Arista Networks Inc. ANET reported a non-GAAP operating income of $1.08 billion during the second quarter, up from $770.4 million in the prior year quarter. This is the first time the company has reported an operating income of more than $1 billion. Non-GAAP operating margin improves to 48.8% from 46.5% a year ago.

The growth underscores strength in the company’s business model and solid momentum across its portfolio. The company’s comprehensive suite of data center and campus Gigabit Ethernet switches and routers is witnessing healthy traction in the AI networking domain. It witnessed strong renewals of its software and services. Despite a 13.2% quarter of quarter increase in operating expenses, strong net sales growth led to strong margin expansion.

Efficient supply chain and inventory management led to overall improvement in gross margin, which, in turn, has a favorable impact on operating margin growth. Non-GAAP gross margin was 65.6% in the second quarter, above the company’s guidance of 63% and up from 65.4% a year ago.

Accounts payable day was 65 days up from 49 days in the first quarter. This actually improves cash flow and also improves liquidity, allowing Arista to invest more in research and development and marketing without putting too much pressure on operating margin.

Backed by its strong focus on efficiency and strong demand trends, Arista has projected an operating margin of 47% for the third quarter. For 2025, the company is expected to have an operating margin of 48%.

How Are Competitors Faring?

Arista faces competition from Hewlett Packard Enterprise Company HPE and Cisco Systems, Inc. CSCO. Hewlett Packard Enterprise’s non-GAAP operating profit increased 0.8% year over year and 26.8% sequentially to $777 million. The non-GAAP operating margin contracted 150 bps year over year but expanded 50 bps sequentially to 8.5%. An unfavorable mix within server, networking and hybrid cloud impacted the gross margin during the quarter. However, Hewlett Packard Enterprise’s acquisition of Juniper partially reversed this trend owing to cost synergies.

In the fourth quarter of fiscal 2025, Cisco reported total non-GAAP operating expenses of $5 billion, up 3.6% year over year. As a percentage of revenues, operating expenses declined 130 bps. Cisco reported a non-GAAP operating income of $5.03 billion, up 13.3% year over year. Operating margin increased to 34.3% from 32.5% a year ago. Strong net sales growth backed by healthy AI-related demand and cost discipline is driving margin expansion.

ANET’s Price Performance, Valuation & Estimates

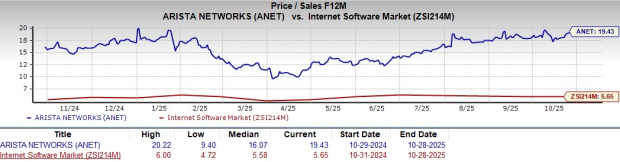

Shares of Arista have surged 56.1% over the past year compared with the industry’s growth of 28.6%.

Image Source: Zacks Investment Research

From a valuation standpoint, Arista trades at a forward price-to-sales ratio of 19.43, above the industry average.

Image Source: Zacks Investment Research

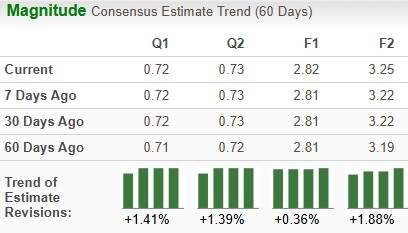

The Zacks Consensus Estimate for Arista’s earnings for 2025 has increased over the past 60 days.

Image Source: Zacks Investment Research

Arista currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.