Fintel reports that on August 27, 2024, Baird initiated coverage of GitLab (NasdaqGS:GTLB) with a Outperform recommendation.

Analyst Price Forecast Suggests 39.89% Upside

As of August 26, 2024, the average one-year price target for GitLab is $65.80/share. The forecasts range from a low of $50.50 to a high of $84.00. The average price target represents an increase of 39.89% from its latest reported closing price of $47.04 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for GitLab is 828MM, an increase of 33.01%. The projected annual non-GAAP EPS is -0.33.

What is the Fund Sentiment?

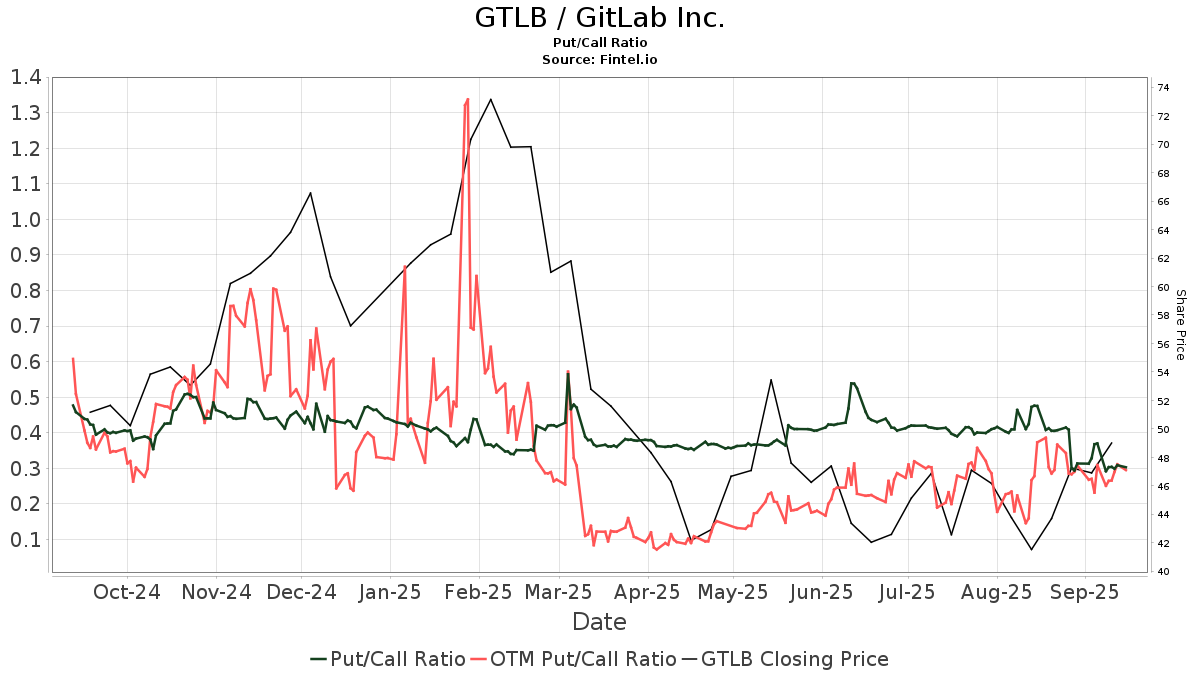

There are 740 funds or institutions reporting positions in GitLab. This is an increase of 55 owner(s) or 8.03% in the last quarter. Average portfolio weight of all funds dedicated to GTLB is 0.34%, an increase of 24.63%. Total shares owned by institutions increased in the last three months by 12.76% to 133,949K shares.  The put/call ratio of GTLB is 0.40, indicating a bullish outlook.

The put/call ratio of GTLB is 0.40, indicating a bullish outlook.

What are Other Shareholders Doing?

Alphabet holds 9,758K shares representing 7.35% ownership of the company. No change in the last quarter.

ICONIQ Capital holds 7,439K shares representing 5.61% ownership of the company. In its prior filing, the firm reported owning 6,703K shares , representing an increase of 9.90%. The firm increased its portfolio allocation in GTLB by 16.22% over the last quarter.

Capital Research Global Investors holds 6,010K shares representing 4.53% ownership of the company. In its prior filing, the firm reported owning 7,040K shares , representing a decrease of 17.14%. The firm decreased its portfolio allocation in GTLB by 29.42% over the last quarter.

HMI Capital Management holds 5,077K shares representing 3.83% ownership of the company. In its prior filing, the firm reported owning 4,602K shares , representing an increase of 9.35%. The firm decreased its portfolio allocation in GTLB by 2.69% over the last quarter.

Norges Bank holds 4,769K shares representing 3.59% ownership of the company. In its prior filing, the firm reported owning 0K shares , representing an increase of 100.00%.

Gitlab Background Information

(This description is provided by the company.)

GitLab is The DevOps platform that empowers organizations to maximize the overall return on software development by delivering software faster and efficiently, while strengthening security and compliance. With GitLab, every team in your organization can collaboratively plan, build, secure, and deploy software to drive business outcomes faster with complete transparency, consistency and traceability. GitLab is an open core company which develops software for the software development lifecycle with 30 million estimated registered users and more than 1 million active license users, and has an active community of more than 2,500 contributors. GitLab openly shares more information than most companies and is public by default, meaning its projects, strategy, direction and metrics are discussed openly and can be found within its website. GitLab values are Collaboration, Results, Efficiency, Diversity, Inclusion & Belonging , Iteration, and Transparency (CREDIT) and these form our culture. GitLab's team handbook, if printed would be over 8,000 pages of text, is the central repository for how we operate and is a foundational piece to the GitLab values. It is GitLab's mission to make it so that everyone can contribute. When everyone can contribute, users become contributors and GitLab greatly increases the rate of innovation.

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.