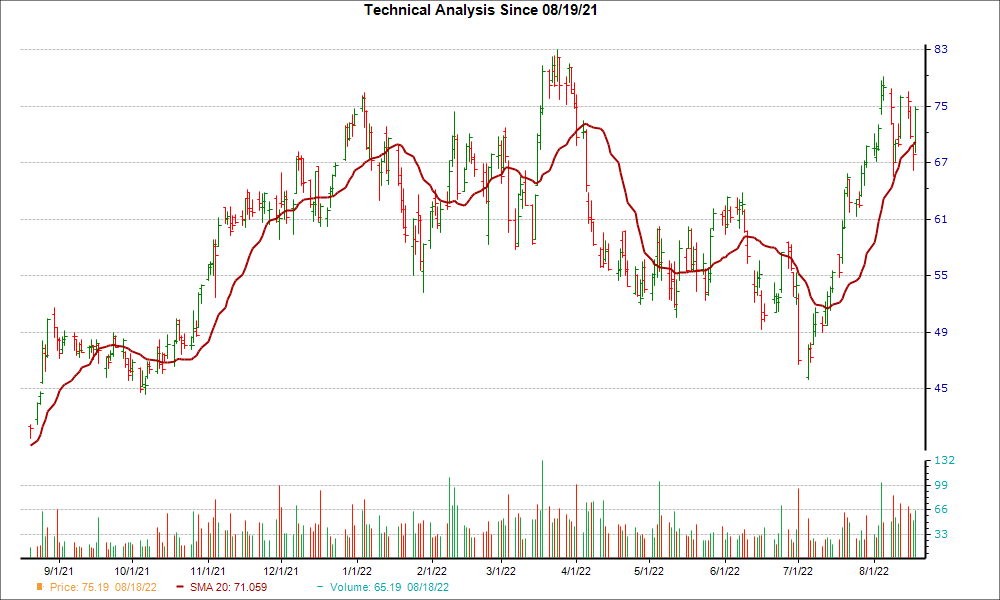

Axcelis Technologies (ACLS) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, ACLS broke through the 20-day moving average, which suggests a short-term bullish trend.

A well-liked tool among traders, the 20-day simple moving average offers a look back at a stock's price over a 20-day period. This is very beneficial to short-term traders, as it smooths out short-term price trends and gives more trend reversal signals than longer-term moving averages.

The 20-day moving average can show signals that are similar to other SMAs as well. If a stock's price is moving above the 20-day, the trend is considered positive. When the price falls below the moving average, it can signal a downward trend.

ACLS could be on the verge of another rally after moving 5.9% higher over the last four weeks. Plus, the company is currently a Zacks Rank #3 (Hold) stock.

The bullish case solidifies once investors consider ACLS's positive earnings estimate revisions. No estimate has gone lower in the past two months for the current fiscal year, compared to 3 higher, while the consensus estimate has increased too.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on ACLS for more gains in the near future.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Axcelis Technologies, Inc. (ACLS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.