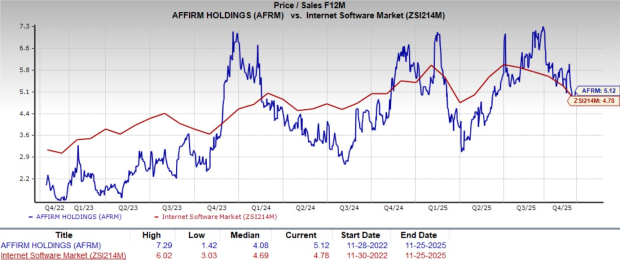

Affirm Holdings, Inc. AFRM continues to behave like a market favorite, but its valuation suggests investors are pricing in an almost flawless future. The stock trades at a forward 12-month price-to-sales (P/S) multiple of 5.12X, far above its three-year median of 4.08X and higher than the broader industry’s 4.78X. The premium becomes more noticeable when stacked against major buy now, pay later (BNPL) competitors. PayPal Holdings, Inc. PYPL trades at 1.64X P/S, while Block, Inc. XYZ stands at 1.47X, underscoring the scale of Affirm’s valuation gap.

These numbers raise a clear question: is the market’s optimism justified, or is it stretching beyond what fundamentals can support? At present, AFRM holds a Value Score of D, a reflection of its elevated trading range relative to peers and the expectations embedded in its stock price.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Free Cash Flow Strength, But at a Premium

Affirm generated $769 million of free cash flow over the past year, a meaningful 27.8% increase that highlights improving operational traction. Positive free cash flow is an important milestone for a business that previously faced questions about durability, and it lends credibility to management’s longer-term plan. However, the stock trades at a price-to-free-cash-flow (P/FCF) ratio of 31.16X, higher than the industry’s 27.25X.

AFRM’s Growth Secrets

A core reason bulls are willing to pay up is Affirm’s ability to drive repeat usage. Short-term offerings such as Pay in 2 and Pay in 30 encourage frequent re-engagement, increasing lifetime value and strengthening loyalty. In the first quarter of fiscal 2026, repeat customers accounted for 96% of transactions. That level of repeat usage suggests Affirm has embedded itself into everyday spending patterns and could sustain transaction growth if retention holds.

It has broadened its relevance into everyday categories like groceries, fuel, travel and subscriptions, raising the number of occasions consumers can use its products. Merchant adoption is rising too: active merchants increased 30% year over year to 419,000 as of Sept. 30, 2025. These gains supported a 52.2% year-over-year jump in transactions to 41.4 million in the most recent quarter. Partnerships that deepen integration, such as with Google Pay, also reduce friction at checkout and increase transaction frequency.

One of Affirm’s most strategic growth initiatives is the Affirm Card. The company aims to offer the card broadly across its user base, transforming it into a primary access point for Affirm services. The firm added 500,000 cardmembers during the fiscal first quarter, aided by a cash-flow underwriting model that assesses real-time spending and deposit behavior rather than relying exclusively on traditional credit files. This underwriting can expand the eligible pool while improving risk assessment.

Affirm’s partnership with Shopify is expected to roll out across Europe, with launches expected in France, Germany, and the Netherlands. Geographic expansion should enlarge the addressable market and diversify revenue streams. Active consumers reached 24.1 million as of September 2025, up 24% year over year, reflecting both domestic and international adoption momentum.

Favorable Earnings Estimates for AFRM

The Zacks Consensus Estimate for Affirm’s fiscal 2026 earnings suggests a 566.7% year-over-year surge to $1 per share, while fiscal 2027 earnings are expected to increase to $1.56. Revenue projections are also strong, with fiscal 2026 and 2027 expected to grow 26% and 22.8%, respectively.

The company anticipates fiscal 2026 Gross Merchandise Value to be more than $47.5 billion. Affirm’s earnings beat estimates in each of the past four quarters, with an average surprise of 129.3%.

Affirm Holdings, Inc. Price, Consensus and EPS Surprise

Affirm Holdings, Inc. price-consensus-eps-surprise-chart | Affirm Holdings, Inc. Quote

AFRM’s Price Performance

Affirmshares have risen 9.8% so far this year, outperforming the industry average of 5.1%. PayPal and Block witnessed significant declines during this time, while the broader S&P 500 Index gained 17.5%.

AFRM YTD Performance Vs. PYPL, XYZ, Industry & S&P 500

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

AFRM’s Key Risks to Watch

Competition remains intense across the innovative payments landscape. Well-capitalized players like PayPal and Block, along with established financial institutions, continue to expand aggressively in the BNPL segment. Walmart’s move to replace Affirm with Klarna Group plc KLAR highlights the difficulty of retaining major merchants in such a crowded market. Klarna’s launch of KlarnaUSD, its first stablecoin pegged to the U.S. dollar, further raises competitive pressure. The initiative is significant because it could reduce cross-border payment costs by allowing Klarna to bypass traditional, higher-cost settlement systems, potentially strengthening its global reach.

Affirm also faces rising operating expenses, which climbed 25.9% in fiscal 2023, 5.4% in fiscal 2024, 12.7% in fiscal 2025 and 4.6% in the first quarter of fiscal 2026. While ongoing investments support growth, maintaining margins will require firm cost control.

The company ended the fiscal first quarter with $1.4 billion in cash and cash equivalents, up 5.5% from fiscal 2025-end. Meanwhile, funding debt increased to $1.8 billion, lifting its long-term debt-to-capital ratio to 70.6%, well above the industry’s 13.4%. Elevated leverage remains a key watch point, though strong cash generation offers some buffer.

Bottom Line

Affirm continues to show meaningful operational progress, supported by strong repeat usage, expanding merchant relationships and rising free cash flow. Its geographic expansion plans and deeper ecosystem integration also add to long-term potential. However, a premium valuation, elevated leverage, rising operating expenses and intensifying competition temper the outlook. These mixed signals suggest that while Affirm has attractive growth drivers, the risk-reward profile is not compelling enough yet. It currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

Affirm Holdings, Inc. (AFRM) : Free Stock Analysis Report

Block, Inc. (XYZ) : Free Stock Analysis Report

Klarna Group plc (KLAR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.