The Nasdaq-100® represents $10.6 trillion in market capitalization and is comprised of the 100 largest non-financial, Nasdaq listed companies. During the Covid-19 crisis, the Nasdaq-100® has had a remarkable streak of outperformance relative to all other major US-equity index peers. This outperformance can be broken down across industries, company size and other factors.

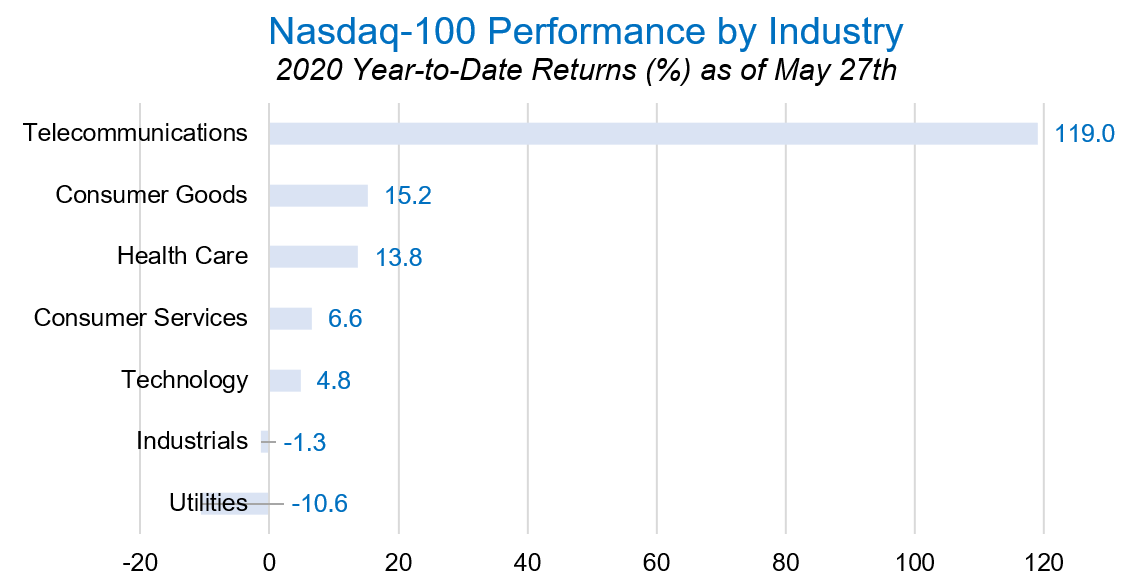

The highest performance industry within the Nasdaq-100® has been in telecommunications, largely driven by T-Mobile (TMUS) and Zoom (ZM), although this industry only makes up 1.5% of the index. Consumer Goods, Health Care, and Consumer Services also drove positive performance while Utilities and Industrials had a negative contribution to performance.

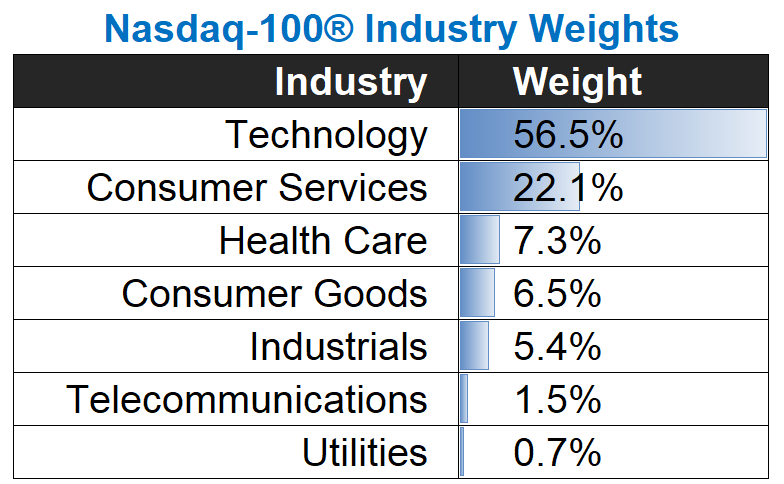

The two largest industries within the Nasdaq-100® are Technology and Consumer Services, making up a combined weight of 78.6% of the index

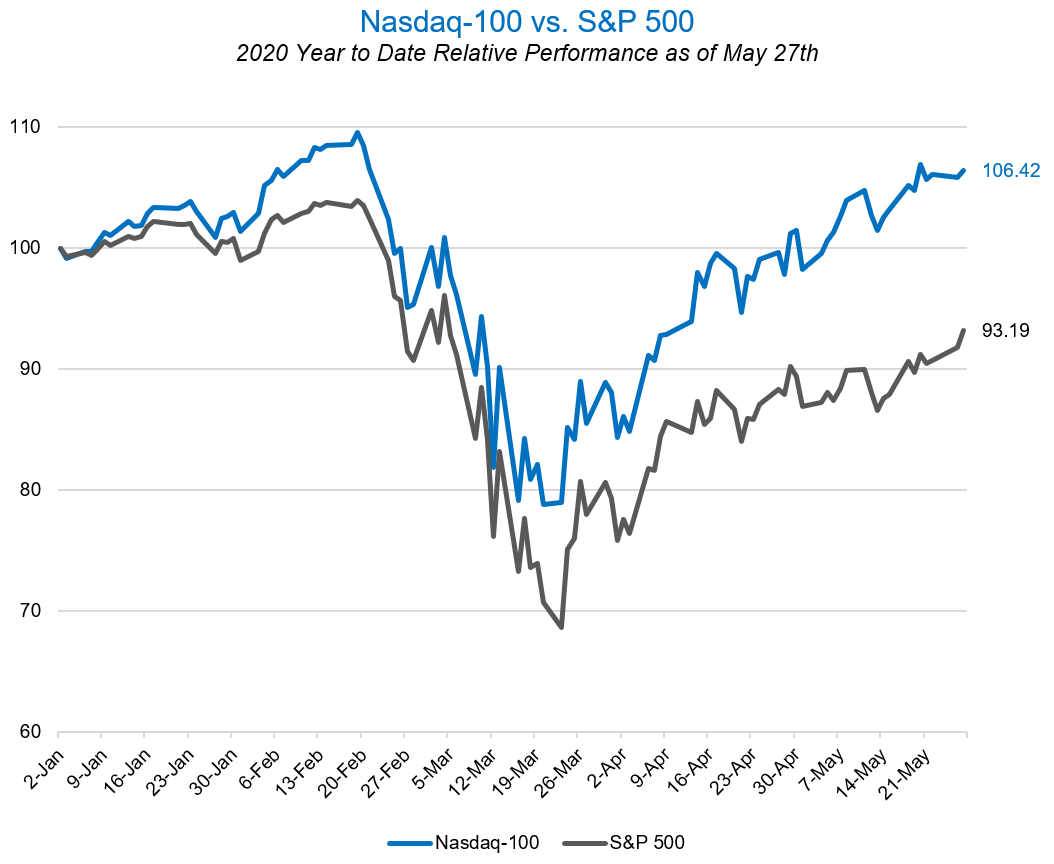

Size was the primary factor that drove outperformance relative to the S&P 500 Index.

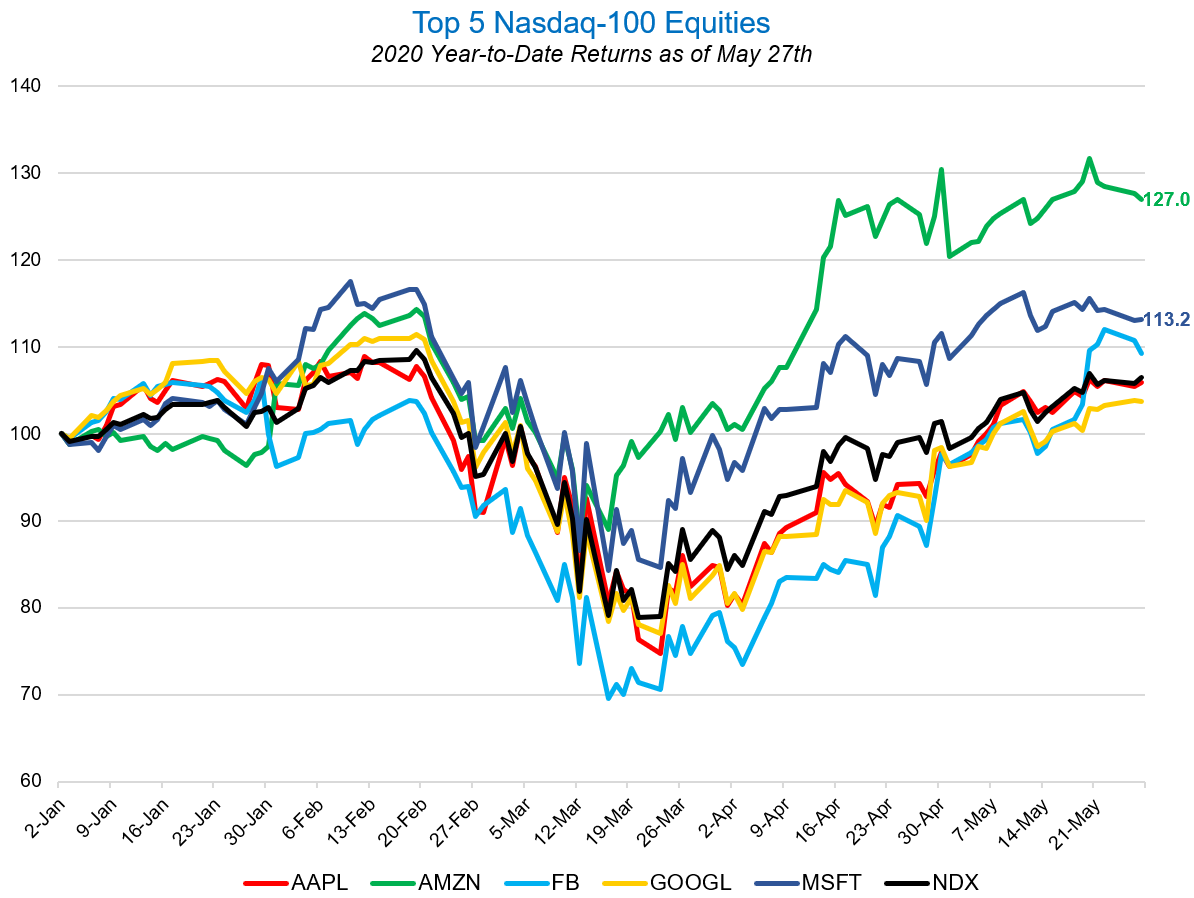

The five largest companies in the Nasdaq-100®, Apple, Microsoft, Facebook, Google, and Amazon, comprise 45.0% of the index. A great deal of the positive performance of the Nasdaq-100® can be attributed to these ultra-large-cap names, particularly Amazon and Microsoft, which together make up 21.2% of the Index and have realized double-digit returns.

The Nasdaq-100® outperformed the S&P 500 by 14.2% on a year-to-date basis. This outperformance seems to indicate that Covid-19 has made “big-tech” even bigger. It’s no secret that Covid-19 has significantly benefited companies such as Amazon and Zoom. But the virus and resulting work-from-home and contactless environment has also accelerated a structural and fundamental shift in the economy toward automation and digitization; Nasdaq-100 companies have been among the largest beneficiaries.

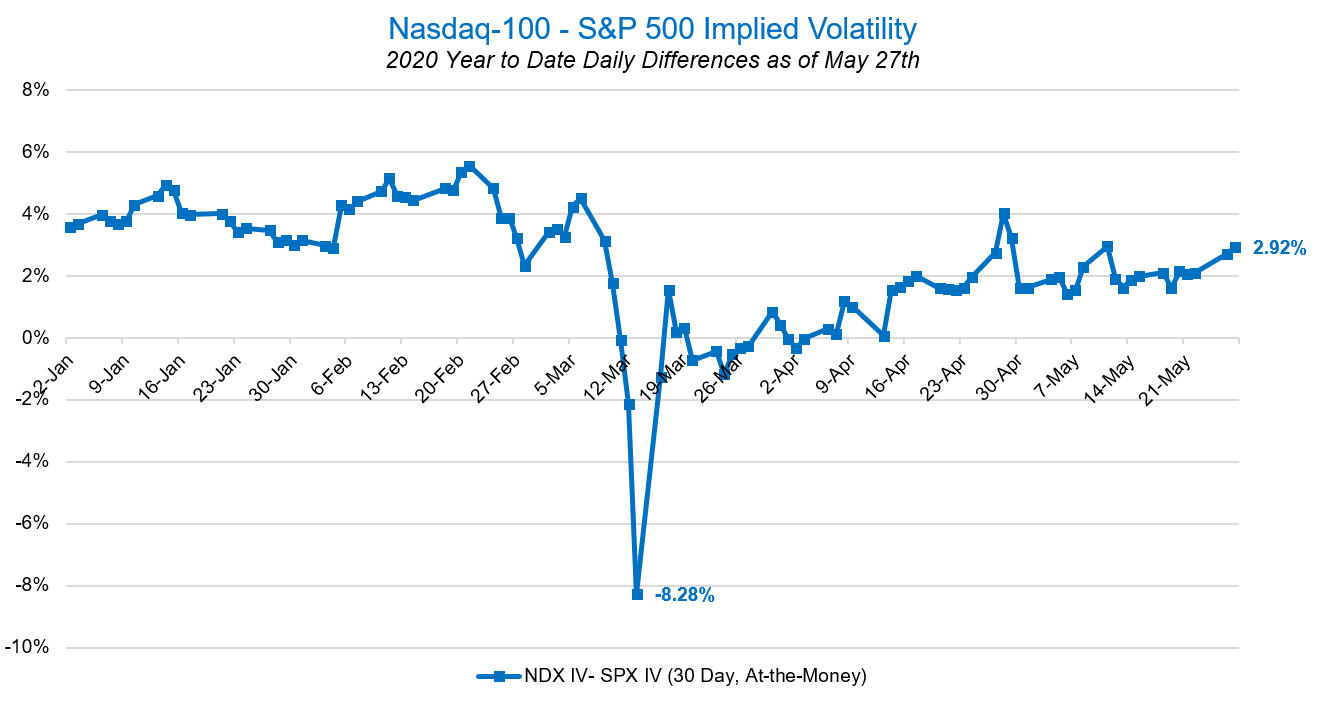

Another reason for the index’s outperformance relative to the S&P 500 is that the Nasdaq-100® is not exposed to energy, real-estate, and financial services companies, many of which are facing issues related to record-low oil prices and stressed credit markets. This stress is perhaps well represented in the options markets. The plot below shows that the difference in implied volatilities of the Nasdaq-100 (NDX) and S&P 500 (SPX) index options went negative in late March, a rare signal that the expected volatility of SPX is greater than NDX.

As the economy reopens will the Nasdaq-100® continue to outperform? Will a return to normalcy close the performance gap between these two major market indexes? Historical data seems to indicate that further outperformance is likely, given the Nasdaq-100® has outperformed the S&P 500 in 12 of the last 14 years, and by an average of 6.91% when considering 2020. Investors will surely continue to monitor the outperformance of the Nasdaq-100® as the economy navigates Covid-19 and begins to reopen.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.