Axon Enterprise, Inc. AXON is witnessing persistent strength in its Connected Devices segment. The company continues to witness robust demand for its next-generation TASER 10 products, whose shipment began in 2023. Higher adoption of TASER 10 handles, virtual reality training services and counter-drone equipment has been augmenting the segment’s results.

In April 2023, the company introduced its next-generation body-worn camera, Axon Body 4. With upgraded features such as a bi-directional communications facility and a point-of-view camera module option, this body camera is experiencing strong orders, boosting the segment’s growth. Shipment of this body camera began in June 2023 and the customer response has been impressive so far.

In third-quarter 2025, revenues from AXON’s TASER and Personal Sensors businesses grew 17% and 20% year over year, respectively, while those from the Platform Solutions were up 71%. This boosted the Connected Devices segment’s results, with revenues increasing 24% year over year to $405 million.

The demand for Axon’s advanced public safety technologies is expected to remain strong due to growing instances of terrorism and criminal activities globally. This is likely to boost demand for AXON’s Connected Devices portfolio, positioning the segment well for sustained growth in the quarters ahead.

Segment Snapshot of AXON's Peers

Among its major peers, Kratos Defense & Security Solutions, Inc.’s KTOS Government Solutions segment’s third-quarter 2025 revenues increased 23% year over year to $260.4 million. The most notable growth in this segment was in the company’s Defense and Rocket Support unit and Space, Training and Cyber businesses, with organic revenue growth rates of 47.2% and 21.2%, respectively, compared with the third quarter of 2024.

Another peer, Teledyne Technologies Incorporated’s TDY Digital Imaging segment’s third-quarter 2025 revenues increased 2.2% year over year to $785.4 million. Higher revenues were augmented by increased demand for Teledyne’s commercial infrared imaging components and subsystems, unmanned air systems and industrial automation imaging systems. Teledyne generated 51% of its total revenues from this segment in the quarter.

AXON’s Price Performance, Valuation and Estimates

Shares of Axon have lost 5.7% in the past year against the industry’s growth of 20.6%.

Image Source: Zacks Investment Research

From a valuation standpoint, AXON is trading at a forward price-to-earnings ratio of 72.59X, above the industry’s average of 46.27X. Axon carries a Value Score of F.

Image Source: Zacks Investment Research

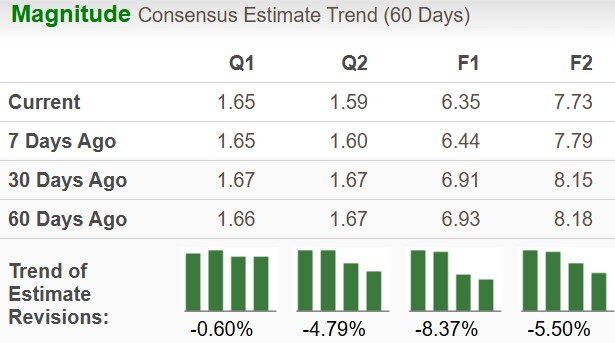

The Zacks Consensus Estimate for AXON’s fourth-quarter 2025 earnings has decreased 0.6% over the past 60 days.

Image Source: Zacks Investment Research

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.