its fiscal fourth quarter in May, with a sales and EPS surprise of -1% and -13% respectively.

Although Champion Homes has still posted an average EPS surprise of 25.67% in its last four quarterly reports, news has recently surfaced that the company has experienced a short interest surge, with 3.59 million shares being shorted at the beginning of the month, which is more than 8% of its outstanding shares.

Image Source: Zacks Investment Research

Correlating with the short interest surge, Champion Homes' stock has now dropped more than 30% since its Q4 report to vastly trail the broader market’s 10% rebound and its Zacks Industry’s decline of -6%.

Image Source: Zacks Investment Research

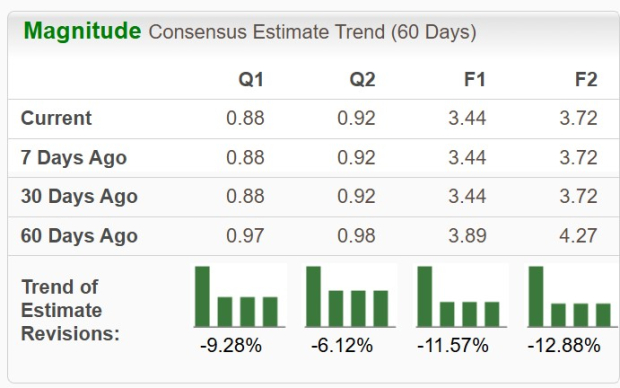

Declining EPS Revisions

Fundamentally, to more downside risk outside of the short interest surge is that earnings estimate revisions for Champion Homes' current fiscal 2026 and FY27 have declined by over 10% in the last 60 days.

Image Source: Zacks Investment Research

The declining EPS revisions have taken away from Champion Homes' reasonable but not necessarily cheap P/E valuation of 19X forward earnings, which is on par with Cavo Industries and their Zacks industry average.

Image Source: Zacks Investment Research

Bottom Line

Considering the decline in EPS revisions, the plausibility of a short squeeze doesn’t look likely for Champion Homes stock, making it one to avoid at the moment, even during peak construction season.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Champion Homes, Inc. (SKY) : Free Stock Analysis Report

Cavco Industries, Inc. (CVCO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.