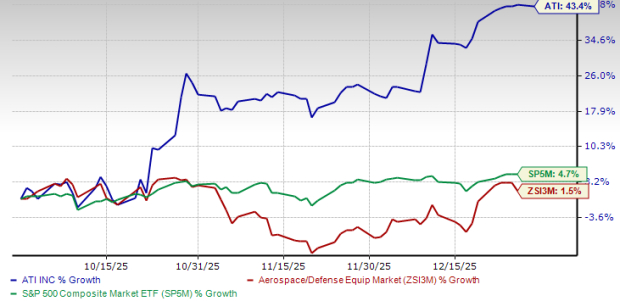

ATI Inc.’s ATI shares have gained 43.4% over the past three months. The company has also outperformed the Zacks Aerospace-Defense Equipment’s 1.5% rise and the S&P 500’s roughly 4.7% increase over the same period.

Image Source: Zacks Investment Research

Robust Demand and Efficiencies Deliver Growth for ATI

ATI is deriving material benefit from strong momentum across the aerospace and defense markets. Production rates on major commercial aerospace platforms have increased along with rising demand for isothermal forgings, resulting in higher shipment volumes. Robust aftermarketenvironment, expanding MRO demand and increased customer diversification are boosting jet engine revenues. The GTF engine overhaul program, combined with improving OEM build rates, is accelerating demand for heavy engines.

The company is also dedicated to lowering costs to sustain profitability in the longer term. It is implementing structural transformation initiatives to improve returns. Continued investments in equipment reliability and AI technology are enabling the prediction of potential issues and proactively correcting them before they occur.

ATI also enjoys an ROI that is well above the industry levels, which serves as evidence of efficient capital use. Its capital projects are also operational and yielding value, with a few other plans lined up that are expected to open up an additional growth opportunity of 15-20% in Hot-Rolling and Processing Facility utilization.

ATI Inc. Price, Consensus and EPS Surprise

ATI Inc. price-consensus-eps-surprise-chart | ATI Inc. Quote

ATI’s Zacks Rank & Key Picks

ATI currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Kinross Gold Corporation KGC, Fortuna Mining Corp. FSM and Equinox Gold Corp. EQX.

At present, KGC sports a Zacks Rank #1 (Strong Buy), while FSM and EQX carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for KGC’s current-year earnings is pegged at $1.67 per share, indicating a rise of 145.59%. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters while missing once, with an average surprise of 17.37%. KGC’s shares have gained 204.3% over the past year.

The Zacks Consensus Estimate for FSM’s current fiscal-year earnings is pinned at 76 cents per share, indicating a 65.22% year-over-year increase. Its shares have surged 131.5% over the past year.

The Zacks Consensus Estimate for EQX’s current-year earnings stands at 54 cents per share, implying a 170% year-over-year increase. Its earnings beat the Zacks Consensus Estimate in two of the trailing four quarters and missed twice, with an average surprise of 87%.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>ATI Inc. (ATI) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Fortuna Mining Corp. (FSM) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.