Altria Group, Inc. (MO) is leaning more on its discount cigarette offerings as rising costs make adult smokers more price-conscious. In the third quarter of 2025, the broader U.S. cigarette industry saw discount retail share rise to 32.2%, reflecting a notable increase of 2.4 share points year over year. Over the same period, Altria’s flagship premium brand, Marlboro, reported an 11.7% volume decline and a 1.2-point drop in total cigarette retail share, underscoring the growing strain on premium-priced offerings.

Against this backdrop, Altria’s discount portfolio emerged as a meaningful counterbalance. Discount cigarette shipment volume surged 74.5% year over year in the third quarter, reaching more than 1.2 billion sticks. This sharp increase helped offset some of the company’s overall cigarette volume decline and reflects a clear focus on the value segment. By strengthening its presence in discount cigarettes, mainly through the Basic brand, Altria is retaining consumers who are shifting to lower-priced options instead of switching to competing brands.

From an operating standpoint, this mix shift carries measurable implications. While smokeable products net revenues declined 2.8% in the quarter, the combination of pricing actions, lower per-unit settlement charges and a more resilient volume mix contributed to a 0.7% increase in adjusted operating companies income for the segment.

Taken together, Basic’s growing role shows how Altria is managing consumer downtrading within its own portfolio, using the brand to help stabilize volumes during periods of economic pressure rather than to drive growth.

Altria vs. Peers: Divergent Paths to Market Resilience

Philip Morris International Inc. (PM) has taken a different approach to managing price-sensitive demand, placing limited emphasis on discount cigarettes. In the third quarter of 2025, Philip Morris saw combustible cigarette volumes decline 3.2% year over year, but this was partly offset by strong pricing and a favorable mix. Rather than expanding value cigarette offerings, Philip Morris continues to rely on premium pricing and growing contributions from smoke-free products to support overall performance.

Turning Point Brands, Inc. (TPB) is strategically positioning its Modern Oral segment, particularly the FRE and ALP brands, as a diversified growth engine to counter declines in traditional categories. In the third quarter of 2025, Turning Point Brands’ Modern Oral sales surged 627.6% year over year, now accounting for 30.8% of total business. By aggressively expanding retail distribution and doubling its sales force, Turning Point Brands aims for double-digit market share, utilizing high-margin nicotine pouches to offset volume pressures in its heritage Zig-Zag segment.

Altria’s Price Performance, Valuation & Estimates

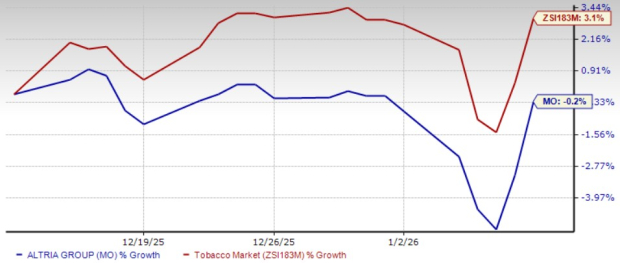

Shares of Altria have lost 0.2% in the past month against the industry’s growth of 3.1%.

Image Source: Zacks Investment Research

From a valuation standpoint, MO trades at a forward price-to-earnings ratio of 10.33X, down from the industry’s average of 14.37X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for MO’s 2025 and 2026 earnings implies year-over-year growth of 6.3% and 2.3%, respectively.

Image Source: Zacks Investment Research

Altria currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Altria Group, Inc. (MO) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Turning Point Brands, Inc. (TPB) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.