Fintel reports that on August 3, 2023, Barclays maintained coverage of Radware (NASDAQ:RDWR) with a Overweight recommendation.

Analyst Price Forecast Suggests 55.45% Upside

As of August 2, 2023, the average one-year price target for Radware is 24.89. The forecasts range from a low of 20.20 to a high of $31.71. The average price target represents an increase of 55.45% from its latest reported closing price of 16.01.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Radware is 309MM, an increase of 6.99%. The projected annual non-GAAP EPS is 0.88.

What is the Fund Sentiment?

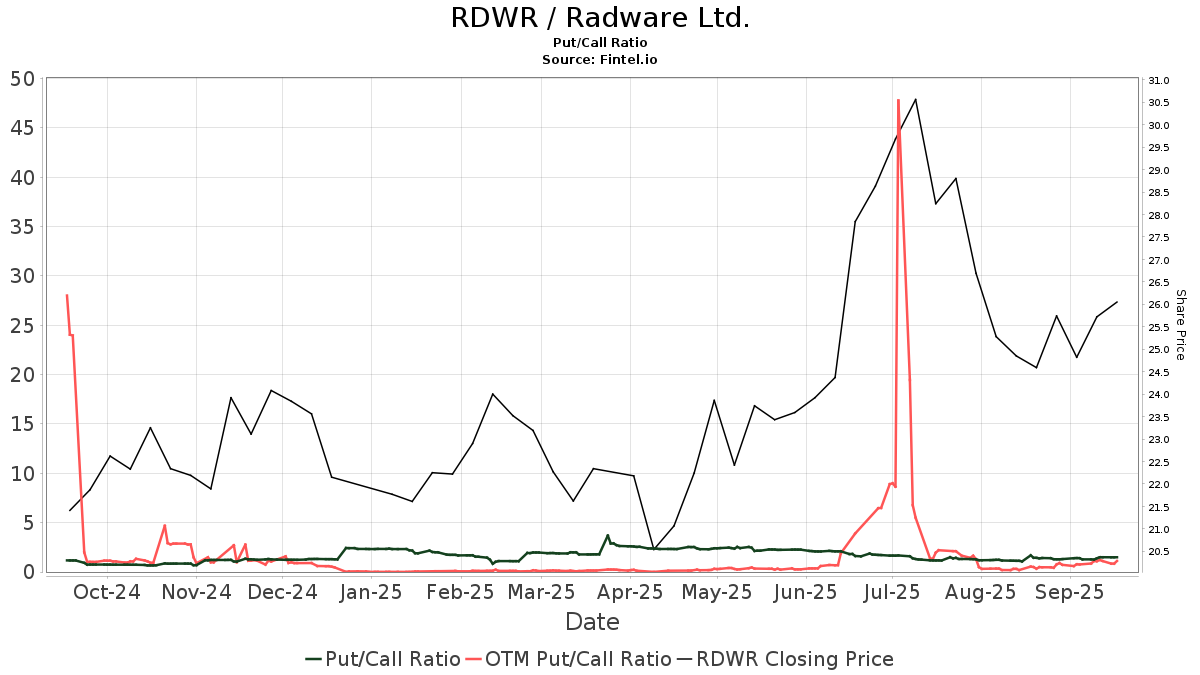

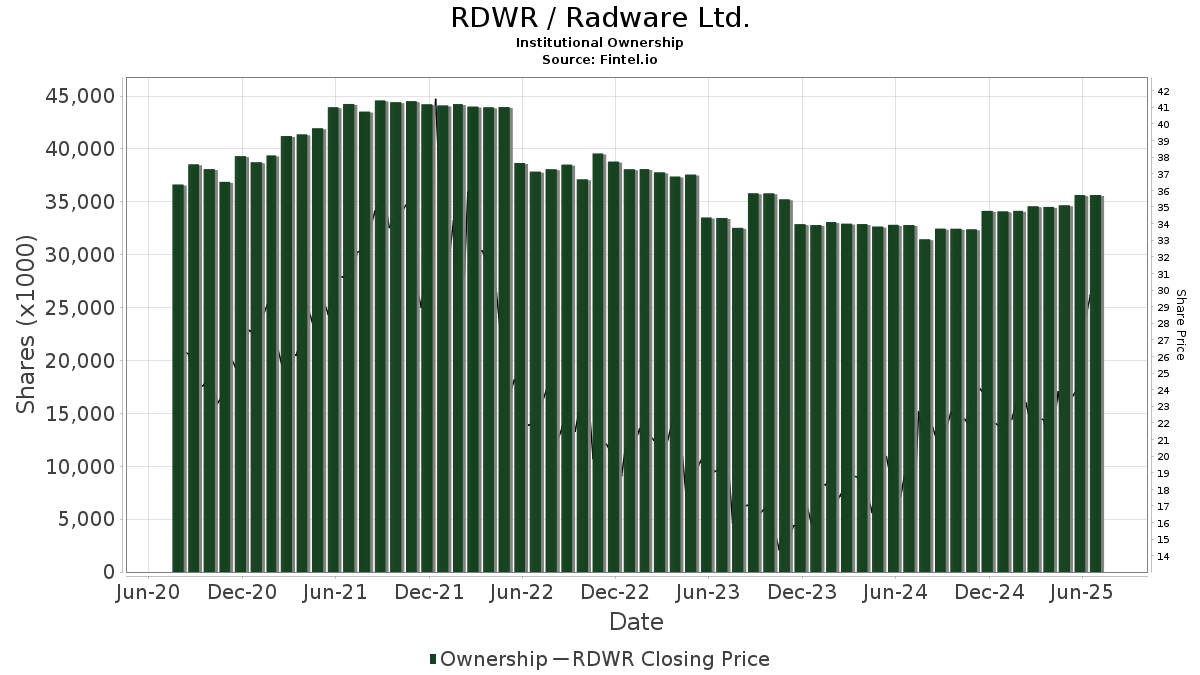

There are 156 funds or institutions reporting positions in Radware. This is a decrease of 15 owner(s) or 8.77% in the last quarter. Average portfolio weight of all funds dedicated to RDWR is 0.19%, an increase of 2.83%. Total shares owned by institutions decreased in the last three months by 13.24% to 32,593K shares.  The put/call ratio of RDWR is 1.19, indicating a bearish outlook.

The put/call ratio of RDWR is 1.19, indicating a bearish outlook.

What are Other Shareholders Doing?

Senvest Management holds 4,045K shares representing 9.23% ownership of the company. No change in the last quarter.

Artisan Partners Limited Partnership holds 2,889K shares representing 6.59% ownership of the company. In it's prior filing, the firm reported owning 2,926K shares, representing a decrease of 1.29%. The firm increased its portfolio allocation in RDWR by 0.17% over the last quarter.

Phoenix Holdings holds 2,833K shares representing 6.47% ownership of the company. In it's prior filing, the firm reported owning 2,840K shares, representing a decrease of 0.24%. The firm increased its portfolio allocation in RDWR by 25.88% over the last quarter.

ARTJX - Artisan International Small-Mid Fund Investor Shares holds 1,822K shares representing 4.16% ownership of the company. No change in the last quarter.

BUG - Global X Cybersecurity ETF holds 1,664K shares representing 3.80% ownership of the company. In it's prior filing, the firm reported owning 1,275K shares, representing an increase of 23.42%. The firm increased its portfolio allocation in RDWR by 13.40% over the last quarter.

Radware Background Information

(This description is provided by the company.)

Radware ®, is a global leader of cyber security and application delivery solutions for physical, cloud, and software defined data centers. Its award-winning solutions portfolio secures the digital experience by providing infrastructure, application, and corporate IT protection and availability services to enterprises globally. Radware's solutions empower enterprise and carrier customers worldwide to adapt to market challenges quickly, maintain business continuity and achieve maximum productivity while keeping costs down.

Additional reading:

- Radware Reports Second Quarter 2023 Financial Results

- Radware Schedules Conference Call for Its Second Quarter 2023 Earnings

- Radware Reports First Quarter 2023 Financial Results

- Radware Schedules Conference Call for Its First Quarter 2023 Earnings

- List of Subsidiaries

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.