BayCom Corp BCML announced a hike in the quarterly dividend. The company declared a quarterly cash dividend of 10 cents per share, marking an increase of 100% from the prior payout. The dividend will be paid out on Apr 14 to shareholders of record on Mar 10.

Considering the last day’s closing price of $19.62, BayCom Corp.’s dividend yield currently stands at 2.04%, which is almost on par with the industry average of 2.15%. Not only is the yield attractive for income investors, but it also represents a steady income stream.

BayCom Corp. pays dividends regularly. Apart from this, the company has a share repurchase program in place announced on October 2022 authorizing the company to buy back up to 645,000 shares. As of Dec 31, 2022, it had 480,773 shares remaining under the share repurchase program. We believe such disbursements highlight the company’s operational strength and commitment to enhancing shareholder wealth.

BayCom Corp. has a solid balance sheet position. As of Dec 31, 2022, the company had total debt (comprising of junior subordinated deferrable interest debentures and subordinated debt) of $72.2 million, and cash and cash equivalents of $176.8 million. The company had earnings growth of 7.7% over the past five years. Given a robust liquidity position and decent earnings strength, the bank is expected to continue with efficient capital deployment activities.

BayCom Corp. has been growing through acquisitions as well. In February 2022, it completed the acquisition of Pacific Enterprise Bancorp and expects to expand its operations in California. In 2019, the company closed its acquisition of TIG Bancorp and Uniti Financial Corporation. Also, in 2018, it acquired Bethlehem Financial Corporation. Expanded geographical footprint and product and balance-sheet diversification stemming from such buyouts will likely support the company’s financials.

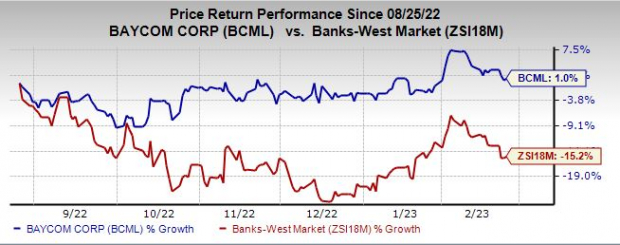

Over the past six months, shares of BayCom Corp. have gained 1% against a decline of 15.2% of the industry it belongs to.

Image Source: Zacks Investment Research

BayCom Corp. currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dividend Hikes by Other Banks

Bank OZK OZK announced a cash dividend of 34 cents per share, marking a 3.03% increase from its prior payout. The dividend was paid out on Jan 24 to shareholders of record as of Jan 17, 2023.

This represents the 50th consecutive quarter of dividend hike by Bank OZK. Prior to this, OZK hiked its dividend by 3.1% to 33 cents per share in October 2022.

Cadence Bank CADE announced a cash dividend of 23.5 cents per share, which represents an increase of 6.8% from the previous dividend payout. The dividend will be paid out on Apr 3 to shareholders of record as of Mar 15, 2023.

Prior to this, CADE hiked its dividend by 9.1% to 24 cents per share in October 2022.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Cadence Bank (CADE) : Free Stock Analysis Report

Bay Commercial Bank (BCML) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.