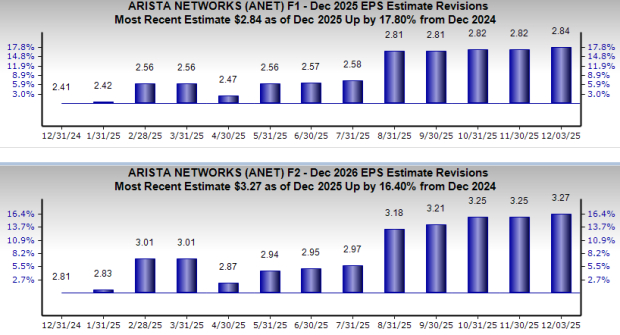

Earnings estimates for Arista Networks, Inc. ANET for 2025 and 2026 have moved up 17.8% to $2.84 and 16.4% to $3.27, respectively, over the past year. The positive estimate revision depicts bullish sentiments about the stock’s growth potential.

Image Source: Zacks Investment Research

ANET Buoyed by Solid Demand Trends

Arista offers one of the broadest product lines of data center and campus Ethernet switches and routers in the industry. It provides routing and switching platforms with industry-leading capacity, low latency, port density and power efficiency. The company also innovates in areas such as deep packet buffers, embedded optics and reversible cooling. Arista holds a leadership position in 100-gigabit Ethernet switches for the high-speed data center segment and is increasingly gaining market traction in 200- and 400-gigabit high-performance switching products.

Arista is witnessing solid demand trends among enterprise customers backed by its multi-domain modern software approach, which is built upon its unique and differentiating foundation, the single EOS (Extensible Operating System) and CloudVision stack. The versatility of Arista’s unified software stack across various use cases, including WAN routing and campus and data center infrastructure, sets it apart from other competitors in the industry. This, in turn, has translated into solid revenue growth for the company over the years.

Image Source: Zacks Investment Research

Cloud Traction Lends Support to ANET’s Growth Trajectory

Arista continues to benefit from the expanding cloud networking market, which is driven by the strong demand for scalable infrastructure. As more business enterprises transition to the cloud, the company is well-poised for growth in the data-driven cloud networking business with proactive platforms and predictive operations. In addition to high capacity and easy availability, its cloud networking solutions promise predictable performance and programmability, enabling integration with third-party applications for network management, automation and orchestration.

With customers deploying transformative cloud networking solutions, the company has announced several additions to its multi-cloud and cloud-native software product family with CloudEOS Edge. It has introduced cognitive Wi-Fi software that delivers intelligent application identification, automated troubleshooting and location services that support video conferencing applications like Microsoft Teams and Zoom.

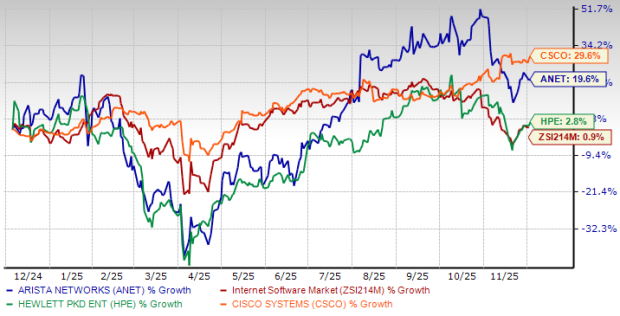

Price Performance

Arista has surged 19.7% over the past year compared with the industry’s growth of 0.9%. It has also outperformed peers like Hewlett Packard Enterprise Company HPE, but lagged Cisco Systems, Inc. CSCO. While Hewlett Packard has gained 2.8%, Cisco is up 29.6% over this period.

One-Year ANET Stock Price Performance

Image Source: Zacks Investment Research

Eroding Margins Hurt ANET

Despite healthy inherent growth potential, Arista remains plagued by depleting margins. As it continues to enhance its existing product line and develop new technologies and products that address emerging technological trends, evolving industry standards and changing end-customer needs, operating costs tend to soar. Moreover, the redesigning of products and their supply chain mechanism has eroded margins. Although the company is witnessing increased demand, there are lingering supply bottlenecks for advanced products. As such, when Arista increases orders for these components and tries to build up inventory, it is blocking working capital.

End Note

With healthy revenue-generating potential driven by robust demand trends, Arista appears poised for solid growth momentum. Further, a strong emphasis on quality, diligent execution of operational plans and continuous portfolio enhancements are driving more value for customers. An uptrend in estimate revision further portrays positive investor sentiments.

However, margin woes amid high selling, general & administrative and R&D costs and elevated customer inventory levels weigh on its bottom line. With a Zacks Rank #3 (Hold), Arista appears to be treading the middle path and investors could be better off exercising caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Picks Stock Most Likely to "At Least Double"

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.