Fintel reports that on May 10, 2023, B of A Securities upgraded their outlook for Interdigital (NASDAQ:IDCC) from Underperform to Buy .

Analyst Price Forecast Suggests 26.33% Upside

As of May 11, 2023, the average one-year price target for Interdigital is 107.36. The forecasts range from a low of 90.90 to a high of $119.70. The average price target represents an increase of 26.33% from its latest reported closing price of 84.98.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Interdigital is 434MM, a decrease of 22.25%. The projected annual non-GAAP EPS is 2.78.

Interdigital Declares $0.35 Dividend

On March 29, 2023 the company declared a regular quarterly dividend of $0.35 per share ($1.40 annualized). Shareholders of record as of April 12, 2023 received the payment on April 26, 2023. Previously, the company paid $0.35 per share.

At the current share price of $84.98 / share, the stock's dividend yield is 1.65%.

Looking back five years and taking a sample every week, the average dividend yield has been 2.24%, the lowest has been 1.64%, and the highest has been 4.04%. The standard deviation of yields is 0.37 (n=236).

The current dividend yield is 1.57 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.21. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company has not increased its dividend in the last three years.

What is the Fund Sentiment?

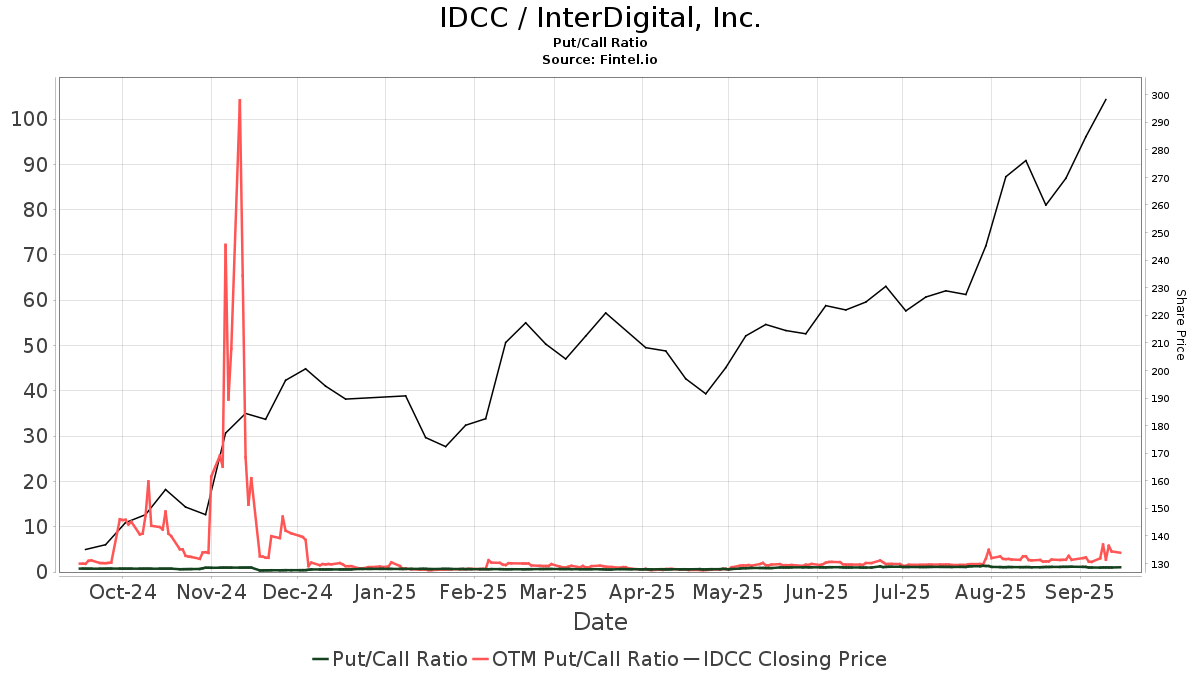

There are 549 funds or institutions reporting positions in Interdigital. This is a decrease of 3 owner(s) or 0.54% in the last quarter. Average portfolio weight of all funds dedicated to IDCC is 0.15%, an increase of 15.48%. Total shares owned by institutions increased in the last three months by 0.96% to 28,334K shares.  The put/call ratio of IDCC is 0.82, indicating a bullish outlook.

The put/call ratio of IDCC is 0.82, indicating a bullish outlook.

What are Other Shareholders Doing?

IJR - iShares Core S&P Small-Cap ETF holds 2,198K shares representing 8.22% ownership of the company. In it's prior filing, the firm reported owning 2,167K shares, representing an increase of 1.42%. The firm increased its portfolio allocation in IDCC by 12.97% over the last quarter.

FIL holds 1,151K shares representing 4.30% ownership of the company. In it's prior filing, the firm reported owning 1,162K shares, representing a decrease of 0.93%. The firm increased its portfolio allocation in IDCC by 13.18% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 890K shares representing 3.33% ownership of the company. In it's prior filing, the firm reported owning 855K shares, representing an increase of 3.92%. The firm increased its portfolio allocation in IDCC by 17.67% over the last quarter.

Disciplined Growth Investors holds 791K shares representing 2.96% ownership of the company. In it's prior filing, the firm reported owning 797K shares, representing a decrease of 0.73%. The firm increased its portfolio allocation in IDCC by 12.13% over the last quarter.

NAESX - Vanguard Small-Cap Index Fund Investor Shares holds 764K shares representing 2.86% ownership of the company. In it's prior filing, the firm reported owning 753K shares, representing an increase of 1.46%. The firm increased its portfolio allocation in IDCC by 15.00% over the last quarter.

Interdigital Background Information

(This description is provided by the company.)

InterDigital develops mobile and video technologies that are at the core of devices, networks, and services worldwide. The Company solves many of the industry's most critical and complex technical challenges, inventing solutions for more efficient broadband networks, better video delivery, and richer multimedia experiences years ahead of market deployment. InterDigital has licenses and strategic relationships with many of the world's leading technology companies. Founded in 1972, InterDigital is listed on NASDAQ and is included in the S&P MidCap 400® index.

See all Interdigital regulatory filings.This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.