Applied Materials’ AMAT gross margin came in at 48.8% in the fourth quarter of fiscal 2025, up 120 basis points year over year. The positive momentum in the gross margin has been there for the past six quarters as the company is gaining from a favorable mix of products and traction in high-margin solutions.

AMAT’s margins are growing on the back of leading-edge logic foundry solutions, Sym3 Magnum etch system, Cold Field Emission eBeam technology, gate-all-around, backside power delivery, and 3D DRAM technology nodes used in the manufacturing of AI and high performance computing chips, as these are inherently high-margin products.

AMAT’s Sym3 Magnum etch system is gaining traction because of its capability to develop high-aspect-ratio structures in 3D NAND, DRAM and logic, which are powering AI and HPC workloads. The Cold Field Emission eBeam technology, which is used in detecting defects at the nanometer scale, is also crucial for high-performance chip manufacturing and testing.

Significant growth in AMAT’s memory segment, including its advanced DRAM technologies, is also an upside. Nevertheless, AMAT has been continuously ramping up its R&D investments, which are offsetting its margin gains. In the fourth quarter of fiscal 2025, AMAT’s R&D expenses increased 10% year over year.

To counter this, AMAT is reducing its general and administrative expenses to offset the rising cost of R&D, which has effectively enabled AMAT to maintain its operating margin. Cutting headcount has been the strategy that AMAT is using to scale productively while maintaining margins.

Applied Materials’ margins are expected to remain strong as demand for high-performance computing and AI continues to grow, as long as the company takes prudent decisions to cut other expenses.

How Competitors Fare Against AMAT

Applied Materials faces intense competition from Lam Research LRCX and ASML Holding ASML across 3D DRAM architectures, EUV Lithography, deposition and etching. Both Lam Research and ASML Holding have seen growth in gross margin and operating margin in recent quarters.

Lam Research delivered a record gross margin of 50.6% and its operating margins also came to 35% in the first quarter of fiscal 2026. ASML Holding’s third-quarter fiscal 2025 gross margins were 51.6%. Strong margins of all three companies reflect the profitability of the chip manufacturing equipment space in this AI era.

AMAT’s Price Performance, Valuation and Estimates

Shares of Applied Materials have gained 49.5% year to date compared with the Electronics - Semiconductors industry’s growth of 44.7%.

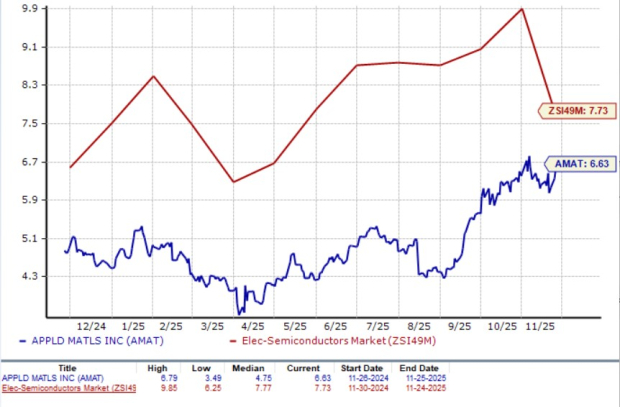

Image Source: Zacks Investment Research

From a valuation standpoint, Applied Materials trades at a forward price-to-sales ratio of 6.63X, lower than the industry’s average of 7.73X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Applied Materials’ fiscal 2025 and 2026 earnings implies year-over-year growth of 0.96% and 15.77%, respectively. The estimates for fiscal 2025 and 2026 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Applied Materials currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.