AST SpaceMobile ASTS recently launched Bluebird 6, its most advanced satellite to date, into low earth orbit. This was the largest commercial communication array ever deployed in low earth orbit. The system is 3x larger and capable of delivering 10x capacity compared to ASTS’ Bluebird 1-5 satellites.

The solution is designed to facilitate seamless direct-to-smartphone connectivity. It can deliver 120 Mbps peak data rates, supporting voice, data and video across unmodified 4G and 5G smartphones. This is a major step forward in establishing a robust space-based broadband connectivity system.

However, from a valuation standpoint, AST SpaceMobile trades at a forward price-to-sales ratio of 100.64, well above the industry. Owing to the stock’s premium valuation, we believe investors should remain cautious as macroeconomic factors, or economic downturns, can significantly impact overvalued stocks like ASTS.

Image Source: Zacks Investment Research

Per a report from Precedence Research, the space-based network market size is $10.41 billion in 2025. It is forecasted to reach $62.08 billion in 2034 with a compound annual growth rate of 22.07%. ASTS is placing a strong focus on innovation and rapidly expanding its portfolio to gain a competitive edge in the market. It has strategically partnered with leading telecom companies to grant customers easy access to their technology. The company has agreements with more than 50 mobile network operators, covering 3 billion subscribers. Some major partners are AT&T, Verizon, Vodafone, Rakuten, stc Group and others. Such a growing partner base bodes well for sustainable growth.

As governments worldwide push for bridging the digital divide and expanding connectivity in remote areas, ASTS’ direct-to-smartphone services effectively address these issues. Investors are betting big on the future potential of this technology.

How Are Competitors Faring?

ASTS operates in a highly competitive mobile satellite services market. The company faces severe competition from existing and new industry leaders like SpaceX’s Starlink and Globalstar GSAT, which are developing satellite communications technology using LEO constellations. Globalstar is a prominent player in the satellite voice and data services market with a presence in 120 countries. The company is steadily advancing development of the C-3 Mobile Satellite System, which aims augment mobile satellite services, particularly in remote regions. Globalstar currently trades at a forward price-to-sales ratio of 11.79, well above the industry’s 0.82.

Viasat, Inc. VSAT is also ramping up investments in the development of its revolutionary ViaSat-3 broadband communications platform. The ViaSat-3 constellation is intended to provide high-speed and high-capacity connectivity to expand coverage and help bridge the digital divide in areas with limited internet access. VSAT currently trades at a forward price-to-sales ratio of 0.44, well below the industry’s 3.44.

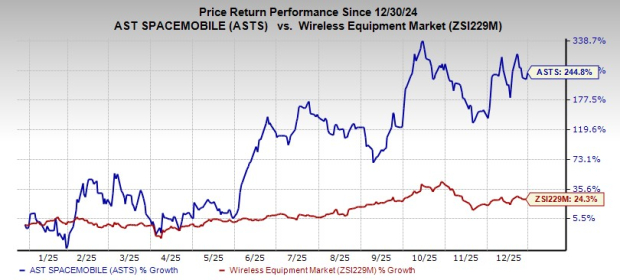

ASTS’ Price Performance and Estimates

Over the past year, shares of AST SpaceMobile have skyrocketed 244.8% compared with the industry’s growth of 24.3%.

Image Source: Shutterstock

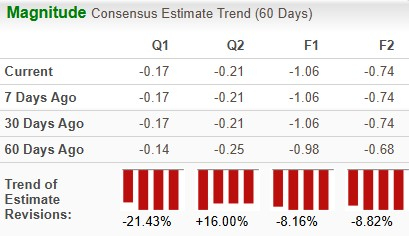

Earnings estimates for 2025 and 2026 have decreased over the past 60 days.

Image Source: Zacks Investment Research

AST SpaceMobile stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Viasat Inc. (VSAT) : Free Stock Analysis Report

Globalstar, Inc. (GSAT) : Free Stock Analysis Report

AST SpaceMobile, Inc. (ASTS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.