Avient Corporation AVNT recently launched ColorMatrix Amosorb Oxyloop-1, the first grade in its new ColorMatrix Amosorb Oxyloop oxygen scavengers portfolio. The oxygen scavenging additive has been designed to enhance the recycling capabilities of Polyethylene Terephthalate (“PET”) packaging.

Having earned endorsement from the European Platform for Bottle Packaging (“EPBP”), Oxyloop-1 grade meets the highest industry standards for recyclability as well as food contact regulatory requirements in key markets. ColorMatrix Amosorb Oxyloop-1 also delivers excellent oxygen scavenging performance, allowing packing applications for products, including juices and vitamin drinks, to maintain freshness and shelf life.

The non-nylon-based product is made compatible with recycled PET, making it a great option for brands that plan on incorporating higher levels of recycled material into packaging. Its outstanding oxygen scavenging performance can even go up to 100% PET content. Added with excellent bottle clarity and non-nylon formulation, it becomes a great choice for transparent bottle applications, offering reduced yellowing while preserving aesthetic appeal.

Avient’s Oxyloop-1 will help brand owners meet their sustainability goals while also meeting quality and food safety requirements. By bringing recyclability and circularity, AVNT portrays its commitment toward reducing environmental impact.

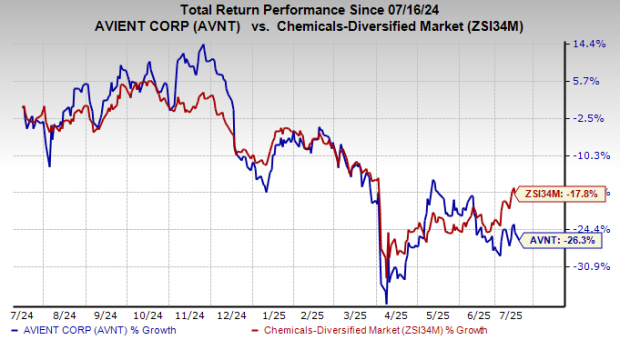

AVNT stock has slumped 26.3% over the past year compared with the industry’s 17.8% decline.

Image Source: Zacks Investment Research

AVNT’s Zacks Rank & Key Picks

AVNT currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Royal Gold, Inc. RGLD, Coeur Mining, Inc.CDE and Carpenter Technology Corporation CRS. While RGLD and CDE currently sport a Zacks Rank #1 (Strong Buy) each, CRS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RGLD’s current-year earnings is pegged at $7.47 per share, indicating a 42% year-over-year increase. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 9%. RGLD’s shares have gained 15.5% in the past year.

The Zacks Consensus Estimate for CDE’s current-year earnings is pegged at 69 cents per share, implying a 283.3% year-over-year increase. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters while missing once, with an average surprise of 136.2%.

The Zacks Consensus Estimate for CRS’ fiscal 2025 earnings is pegged at $7.28 per share, indicating a rise of 53.6% from year-ago levels. The company’s earnings beat the consensus estimate in each of the trailing four quarters. Its shares have gained 128.8% in the past year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers "Most Likely for Early Price Pops."

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

See them now >>Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Coeur Mining, Inc. (CDE) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.