Amphenol APH is benefiting from its strategic acquisitions that contributed 15% to the first half of 2025 revenues. On a reported basis, revenues jumped 52% and excluding acquisition-related contributions, organic growth was 37% to hit $10.46 billion. In second-quarter 2025, revenues jumped 57% year over year on a reported basis and 41% organically to $5.65 billion. Acquisitions contributed 15% while favorable forex benefited revenues by 1%.

Plethora of acquisitions – CIT, Lutze, CommScope’s COMM Andrew business, LifeSync, Narda-MITEQ, XMA and Q Microwave — have been driving Amphenol’s prospects. In the first half of 2025, the company completed three acquisitions, including the Andrew business from CommScope, for approximately $2.48 billion, net of cash acquired. The Andrew business has been included in the Communications Solutions segment, and the other two acquisitions have been included in the Harsh Environment Solutions segment.

In early August, Amphenol announced a definitive agreement to acquire CommScope’s Connectivity and Cable Solutions (CCS) business for $10.5 billion in cash. The deal expands Amphenol’s interconnect product capabilities in the fast-growing IT datacom market. The acquisition will add fiber optic interconnect products for AI and other data center applications. The CCS acquisition will diversify Amphenol’s broad portfolio of fiber optic and other interconnect product solutions in the communications networks and industrial markets. The CCS business is expected to have sales and EBITDA margins of approximately $3.6 billion and 26% in 2025, respectively.

Recently, Amphenol announced a definitive agreement to acquire Trexon for approximately $1 billion in cash. Trexon is expected to have 2025 sales and EBITDA margins of approximately $290 million and 26%, respectively.

Amphenol expects third-quarter 2025 revenues between $5.4 billion and $5.5 billion, suggesting growth in the 34-36% range. The Zacks Consensus Estimate for the third quarter of 2025 is pegged at $5.48 billion, indicating 35.62% growth from the figure reported in the year-ago quarter.

Intensifying Competition Hurts APH’s Prospects

Amphenol is facing stiff competition from the likes of TE Connectivity TEL and RF Industries RFIL.

TE Connectivity is expected to benefit from strong demand for its solutions in the AI domain as well as energy applications. The company is benefiting from strength in Asia in the Transportation segment, where increased data connectivity trends and the ongoing growth of the electrified powertrain.

RF Industries benefits from growing adoption of its integrated solutions, with backlog increasing to $15 million at the end of the second quarter of 2025 on bookings of $18.7 million. RF Industries’ ongoing transition from a product-oriented company to an integrated solutions provider is expected to drive top-line growth over the long term.

APH’s Share Price Performance, Valuation & Estimates

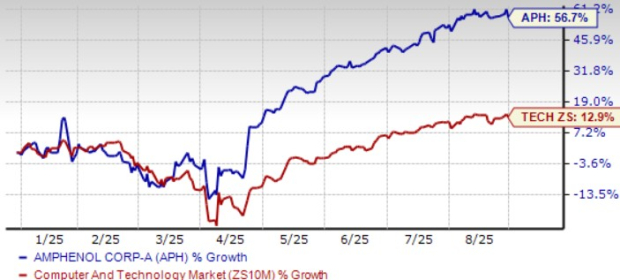

Amphenol shares have jumped 56.7% year to date, outperforming the broader Zacks Computer and Technology sector’s return of 12.9%.

APH Stock’s Performance

Image Source: Zacks Investment Research

APH stock is overvalued, with a forward 12-month price/earnings of 33.4X compared with the broader sector’s 27.71X. Amphenol currently has a Value Score of D.

APH Valuation

Image Source: Zacks Investment Research

Amphenol expects third-quarter 2025 earnings between 77 cents and 79 cents per share, indicating growth between 54% and 58% year over year. The Zacks Consensus Estimate for third-quarter 2025 earnings is pegged at 79 cents per share, up by a couple of cents over the past 30 days, suggesting 58% year-over-year growth.

Amphenol Corporation Price and Consensus

Amphenol Corporation price-consensus-chart | Amphenol Corporation Quote

Amphenol currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpAmphenol Corporation (APH) : Free Stock Analysis Report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

RF Industries, Ltd. (RFIL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.