Analog Devices’ ADI consumer segment grew 21% year over year due to traction across handsets, gaming, hearables and wearables categories. As ADI develops analog, digital, mixed signal processors and power solutions for personal and professional entertainment systems, and feature-rich consumer products, the traction is benefiting ADI.

The hearables market is growing at a rate of 18.5% CAGR from 2025 to 2035, per a report by Market Research Future. The wearables market is witnessing a CAGR of 13.6% from 2025 to 2030, per a report by Grand View Research.

ADI also supplies semiconductor products for the smartphone market, which is witnessing a CAGR of 7.3% till 2029, per Fortune Business Insights report. Another major tailwind has been the global semiconductor sales, which increased 15.8% in the third quarter of 2025, per a report by the Semiconductor Industry Association.

These numbers suggest that the growth in ADI’s consumer segment is expected to continue for the long term. Four straight quarters of double-digit YoY growth are a testament to the strong execution and product relevance in consumer applications.

How Competitors Fare Against Analog Devices

Analog Devices competes with Texas Instruments TXN and NXP Semiconductors NXPI in the consumer applications segment. Texas Instruments competes with ADI in analog, digital and mixed signal chains, precision sensing, and power management for consumer electronics products.

NXP Semiconductor is one of the leading solution providers of analog and mixed-signal chips serving mobile, connectivity, and consumer applications. NXP Semiconductor competes in analog front-end, power management, and mixed signal for consumer devices, especially in mobile and IOT markets.

ADI’s Price Performance, Valuation and Estimates

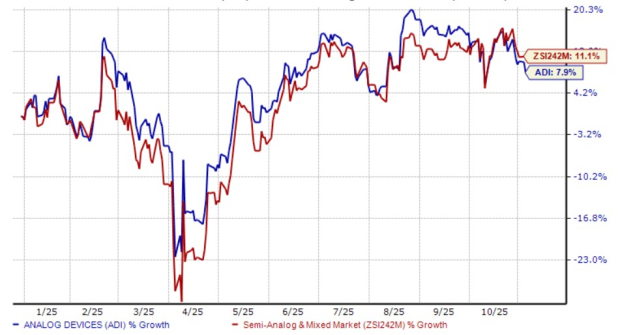

Shares of ADI have gained 7.9% year to date compared with the Semiconductor - Analog and Mixed industry’s growth of 11.1%.

Image Source: Zacks Investment Research

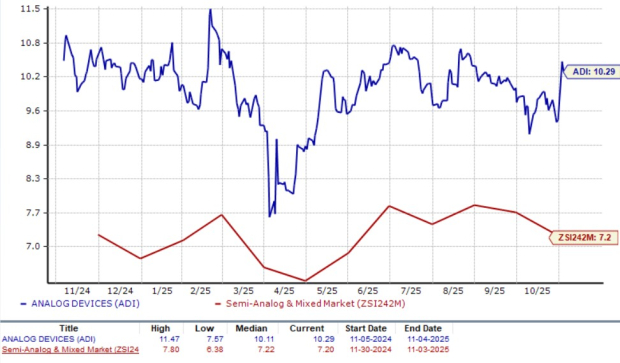

From a valuation standpoint, ADI trades at a forward price-to-sales ratio of 10.29X, higher than the industry’s average of 7.2X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for ADI’s fiscal 2025 and 2026 earnings implies year-over-year growth of 21.5% and 20.1%, respectively. The consensus estimate for fiscal 2025 and 2026 has remained unchanged in the past 30 days.

Image Source: Zacks Investment Research

ADI currently sports a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

NXP Semiconductors N.V. (NXPI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.