Amphenol’s APH growth trajectory has been shaped by acquisitions, with the latest being the Connectivity and Cable Solutions (CCS) business from CommScope. The acquisition strengthens APH’s fiber optic interconnect capabilities, thereby driving footprint in the IT datacom and communications networks end markets as well as in the infrastructure connectivity market. For 2026, APH expects the CCS business to generate sales of approximately $4.1 billion and contribute 15 cents to the bottom line. The CCS business will be included in the Communications Solutions Segment.

Plethora of acquisitions – CIT, Lutze, CommScope’s Andrew business, Rochester sensors, LifeSync, Narda-MITEQ, XMA and Q Microwave — have been driving Amphenol’s prospects. In the first nine months of 2025, the company completed four acquisitions for $2.77 billion. The Andrew business is benefiting the communications end-market sales, with 2025 sales expected to jump more than 130%. CIT acquisition benefits the commercial aerospace end-market, with 2025 sales expected to increase in the high 30% range from 2024. The Rochester sensors’ acquisition expands APH’s offering in the industrial market. The addition of Trexon is expected to drive the Harsh Environment Solution segment's top-line growth.

Amphenol expects fourth-quarter 2025 revenues between $6 billion and $6.1 billion, suggesting growth in the 39-41% range. The Zacks Consensus Estimate for the fourth quarter of 2025 is pegged at $5.84 billion, indicating 35.2% growth from the figure reported in the year-ago quarter.

Intensifying Competition Hurts APH’s Prospects

Amphenol is facing stiff competition from the likes of TE Connectivity TEL and Belden BDC.

TE Connectivity is expected to benefit from strong demand for its solutions in the AI domain as well as energy applications. The company is benefiting from strength in Asia in the Transportation segment, where increased data connectivity trends and the ongoing growth of the electrified powertrain. TE Connectivity expects fiscal first-quarter 2026 net sales to increase 17% year over year and 11% organically year over year to $4.5 billion.

Belden competes with Amphenol by concentrating on innovation and capability upgrades in enterprise networking and industrial automation. Belden’s acquisitions, including Precision Optical and Voleatech, reinforce its strength in data-center and digital-factory markets. Collaboration with Accenture and NVIDIA is noteworthy.

APH’s Share Price Performance, Valuation & Estimates

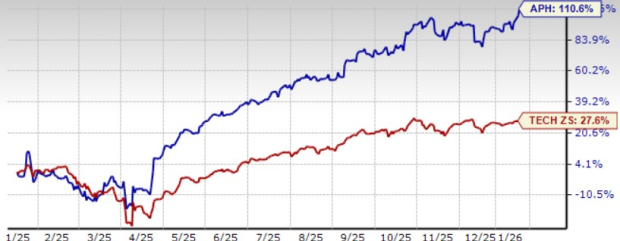

Amphenol shares have jumped 110.6% in the trailing 12-month period, outperforming the broader Zacks Computer and Technology sector’s return of 27.6%.

APH Stock’s Performance

Image Source: Zacks Investment Research

APH stock is overvalued, with a forward 12-month price/earnings of 37.16X compared with the broader sector’s 27.98X. Amphenol currently has a Value Score of D.

APH Valuation

Image Source: Zacks Investment Research

Amphenol expects fourth-quarter 2025 earnings between 89 cents and 91 cents per share, indicating growth between 62% and 65% year over year. The Zacks Consensus Estimate for fourth-quarter 2025 earnings is pegged at 92 cents per share, unchanged over the past 30 days, suggesting 67.3% year-over-year growth.

Amphenol Corporation Price and Consensus

Amphenol Corporation price-consensus-chart | Amphenol Corporation Quote

Amphenol currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

See New Top 10 Stocks >>Amphenol Corporation (APH) : Free Stock Analysis Report

Belden Inc (BDC) : Free Stock Analysis Report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.