Ball Corporation BALL is scheduled to report third-quarter 2024 results on Oct. 31, before the opening bell.

The Zacks Consensus Estimate for BALL’s revenues is pegged at $3.17 billion, indicating a 11.3% fall from the year-ago figure.

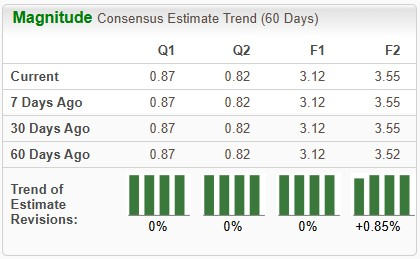

The consensus estimate for earnings is pegged at 87 cents per share. The consensus estimate for BALL’s earnings has remained unchanged in the past 60 days. The estimate indicates year-over-year growth of 4.8%.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

BALL’s Solid Earnings Surprise History

Ball Corp’s earnings beat the Zacks Consensus Estimates in each of the trailing four quarters, the average surprise being 6.3%.

Image Source: Zacks Investment Research

What the Zacks Model Unveils for Ball Corp.

Our model does not conclusively predict an earnings beat for Ball Corp. this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you can see below.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: Ball Corp. has an Earnings ESP of -4.05%.

Zacks Rank: BALL currently carries a Zacks Rank of 3.

Factors Likely to Have Shaped BALL’s Q3 Performance

Ball Corp. has lately been witnessing weaker-than-expected demand as customer spending has been muted amid higher retail prices, particularly in the United States. This is likely to be reflected in its third-quarter results. High input and labor costs due to supply constraints are anticipated to have impacted the company’s performance .

However, BALL has been focused on improving its efficiency and reducing costs, which is likely to have negated these impacts and aided margins .

Our estimate for the Beverage packaging, North and Central America segment’s net sales is pegged at $1.53 billion, indicating a 0.5% year-over-year fall. We expect the segment’s volume to increase 0.3% year over year due to lower demand.

Despite the lower revenues, we expect 14.6% year-over-year growth in the segment’s operating income to $224 million, backed by the execution of strategic initiatives.

Our model predicts the Beverage Packaging, Europe segment’s sales to be $926 million, indicating a 2.7% rise from the year-ago quarter’s figure. We expect volume growth of 6.6% for this segment.

The segment’s operating income is projected at $117 million, indicating 13.7% year-over-year growth. The focus on reducing costs is likely to have partially negated headwinds from lower demand.

We expect the Beverage Packaging, South America segment’s net sales to be $514 million, indicating 5.1% growth from the year-ago period’s level. The consensus estimate for the segment’s operating income is pegged at $63 million, indicating 3.1% growth from the year-ago quarter’s level. Our model predicts a volume increase of 3.9% for the segment.

Ball Corp.’s Share Price Performance

Shares of Ball Corp have gained 44% in the past year compared with the industry's 36.4% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some companies with the right combination of elements to post an earnings beat in their upcoming releases.

Crane Company CR is scheduled to release its third-quarter results on Oct. 28. It has an Earnings ESP of +0.09% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CR’s earnings is pegged at $1.31 per share, which indicates year-over-year growth of 27.2%. It has a trailing four-quarter average surprise of 11.2%.

Ingersoll Rand Inc. IR, scheduled to release its third-quarter results on Oct. 31, currently has an Earnings ESP of +1.22% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Ingersoll Rand’s earnings is pegged at 82 cents per share, indicating year-over-year growth of 6.5%. It has a trailing four-quarter average earnings surprise of 11%.

Eaton Corporation plc ETN, slated to release third-quarter earnings on Oct. 31, has an Earnings ESP of +1.25% and a Zacks Rank of 2 at present.

The consensus estimate for Eaton’s earnings is pegged at $2.80 per share, indicating year-over-year growth of 13.4%. ETN has a trailing four-quarter average earnings surprise of 4.7%.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpEaton Corporation, PLC (ETN) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Ball Corporation (BALL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.