Analog Devices ADI and NXP Semiconductors NXPI are two of the largest semiconductor players in the analog signal processing space. Both Analog Devices and NXP Semiconductors develop analog chips for industrial, automotive and consumer electronic applications.

With the recent boom in the semiconductor industry, the question remains: which stock has more upside potential? Let us break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

The Case for ADI Stock

Analog Devices is the second-largest producer of analog chips after Texas Instruments. The company should benefit from its strong market position in high-performance analog, especially in the industrial, communications infrastructure and consumer markets. Analog Devices experienced growth across Industrial, Automotive, Consumer and Communications segments in the third quarter of 2025.

ADI is benefiting from its strong market position in high-performance analog, especially in the industrial, communications infrastructure and consumer markets. The strong momentum across the industrial and automotive end markets, especially the electric vehicle space, is growing on the back of its robust Battery Management System solutions.

Analog Devices delivered a solid performance in its third quarter of fiscal 2025, with revenues reaching $2.88 billion, marking approximately a 25% year-over-year increase and sequential growth of 9%. The sequential improvement signals that the company has moved past the cyclical downturn.

Analog Devices’ hybrid manufacturing strategy provides a significant competitive advantage by balancing internal production capacity with external partnerships. This approach enhances supply-chain flexibility and reduces geopolitical risk, ensuring consistent product availability for customers.

The Zacks Consensus Estimate for ADI’s fiscal 2025 and 2026 revenues indicates year-over-year growth of 12.2% and 10%, respectively. The consensus mark for EPS suggests a robust year-over-year improvement of 21.5% for fiscal 2025 and 19.4% for fiscal 2026.

Image Source: Zacks Investment Research

The Case for NXPI Stock

NXP Semiconductor has a broad portfolio of analog products that are used across key markets, particularly automotive, industrial & IoT, and mobile. The company has successfully partnered with leading OEMs to co-develop custom and semi-custom products. NXP’s collaborations with tech giants, including Amazon Web Services and Micron Technology, reinforce its leadership in secure, intelligent and high-performance semiconductors across multiple industries.

In automotive, NXPI provides solutions like 77Ghz radar solution for ADAS, battery management products for vehicle electrification, audio processing solutions and amplifiers for in-car entertainment, and networking solutions spanning Controller Area Network (CAN), Local Interconnect Network (LIN), FlexRay, and Ethernet. Additionally, NXPI’s two-way secure access products are enabling safer and more efficient vehicle entry systems.

In the industrial & IoT and mobile segments, NXPI provides interface, power, and high-performance analog solutions. NXPI’s portfolio includes I2C/I3C, General Purpose Input/Output, LED controllers, real-time clocks, signal and load switches, signal integrity products, wired and fast charging solutions, DC-DC and AC-DC converters, and high-performance RF amplifiers.

The Industrial & IoT segment has remained a weak spot for NXP. The industrial semiconductor market has been under pressure due to sluggish capital spending, weak enterprise demand and declining factory automation investments. NXP’s Communication Infrastructure & Other segment also declined in second-quarter 2025. NXPI attributed this decline to the accelerated end-of-life cycle of older networking products, particularly from Freescale’s legacy digital networking portfolio.

For the third quarter of 2025, NXPI expects revenues in the range of $3.05-$3.25 billion. NXPI expects non-GAAP earnings per share in the band of $2.89-$3.30. The Zacks Consensus Estimate for third-quarter 2025 revenues and earnings shows a decline of 3% and 10.14%, respectively.

Image Source: Zacks Investment Research

ADI vs. TXN: Price Performance and Valuation

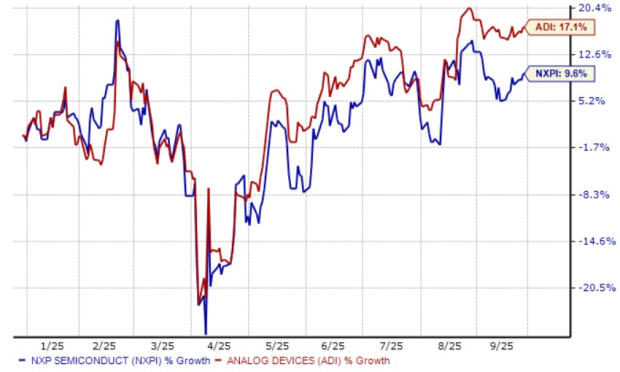

Year to date, NXPI shares have climbed 9.6% compared with the 17.1% rise in ADI shares.

Image Source: Zacks Investment Research

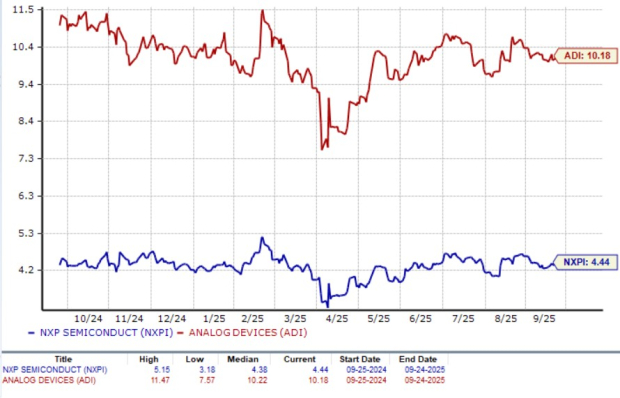

On the valuation front, NXPI looks more attractive than ADI. ADI trades at a forward 12-month P/S multiple of 10.18X, significantly higher than NXPI’s 4.44X.

Image Source: Zacks Investment Research

Conclusion: Buy ADI Stock Now

Although both NXPI and ADI are established players in the analog signal processing space, NXPI is facing multiple near-term headwinds like geopolitical risks and slow recovery in the industrial end market. This is not the case for ADI, which is performing extraordinarily well at present.

ADI flaunts a Zacks Rank #1 (Strong Buy), making it a clear winner over NXPI, which has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the "first wave" of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks' AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>Analog Devices, Inc. (ADI) : Free Stock Analysis Report

NXP Semiconductors N.V. (NXPI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.