One of the most valuable lessons I have learned is stocks with bullish momentum tend to continue higher in the stock market. Instead of overcomplicating investing and trying to pick bottoms, most investors would be better served by latching onto stocks that are already exhibiting strong price momentum. Below are two of my favorite trend-following quotes:

“It is one of the great paradoxes of the stock market that what seems too high usually goes higher, and what seems too low, usually goes lower.” ~ William J O’Neil

“The trend is your friend until the end when it bends.” ~ Ed Seykota

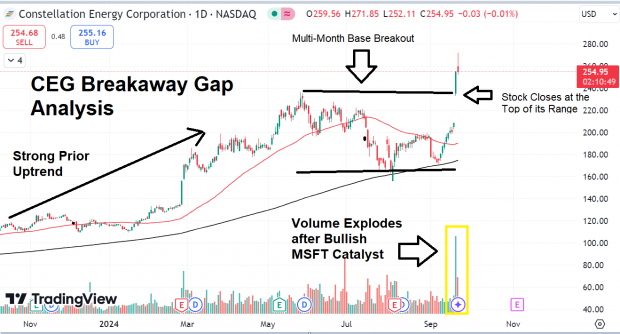

I have discovered that many of my best trades over the past two decades have been related to the breakaway gap set up. Today, I will articulate five traits to look for in a breakaway gap using a real-time example. Later, I will discuss how to handle these trades.

1. Game-Changing Bullish Catalyst

A new, bullish catalyst is at the heart of successful breakaway gap set ups. Bullish catalysts cause massive overnight price gaps in stocks. A recent example is last week’s nuclear deal signed between Microsoft (MSFT) and Constellation Energy (CEG). In a landmark energy deal, CEG will revive Three Mile Island’s nuclear plant and provide energy to MSFT for 20 years. Because energy-hungry data center construction is needed to train artificial intelligence (AI) models, which is growing rapidly, energy is the next wave of the AI cycle.

2. Prior Uptrend & Base Breakout

To find the best breakaway gaps, I look for a prior uptrend, a base structure, and a price gap out of that base structure. CEG is breaking out of a base structure dating back to May

3. Explosion in Volume

A breakaway gap works for retail investors is that they can piggyback on institutional investors that move the market. A volume explosion tells us that institutions are hungry to acquire shares. Because large mutual funds can take years to accumulate stock, buying gaps can be a profitable strategy. Volume increases of 100% or more versus the 50-day average are ideal. CEG’s volume exploded by more than 300% after the MSFT news – a bullish sign.

4. Strong Closing Range

A high closing range is a clue that buyers have conviction and are not rushing to sell shares. Seek stocks that close in the top 25% of the daily range on a gap day. CEG’s high of day on the gap was $255.24, and the stock closed at $254.98.

Image Source: TradingView

5. Top industry Group

A strong industry is a sign that the breakaway gap is not a one-off but is instead an industry trend. In CEG’s case, other industry peers in the uranium and utility industry are acting well, including, Vistra (VST), Cameco (CCJ), and NRG (NRG).

Managing the Position

Buying a Breakaway Gap

There are several ways to buy a breakaway gap. I typically buy half of my position on the open of the gap day (so I can capitalize on the initial momentum) and add toward the end of the day (confirmation of a strong close). By buying the stock in increments, I give myself flexibility.

Breakaway Gap Risk Management

Like any set up, breakaway gaps are not a guaranteed and investors must manage risk. I will usually stop myself out of a position if it closes below the gap-day low. A close below this level indicates that the stock may need time and is not as strong as we thought.

Bottom Line

Breakaway gap technical set ups often produce big stock market winners. CEG is one stock that exhibits all the right traits.

Zacks Names #1 Semiconductor Stock

It's only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Cameco Corporation (CCJ) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.