Baidu BIDU is beginning to see real traction from its years-long investment in artificial intelligence (AI), with AI Cloud emerging as a key driver of growth and profitability. While macro pressures and regulatory uncertainty still weigh on China’s tech landscape, Baidu’s cloud transformation signals a notable shift in the company’s core business dynamics.

AI Cloud revenue jumped 42% year over year to RMB6.7 billion, now contributing 26% of Baidu Core revenue, up from 20% a year earlier. This growth is fueled by rising enterprise demand for generative AI capabilities and foundation models, delivered primarily through Qianfan, Baidu’s Model-as-a-Service (MaaS) platform.

The company’s emphasis on full-stack AI infrastructure and continual model optimization, evidenced by the recent launches of ERNIE 4.5 Turbo and ERNIE X1 Turbo, has significantly cut inference costs while improving output quality. These improvements are making Baidu’s AI Cloud more attractive to clients seeking scalable and cost-efficient AI deployments.

Importantly, Baidu has shifted its cloud revenue mix toward subscription-based models, offering greater visibility and sustainability. Management emphasized that subscription revenues now make up the majority of enterprise cloud sales, with Gen AI-related subscription revenue growing at triple-digit rates for multiple quarters.

Profitability is also on an upswing, with non-GAAP operating margins for AI Cloud reaching the mid-teens. However, Baidu continues to reinvest aggressively in AI infrastructure and emerging applications, such as autonomous driving and Gen AI search, which may cap near-term margin expansion.

Overall, Baidu’s execution in cloud AI is gaining momentum, signaling that its multi-year bet on AI is not only paying off but also reshaping the company’s long-term growth narrative.

Baidu Competing With China’s Cloud AI Giants: Alibaba and Tencent

As Baidu doubles down on AI Cloud, it faces formidable competition from Alibaba BABA and Tencent TCEHY, both are aggressively expanding their cloud footprints in China’s evolving AI landscape. Alibaba Cloud, still the market leader by share, is integrating its proprietary Tongyi Qianwen foundation models into a broad range of enterprise services. With a massive installed base and strong ties across e-commerce and logistics, Alibaba offers both scale and cross-sector penetration that Baidu must contend with.

Meanwhile, Tencent is leveraging its strengths in gaming, social platforms, and fintech to embed AI services into vertical applications. Tencent’s Hunyuan model is gaining traction, and the company’s approach emphasizes AI-as-a-service across its super app ecosystem.

Where Baidu sets itself apart is through its deep stack integration, from chips to models to applications, via Qianfan.

BIDU’s Price Performance, Valuation and Estimates

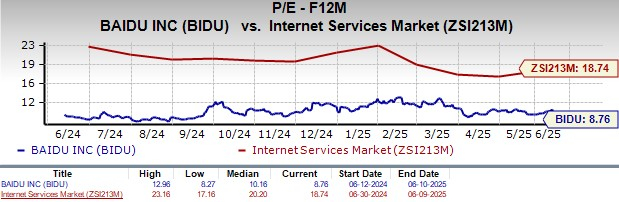

Baidu shares have lost 5.3% in the past three months against the Zacks Internet - Services industry’s 6.1% rise.

Image Source: Zacks Investment Research

BIDU’s forward 12-month price/earnings ratio sits at 8.76, far below the industry average of 18.74.

Image Source: Zacks Investment Research

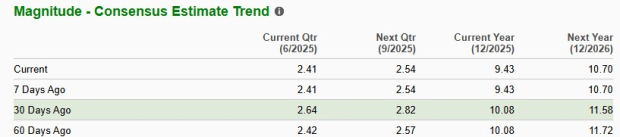

Over the past 30 days, the Zacks Consensus Estimate for Baidu’s 2025 earnings per share has decreased, as you can see below.

Image Source: Zacks Investment Research

Baidu stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpBaidu, Inc. (BIDU) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.