I have been detailing the rotation unfolding beneath the surface of the market in recent weeks. While mega-cap technology and much of the AI ecosystem pulled back, value stocks, cyclicals and several international markets attracted fresh inflows. This type of leadership transition is common during ongoing bull markets. Extended winners consolidate, capital briefly rotates elsewhere, and once expectations reset, the strongest franchises often resume leadership.

That pattern appears to be playing out again. The Magnificent 7 has largely traded sideways to modestly lower since last November as concerns surrounding AI overinvestment, valuation multiples and aggressive capital spending prompted some investors to step aside. Yet the fundamental reality has not deteriorated. If anything, the strategic positioning of these companies looks stronger than ever. These businesses remain the premier assets in global equities, combining dominant competitive moats, enormous cash flow generation and exposure to nearly every major secular growth theme in the modern economy.

Importantly, artificial intelligence is not their only growth driver. Even without AI, these firms would still sit at the center of multiple long-term expansion trends spanning cloud computing, digital advertising, e-commerce, enterprise software, consumer devices, social media, and digital payments. AI therefore functions less as a speculative add-on and more as an accelerator layered on top of already powerful business models.

Image Source: TradingView

Cloud Is Reaccelerating for MSFT, GOOGL and AMZN

For Amazon (AMZN), Alphabet (GOOGL) and Microsoft (MSFT), the most immediate signal of strengthening fundamentals is coming from cloud computing. Demand for compute capacity tied to AI workloads remains extraordinarily strong, with hyperscalers continuing to report that available capacity is effectively sold out. In practical terms, they cannot build data centers fast enough to meet customer demand.

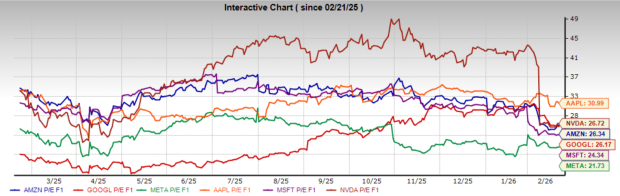

After moderating through parts of 2024, growth in these cloud divisions is now re-accelerating. At the same time, valuations for several of these names have become notably more reasonable following the recent consolidation.

Amazon and Microsoft in particular are trading near some of their more compelling forward multiples in several years, while Alphabet, though slightly elevated is not unreasonably priced. For investors seeking exposure to AI infrastructure without paying peak enthusiasm pricing, this reset may prove meaningful.

Compelling Valuations Across Magnificent 7 Stocks

Meta Platforms (META) remains one of the clearest valuation standouts within the cohort. The stock frequently becomes the subject of extreme sentiment swings, yet the underlying business continues to generate massive free cash flow while maintaining dominant global advertising reach. Trading at less than roughly 22x earnings while analysts project approximately 20% long-term annual earnings growth, the risk-reward profile appears unusually attractive for a company of its scale. Early evidence also suggests that AI-driven improvements in content targeting, ad efficiency and internal operations are contributing to margin expansion.

Nvidia (NVDA) continues to function as the foundational infrastructure provider for the global AI buildout. Despite remaining one of the market’s strongest performers over the past two years, the stock now trades around the mid-20s on forward earnings while consensus expectations still call for earnings growth approaching the high-40% range. That combination produces a PEG ratio near 0.5, a level that historically has signaled strong growth relative to valuation for dominant technology leaders. As long as hyperscale spending remains elevated, Nvidia’s central role in supplying high-performance AI chips keeps its earnings outlook firmly supported.

Apple (AAPL) occupies a somewhat different but equally important position inside the Magnificent 7. Unlike many peers, Apple has not pursued the same aggressive AI infrastructure spending strategy, which has helped shield the stock from some of the capex-related volatility affecting other mega-caps. Operationally, the company continues to execute at an impressive level given its enormous size. Recent results showed renewed strength in both iPhone demand and China revenue, two areas that previously concerned investors, while the high-margin services segment continues to expand rapidly. Total revenue growth in the mid-teens underscores that Apple’s ecosystem remains extraordinarily resilient. Increasingly, investors are recognizing that Apple’s greatest AI advantage may not be building models but owning the dominant global device platform through which billions of users will access AI services.

Image Source: Zacks Investment Research

Magnificent 7 Shares Consolidating

Viewed together, the recent trading pattern in the Magnificent 7 looks far more like a healthy consolidation than a structural breakdown. Bull markets rarely advance in straight lines, particularly after powerful multi-year runs. Periods of sideways movement allow earnings to catch up with prices, valuations to normalize and investor expectations to reset.

With cloud demand strengthening, AI adoption continuing to expand, earnings growth forecasts remaining robust and valuations in several cases becoming more attractive, the setup suggests that mega-cap technology may be positioned to reassert leadership as the year progresses.

For investors, the key takeaway is straightforward: the temporary pause in the market’s most dominant companies has not altered their long-term competitive positioning. If the broader bull market remains intact, history suggests that the premier franchises with the strongest balance sheets, widest moats and deepest exposure to structural growth trends are often the ones that ultimately lead the next advance.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.