Applied Materials’ AMAT latest wafer fabrication equipment (WFE) is experiencing increased demand due to rising usage of semiconductors in artificial intelligence and high performance computing (HPC). AMAT reported that its leading-edge foundry/logic, DRAM and advanced packaging will be the fastest-growing areas of the WFE market.

AMAT specializes in Gate-All-Around (GAA) transistors at 2nm and below, Backside power delivery, Advanced wiring and interconnect, HBM stacking and hybrid bonding and 3D device metrology, which are indispensable for manufacturing next-generation semiconductor chips. Recent launches like Xtera epi, Kinex hybrid bonding, PROVision 10 eBeam will add to AMAT’s growth story.

AMAT expects next-generation technologies to be produced in large volume, which means that the company’s customers will be ramping up their foundries, naturally benefiting AMAT’s business. In 2025, AMAT strengthened its leadership in DRAM, growing revenues from leading-edge customers by more than 50%. This trend is likely to continue in the future.

However, in fiscal 2025, AMAT’s growth was constrained by increased trade restrictions and an unfavorable market mix. China’s share of total systems and services revenues declined to 28% for the year and 25% in the fourth quarter of fiscal 2025. AMAT expects that wafer fab equipment spending in China is expected to be lower in 2026, with no major easing in restrictions.

How Competitors Fare Against AMAT

Companies like Lam Research LRCX and ASML Holdings ASML are leading WFE players in the DRAM, Logic and etching space. Lam Research’s Dynamic Random Access Memory and Non-Volatile Memory products are gaining traction on the back of AI. Lam Research is also winning multiple clients as DRAM manufacturers are using its latest conductor etch tool, Akara.

ASML Holdings’ top line is driven by its DRAM and logic customers, who are ramping leading-edge nodes using ASML’s NXE:3800E EUV systems. The company also delivers deposition and etching tools. However, ASML expects its gross margin to contract due to the revenue recognition from low-margin High Numerical Aperture EUV tools and lower upgrade revenues.

AMAT’s Price Performance, Valuation and Estimates

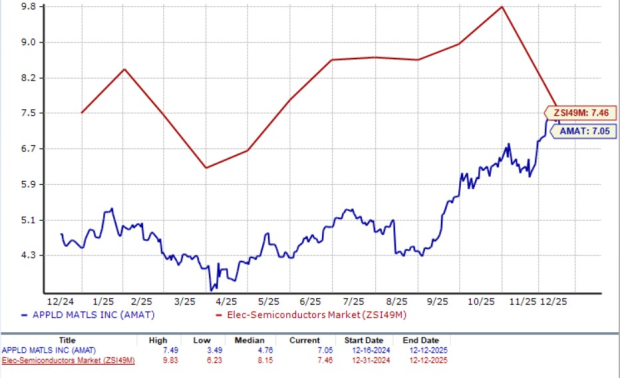

Shares of Applied Materials have gained 53% in the past year compared with the Electronics - Semiconductors industry’s growth of 32.3%.

AMAT One Year Performance Chart

Image Source: Zacks Investment Research

From a valuation standpoint, Applied Materials trades at a forward price-to-sales ratio of 7.05X, lower than the industry’s average of 7.46X.

AMAT Forward 12 Month (P/S) Valuation Chart

Image Source: Zacks Investment Research

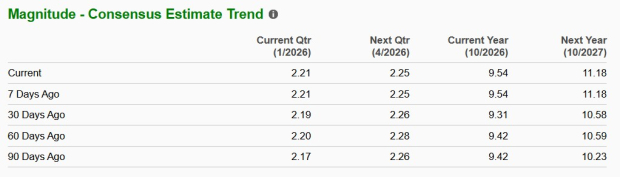

The Zacks Consensus Estimate for Applied Materials’ fiscal 2026 and 2027 earnings implies year-over-year growth of 1.27% and 17.20%, respectively. The estimates for fiscal 2026 and 2027 have been revised upward in the past 30 days.

Image Source: Zacks Investment Research

Applied Materials currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.