Trump Tariffs Shake US Stock Market

Though Donald Trump was merely a civilian at the time (albeit very famous), he has been voicing concerns about how countries like Japan, China, and Germany have taken advantage of soft U.S. trade policies for years. Now, in his second presidential term, Trump is acting on his intuition and promises to his voters to hit countries back with retaliatory tariffs to stop the flow of fentanyl, bring trade imbalances to an equilibrium, and return America to the manufacturing powerhouse it once was.

Thus far, Wall Street is taking a dim view of the tariff policy. The S&P 500 Index ETF (SPY) is down 5% over the past month, volatility is increasing, and intraday headlines from Trump and his economic advisors are causing “tape bombs” that swing the market violently intraday. Though the market action has been ugly in reaction to the tariffs in the short-term, are investors overreacting?

Pullbacks are Normal, Even in Bull Markets

The S&P 500 Index has gained ~40% since the bear market bottom in October 2022. That said, experienced investors understand that markets do not move in a straight line. For instance, there have been multiple 5% corrections over the course of the current bull market and nearly 100 since 1950! Perhaps investors were looking for a reason to sell, and tariffs were that reason.

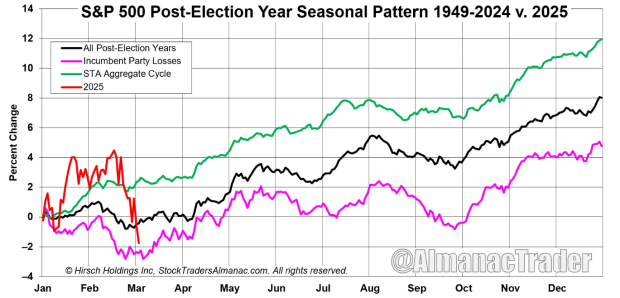

Election Seasonality Suggested a Correction was Likely

Over the past few years, historical seasonality patterns have been one of the most valuable and accurate means of predicting the market’s next move. Even before the tariffs were announced, the post-election seasonality pattern suggested that Q1 equity weakness was likely. The good news is that this weakness typically subsides, and markets bottom more often in the back half of March than any other time of year.

Image Source: Hirsch Holdings, (@almanactrader)

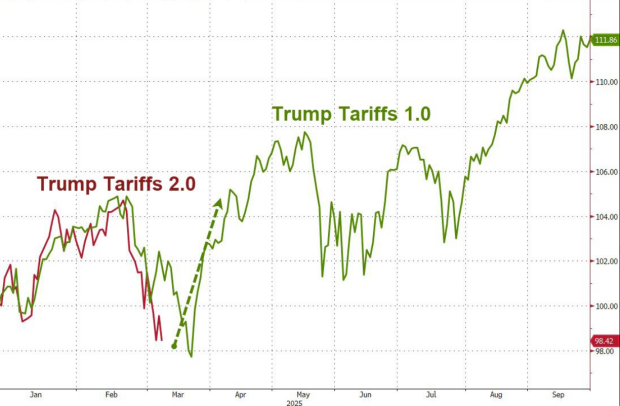

Historical Precedent: Déjà vu?

Meanwhile, investors can rely on historical precedent. After all, Trump was president and implemented tariffs before.

Image Source: Zacks Investment Research

200-Day Moving Average

Since the 2022 lows, the entire bull market has been contained above the 200-day moving average. Though Nasdaq 100 Index ETF (QQQ) has visited the 200-day several times, each time the market has found support. Will this time be different?

Image Source: TradingView

Volatility Above the 200-Day MA Can Be Bullish

Ryan Detrick, Chief Market Strategist at Carson Investment Research, made an interesting discovery:

“Historically, when the S&P 500 has experienced five consecutive days of 1% moves while remaining above its 200-day MA (like it is now), it has performed well over the following six months, averaging an 11.0% gain and rising 91.7% of the time.”

Rate Cut Odds on the Rise

The Trump Administration has been lobbying for lower interest rates for months. Though the U.S. Federal Reserve acts independently, recent rate cut odds suggest that the Trump tariffs may force Fed Chair Jerome Powell’s hand. Rate cut chances for May are at 54% and climbing.

Potential Tariff Resolution

Though Trump says he wants to leave tariffs on permanently, I prefer to watch for what a person does rather than what they say. Trump is likely using tariffs as a bargaining chip to get better trade deals for the U.S. Meanwhile, signs of potential resolutions are emerging. Earlier, Trump said:

“After speaking with President Claudia Sheinbaum of Mexico, I have agreed that Mexico will not be required to pay tariffs on anything that falls under the USMCA Agreement. This agreement is until April 2nd. I did this as an accommodation and out of respect for President Sheinbaum. Our relationship has been a very good one, and we are working hard together on the border, both in terms of stopping illegal aliens from entering the United States and likewise, stopping fentanyl. Thank you, President Sheinbaum, for your hard work and cooperation!”

The softer rhetoric between rival nations is a welcome sign for investors.

Lower Valuations

Investors have been complaining for years now that tech stocks like Tesla (TSLA) and Microsoft (MSFT) have seen valuations get too bloated. However, a silver lining is that the recent market pullback will lead to more attractive valuations. For instance, Nvidia (NVDA) has its lowest P/E ratio since the bull market began.

Image Source: Zacks Investment Research

Bottom Line

The Trump tariffs may have been the spark that caused a market pullback. However, several data points suggest that the market correction may be short-lived and that tariff concerns are overdone.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.