Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has spent about eight years focusing on artificial intelligence (AI), a market forecast to soar in the double digits this decade. This technology may revolutionize everything from work to daily life, making it an area tech companies can't ignore.

Late last year, Alphabet took a particularly big step forward in the area of AI. The technology giant introduced Gemini, its strongest AI model yet and one that could help the company progress across its businesses, from Google Search to cloud computing. In fact, Alphabet says it's integrating Gemini in all of its products and services. Gemini can indeed do a lot -- from powering features in the company's Pixel 8 Pro smartphone to offering developers a building platform.

But, for Alphabet, Gemini and the company's overall AI work may be most valuable in one particular area.

Image source: Getty Images.

The search market leader

As mentioned above, Alphabet has more than one business. The company offers clients cloud computing services through Google Cloud and also sells hardware such as phones and watches. But Alphabet's biggest business of all -- and the one most people are probably familiar with -- is Google Search.

Google holds a 91% share of the worldwide search market, leaving even its closest rival, Microsoft's Bing, in the dust with a share of less than 4%. This leadership isn't likely to end thanks to Alphabet's solid moat, or competitive advantage, which is its comfortable position in our daily routines. Proof of that is its entrance into our language -- when you don't know something, the common reflex is to say, "I'll Google it."

Now, let's get back to Gemini and where it could be most valuable for Alphabet -- and that's in the area of search. The company has made the smart decision to aggressively work to improve its search engine and not just ride those waves of success.

Alphabet has started to experiment with Gemini in search, and the result is it's speeding up the company's Search Generative Experience (SGE). With Gemini on board, search latency has dropped 40% in the English language, and that means searches are considerably faster.

The tech giant has been developing SGE as a search platform using generative AI -- so that when you search for something, you're immediately served a general overview of the particular topic, along with links to find more in-depth information and different perspectives. All of this offers you the opportunity to gain a broader knowledge of the topic you're interested in and discover a wider range of content related to it.

Google advertising revenue

Today, Alphabet generates most of its revenue through Google advertising, with businesses aiming to sell their products or services to users as they use the search engine. In the most recent quarter, Google advertising represented 75% of total revenue.

AI, by making searches faster and better, will keep users loyal, ensuring advertisers will keep coming back. Gemini is also directly helping advertisers build better ad campaigns through an AI-powered chat experience.

Of course, this new AI model also may help Alphabet score wins across its businesses and lift revenue in both its cloud and hardware segments. But considering the company's leadership in search and the ad revenue linked to that, search is where Gemini truly could make its mark, becoming a key element to drive future revenue growth.

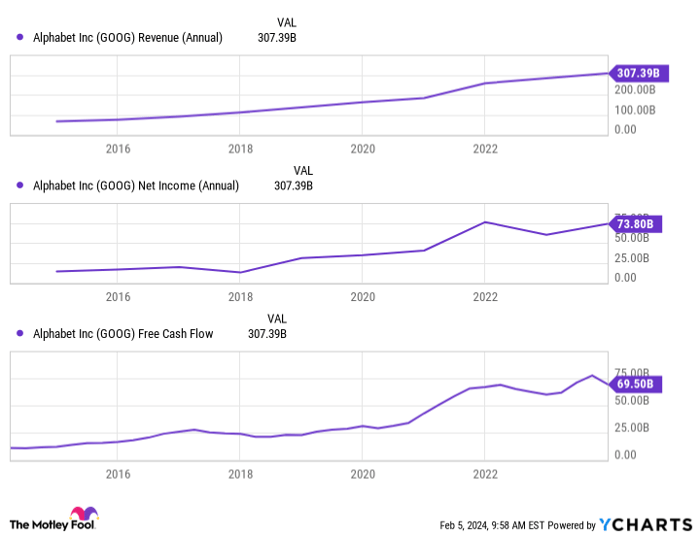

What does this mean for investors? Alphabet has a solid track record of earnings increases and has displayed dominance in the search business and growth in its other businesses over time.

GOOG Revenue (Annual) data by YCharts

And even in difficult economic environments, such as the past two years, revenue has gained.

At the same time, the shares trade for only 21x forward earnings estimates, down from 30 a year ago, a bargain considering the whole picture. And that's why today is a great time to buy Alphabet -- and benefit as Gemini makes the company's top business even better.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Alphabet wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 5, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.