Aris Mining Corporation ARMN reported solid growth in gold production in third quarter of 2025. In the quarter, the company produced 73,236 ounces of gold, increasing 36.6% on a year-over-year basis. Production also rose 25% from the prior quarter. ARMN’s gold production growth is primarily driven by the Segovia mine, where the commissioning of a second mill has increased its gold processing capacity. While the Marmato upper mine continues steady production, the development of its Bulk Mining Zone is progressing, with first gold exploration expected in the second half of 2026.

Segovia posted a 38% year-over-year increase in production to 65,549 ounces in the third quarter. Also, the Colombia-based Marmato Upper Mine produced 7,687 ounces of gold, rising 25.7% from the year-ago quarter.

Beyond its operating mines, Aris Mining is strengthening its growth pipeline with a 51% stake in Colombia’s Soto Norte Project, where a recent pre-feasibility study confirmed its high potential as an undeveloped gold asset in the Americas. In Guyana, ARMN released a preliminary economic assessment (PEA) for its fully owned Toroparu Project in October 2025, which shows that Toroparu has the potential to become a long-lasting and low-cost mine.

The company is expected to produce 230,000-275,000 ounces of gold in 2025. As ARMN advances its expansion initiative, it is well-positioned to reach its production targets and boost its presence in Latin America’s gold mining industry.

Snapshot of Aris Mining’s Peers

Among its major peers, B2Gold Corp. BTG recorded a consolidated gold production of 254,369 ounces in the third quarter of 2025, up 40.9% year over year. B2Gold remains on track to meet total gold production expectations from Fekola, Masbate and Otjikoto mines at 890,000-965,000 ounces for 2025. B2Gold expects Goose Mine production to be between 50,000 ounces and 80,000 ounces of gold in 2025.

Its another peer, Barrick Mining Corp.’s B consolidated gold production fell 12% year over year to 829,000 ounces in the third quarter of 2025. Barrick Mining provided a tepid forecast for 2025, with attributable gold production expected to be in the range of 3.15-3.5 million ounces. Lower production is expected to weigh on Barrick Mining’s performance in 2025.

ARMN’s Price Performance, Valuation and Estimates

Shares of Aris Mining have surged 138.5% in the past six months compared with the industry’s growth of 70.6%.

Image Source: Zacks Investment Research

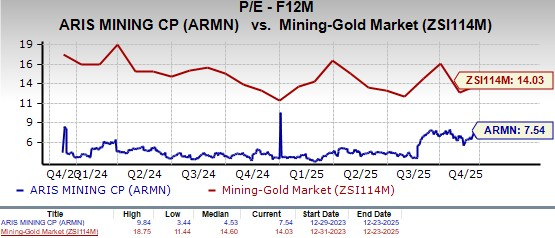

From a valuation standpoint, Aris Mining is trading at a forward price-to-earnings ratio of 7.54X compared with the industry’s average of 14.03X. ARMN carries a Value Score of D.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Aris Mining’s earnings has remained steady over the past 30 days.

Image Source: Zacks Investment Research

The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpBarrick Mining Corporation (B) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

Aris Mining Corporation (ARMN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.