Analog Devices’ ADI Industrial segment is experiencing massive growth on the back of demand for its offerings across instrumentation, automation, health care, aerospace and defense and energy management businesses, as mentioned in their recent earnings call. The Industrial segment grew 23% year over year in the third quarter of fiscal 2025.

The industrial segment showed robust growth across all subsectors and geographies, mainly driven by automatic test equipment, benefiting from AI chip infrastructure buildout and record aerospace & defense performance. ADI’s automation business also showed double-digit growth. ADI sees potential to double its automation business by 2030.

In the robotics front, Analog Devices has partnered with Teradyne to advance its footprint in the robotics market. ADI’s positioning and dynamic motion control systems are enabling Teradyne to develop high-performing cobots and autonomous mobile robots for the logistics industry.

ADI is also working with NVIDIA on digital twin simulations and reference designs for humanoid and advanced robotic systems. With all these factors at play, ADI expects its Industrial segment to grow at the fastest pace among all its segments. The Zacks Consensus Estimate for ADI’s fiscal 2025 and 2026 revenues is expected to grow 15% and 17.4%, respectively.

How Competitors Fare Against Analog Devices

Analog Devices competes with Texas Instruments TXN and STMicroelectronics STM in the Industrial segment. Texas Instruments competes with ADI in industrial signal chains, precision sensing, and power management, especially in PLCs, factory automation, and motor control. STMicroelectronics competes in industrial MCUs, motor drivers, sensors, and automation systems.

In the robotics space, STMicroelectronics provides sensors, motor control ICs, and power management for cobots, AMRs, and humanoid robots. In automation, Texas Instruments provides low-power precision analog and sensing for medical imaging, patient monitoring, and diagnostics.

Both STMicroelectronics and Texas Instruments compete with ADI in the aerospace and defence business through their radiation-hardened analog and mixed-signal ICs, secure communications, and avionics systems.

ADI’s Price Performance, Valuation and Estimates

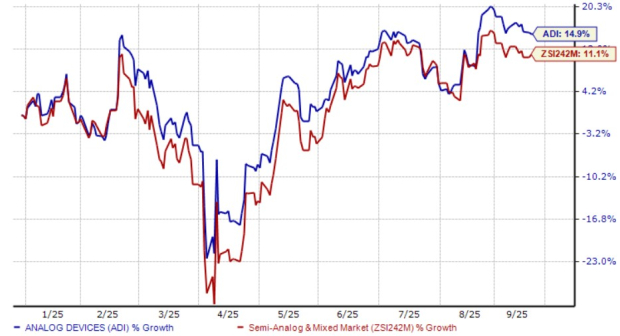

Shares of ADI have gained 14.9% year to date against the Semiconductor - Analog and Mixed industry’s growth of 11.1%.

Image Source: Zacks Investment Research

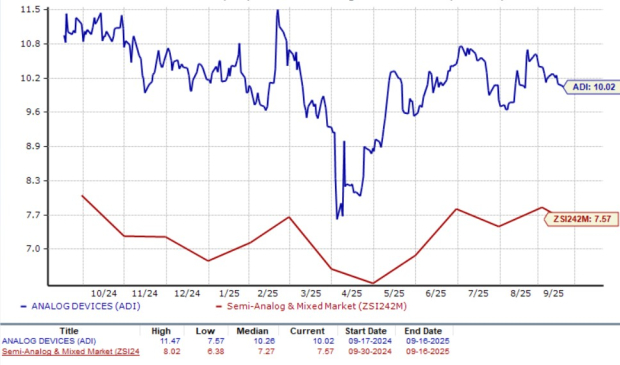

From a valuation standpoint, ADI trades at a forward price-to-sales ratio of 10.02X, lower than the industry’s average of 7.57X.

Image Source: Zacks Investment Research

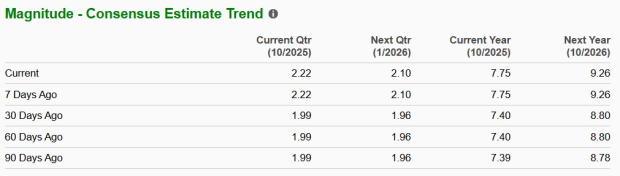

The Zacks Consensus Estimate for ADI’s fiscal 2025 and 2026 earnings implies year-over-year growth of 21.5% and 19.4%, respectively. The consensus estimate for fiscal 2025 and 2026 has been revised upward in the past 30 days.

Image Source: Zacks Investment Research

ADI currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA's enormous potential back in 2016. Now, he has keyed in on what could be "the next big thing" in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

See Top Quantum Stocks Now >>Analog Devices, Inc. (ADI) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.