McDonald's Corporation MCD is leaning heavily on Extra Value Meals (EVM) as it works to stabilize and rebuild customer traffic heading into 2026. Management has been clear that value is not a tactical lever but a core brand promise, especially as consumer pressures persist across key markets. With U.S. lower-income QSR traffic down sharply for nearly two years, restoring confidence around everyday affordability has become central to McDonald’s strategy.

The reintroduction of EVMs, anchored by clearly priced $5 and $8 meal options, aims to reset customer expectations on the core menu. These bundled meals represent roughly 30% of U.S. transactions, making them a critical driver of both traffic and value perception. Early performance has been in line with internal expectations, with management emphasizing that awareness and behavior changes should build gradually over several quarters rather than deliver an immediate spike.

Importantly, McDonald’s is measuring success not just through sales, but through traffic share gains among value-sensitive consumers and improvements in affordability scores. The company has also backed the relaunch of EVMs with meaningful marketing and short-term financial support for franchisees, signaling confidence that near-term margin pressure can translate into longer-term volume-led benefits.

Looking ahead to 2026, macro headwinds are expected to linger, limiting a quick rebound in discretionary spending. In that environment, predictable pricing and visible value may be McDonald’s strongest tools to defend and regain traffic. While EVMs alone will not solve every challenge, they appear well-positioned to serve as a foundational pillar of the brand’s traffic recovery playbook.

How Competitors Are Using Value to Compete for Budget-Conscious Diners

McDonald’s renewed focus on Extra Value Meals comes amid competitors with their own value-centric plays. Wendy’s WEN has emphasized its $5 and $6 Biggie Bags as a core traffic driver, bundling a sandwich, fries and a drink at accessible price points. This approach directly challenges McDonald’s EVMs by offering similar perceived affordability while blending value with limited-time premium items to maintain customer interest.

Restaurant Brands International QSR, the parent of Burger King, is also pushing value through aggressive digital offers and meal bundles marketed via the BK app. These deals aim to lure price-sensitive customers but are often more promotional in nature and less visible on the everyday menu compared with McDonald’s EVMs.

In a market where consumers increasingly prioritize predictable pricing over occasional discounts, McDonald’s nationally advertised value meals could offer a steadier pull-on traffic than its peers’ more fluctuating promotions. This dynamic sets the stage for value competition among major players in 2026.

MCD’s Price Performance, Valuation and Estimates

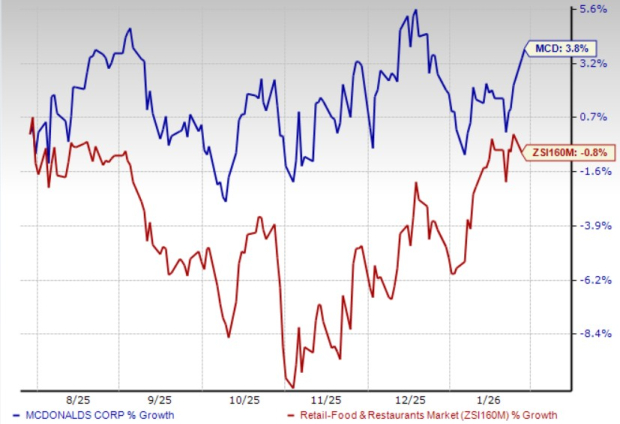

McDonald’s shares have gained 3.8% in the past six months against the industry’s 0.8% decline.

Price Performance

Image Source: Zacks Investment Research

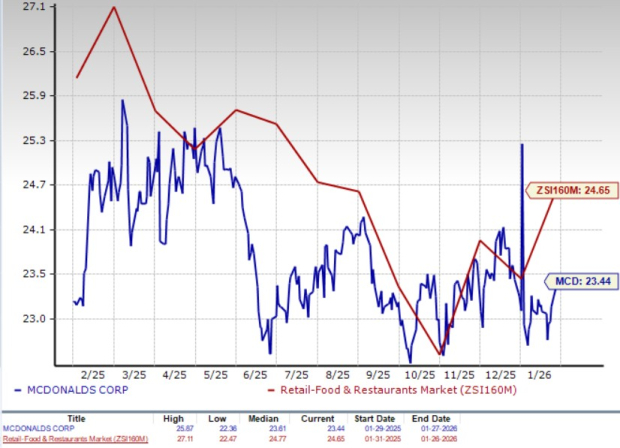

In terms of its forward 12-month price-to-earnings ratio, MCD is trading at 23.44, down from the industry’s 24.65.

P/E (F12M)

Image Source: Zacks Investment Research

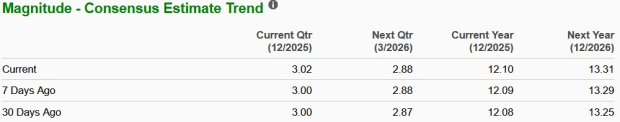

Over the past seven days, the Zacks Consensus Estimate for MCD’s 2026 earnings per share has increased, as shown in the chart.

Image Source: Zacks Investment Research

MCD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you'll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Access the Report Free Now >>McDonald's Corporation (MCD) : Free Stock Analysis Report

The Wendy's Company (WEN) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.