ANSYS ANSS announced that its simulation solutions are being leveraged by Lufthansa Technik to develop and certify AeroSHARK, a revolutionary biomimetic coating technology inspired by shark skin. By utilizing ANSYS' computational fluid dynamics (CFD) and high-performance computing technology, Lufthansa Technik and BASF have designed a coating film with a ribbed texture similar to the placoid scales on shark skin, known as riblets.

These riblets lessen drag and friction while increasing buoyancy for sharks. As a result, the coating inspired by these riblets is expected to lower aircraft drag and friction, reduce fuel consumption for airplanes and boost sustainable aviation.

ANSYS' CFD capabilities helped engineers to analyze the turbulent flow around the riblets to ensure they would generate the desired effect, added the company. Lufthansa Technik utilized ANSYS' tools to build and validate virtual prototypes of AeroSHARK, allowing them to perform comprehensive aerodynamic simulations and minimize the need for physical flight tests. This approach significantly reduced the risk and time required for certification.

ANSYS, Inc. Price and Consensus

ANSYS, Inc. price-consensus-chart | ANSYS, Inc. Quote

AeroSHARK has received certification from the European Union Aviation Safety Agency and the American Federal Aviation Authority for specific Boeing 777 aircraft models. Currently, Swiss International Air Lines and Lufthansa Cargo are operating AeroSHARK on some of their Boeing 777s, added the company.

Overall, the collaboration is aimed at enhancing AeroSHARK's ability to improve sustainability in air transport and promote a more sustainable future for commercial aircraft. Currently, AeroSHARK can cover 40% of an aircraft surface, but Lufthansa Technik plans to expand its coverage to other areas of the plane based on the success of simulation-powered testing.

ANSS develops and globally markets engineering simulation software and services widely used by engineers, designers, researchers and students across a broad spectrum of industries and academia.

The company announced that it plans to reduce its carbon footprint by 15% by minimizing materials waste and physical prototyping. The company plans to reach its target by 2027.

On Oct 19, 2022, ANSYS announced that its simulation solutions are being leveraged by ZeroAvia for the development of its sustainable hydrogen-electric powertrain, which is aimed at reducing aviation emissions to tackle climate change. According to ZeroAvia, the company’s powertrain will help reduce operating expenses and tackle climate change as hydrogen-electric propulsion technology emits 90% less lifecycle emissions as compared to jet fuel-based turbines.

Prior to that, the company announced that its simulation solutions are being leveraged by a NASA-backed program to accelerate aviation sustainability. The collaboration is aimed at using liquid ammonia to develop zero-carbon jet engines.

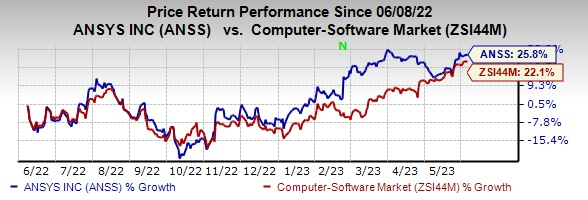

ANSS currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 25.8% in the past year compared with the sub-industry’s rise of 22.1%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Dropbox DBX, Badger Meter BMI and Blackbaud BLKB. Dropbox and Blackbaud presently sport a Zacks Rank #1 (Strong Buy), whereas Badger Meter currently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dropbox’s 2023 earnings has increased 10.1% in the past 60 days to $1.85 per share. The long-term earnings growth rate is anticipated to be 12.3%.

Dropbox’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.4%. Shares of DBX have gained 3% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has increased 4.7% in the past 60 days to $2.69 per share.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have surged 77.2% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings has increased 9.3% in the past 60 days to $3.75 per share.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 10.4%. Shares of the company have jumped 13.4% in the past year.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.