BASF SE BASFY is set to showcase its VALERAS portfolio’s journey at K 2025. BASFY will highlight how issues of plastic circularity, durability and carbon transparency have been addressed by its additive solutions and services. Since VALERAS’ debut in K 2022, it has advanced sustainability across the plastic lifecycle.

In K 2025, BASFY will feature two innovations, Tinuvin NOR112 to support organic farming and reveal developments in a new hindered amine light stabilizer (“HALS”) solution. The former has been developed to enhance greenhouse film performance against harsh agrochemicals. The NOR portfolio has continued to set such benchmarks in agricultural plastics. Tinuvin NOR 211 AR and 112 AR can handle strong sunlight, heat and chemicals while being cost-effective. Tinuvin NOR 356 offers exceptional durability and performance.

Such innovations with strong resistance to agrochemical contaminants, a dust-free form and the absence of critical hazard labels ensure that BASFY emerges as the most trusted choice in the field of agrochemicals and agricultural film applications.

The K 2025 will also serve as a platform for BASFY to not just showcase innovation but also initiate dialogue with external partners from the industry and internal experts to gain insights and explore solutions to challenges. Additionally, BASFY will also underline successful partnerships that enable transformation across various sectors, such as a closed-loop agricultural packaging solution with Cleanfarms and McKenzie/Snyder, a partnership with Shouman Group that has strengthened Egypt’s plasticulture market and a collaboration with Takazuri Ltd. to create climate-resilient roofing solutions in Eastern Africa.

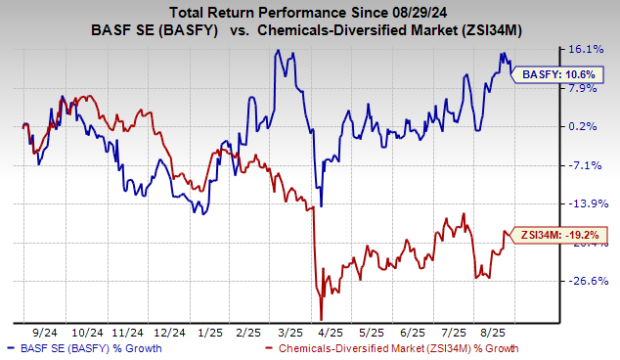

BASFY stock has gained 10.6% over the past year against the industry’s 19.2% decline.

Image Source: Zacks Investment Research

BASFY’s Zacks Rank & Other Key Picks

BASFY currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the Basic Materials space are Agnico Eagle MinesLimited AEM, The Mosaic Company MOS and Carpenter Technology Corporation CRS, each currently sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AEM’s current-year earnings is pegged at $6.94 per share, implying a 64.07% year-over-year surge. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 10.03%. AEM’s shares have gained 72.8% in the past year.

The Zacks Consensus Estimate for MOS’ 2025 earnings is pegged at $3.17 per share, indicating a rise of 60.10% from year-ago levels. The company’s earnings beat the consensus estimate in one of the trailing four quarters, while missing it in the rest. Its shares have soared 20.8% in the past year.

The Zacks Consensus Estimate for CRS’ current fiscal-year earnings is pegged at $9.51 per share, indicating a 27.14% year-over-year increase.Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 8.38%. CRS’ shares have gained 67.9% in the past year.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>BASF SE (BASFY) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.