Applied Digital APLD announced its plan to sell its cloud services division — about one-third of its FY2025 revenues — in April to sharpen its focus on becoming a pure-play data center REIT. This pivot reflects strategic and financial advantage:

Customer Conflicts & Market Positioning: The company’s cloud unit was increasingly seen as a competitor by potential hyperscale customers, complicating its primary leasing business for HPC/data-center infrastructure.

Tightening Capital Models: Divesting the cloud unit clears the path to REIT conversion — a structure that typically enjoys a lower cost of capital and higher valuation multiples.

Market Disappointment & Stock Reaction: A 32-36% quarterly drop in cloud revenues prompted slump in shares slumped as results missed revenue expectations (US$52.9M vs. ~US$64M est.).

Data-Center Momentum Offsets Cloud Headwinds: Despite cloud troubles, the company secured major deals, including a $7 billion, 15 year lease with CoreWeave and a nearly $5 billion investment from Macquarie, highlighting pent-up demand for its HPC infrastructure.

Selling the cloud unit is a corrective move to appease hyperscale clients, streamline operations for a REIT transition, and capitalize on momentum in data-center and HPC leasing. The bold shift aims to stabilize balance sheets and unlock long-term shareholder value, although execution risk and timing remain critical.

Other Divestments in Cloud Space

On April 22, 2025, Boeing BA announced an agreement to sell major portions of its Digital Aviation Solutions business. This strategic divestiture excludes Boeing's core digital assets related to aircraft maintenance, diagnostics, and repair services, which will be retained. By selling its digital aviation division, Boeing is taking a purposeful step toward cleansing its balance sheet, focusing on what it does best — airplanes, defense, and space — and restoring investor trust. The move underscores Boeing’s shift under Ortberg, from crisis management to disciplined strategic execution, and positions the company to rebuild value and stability ahead of a busy production ramp in the next two years.

Advanced Micro Devices AMD is negotiating the sale of its data-center manufacturing plants, acquired through the ZT Systems deal, for up to $3-$4 billion. Advanced Micro Devices intends to retain the ZT design and support teams while partnering with Sanmina to strengthen U.S. AI-oriented manufacturing capabilities. This move by AMD reflects a strategic plan, streamlining operations and refocusing Advanced Micro Devices on its AI???driven semiconductor roadmap.

APLD’s Price Performance, Valuation and Estimates

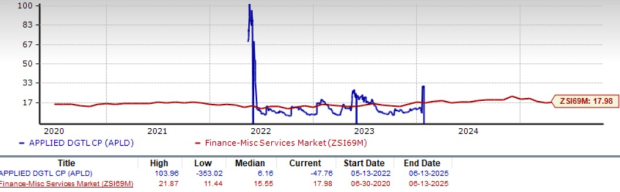

Shares of APLD have surged 46.3% in the year-to-date period against the industry’s decline of 6.8%.

Image Source: Zacks Investment Research

From a valuation standpoint, Applied Digital trades at a forward price-to-earnings ratio of 10.44, above the industry average as well as its five-year median of 1.43. APLD carries a Value Score of F.

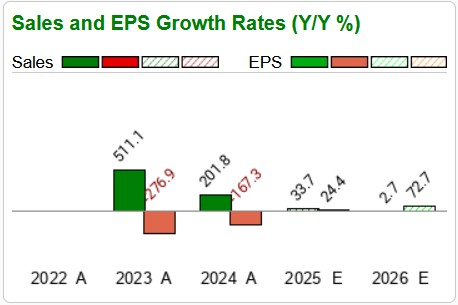

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Applied Digitals’ fiscal 2026 earnings implies a 73.6% rise year over year.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpThe Boeing Company (BA) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Applied Digital Corporation (APLD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.