3M Company MMM has undertaken structural reorganization actions to reduce the size of its corporate center, streamline its geographic footprint, simplify the supply chain and optimize manufacturing roles to align with production volumes. As part of its restructuring program, the industrial conglomerate announced significant job cuts and spun off its healthcare business into a publicly listed company in 2024. Further, in the first nine months of 2025, the company’s management agreed and committed to undertake additional actions under the program.

3M expects these restructuring actions to reduce operational costs and improve margins and cash flow in the long term. It expects these actions to be completed by 2025 and yield annual pre-tax savings. In the first nine months of 2025, these actions, together with strong organic volume and productivity, raised 3M’s adjusted operating margin by 220 basis points year over year to 24.2%.

Benefiting from its efforts to boost sales and reduce costs, 3M provided strong financial guidance for 2025. For the year, the company expects adjusted earnings to be in the range of $7.95-$8.05 per share. The midpoint of the guided range is $8.00, which reflects an increase from earnings of $7.30 per share reported in 2024. Adjusted organic revenues are projected to grow more than 2%, while the adjusted operating margin is expected to expand 180-200 basis points year over year.

Margin Performance of MMM’s Peers

Among 3M’s major peers, Griffon Corp. GFF witnessed an increase in its adjusted gross margin from 41.1% to 41.7% in the third quarter. Griffon’s focus on cost-management actions and operational efficiency has been beneficial. In the third quarter, Griffon’s cost of sales declined 2.6% on a year-over-year basis.

MMM’s another peer, Honeywell International Inc.’s HON operating margin contracted 220 basis points to 16.9% in the third quarter. Honeywell’s cost of sales (cost of products and services) increased 14.7% year over year. The increase in operating expenses adversely impacted Honeywell’s margins during the quarter.

The Zacks Rundown for MMM

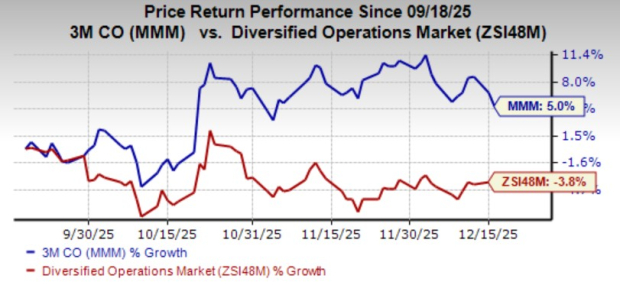

Shares of 3M have gained 5% in the past three months against the industry’s decline of 3.8%.

Image Source: Zacks Investment Research

From a valuation standpoint, 3M is trading at a forward price-to-earnings ratio of 19.05X, above the industry average of 14.03X. The metric is pegged higher than its five-year median of 15.98X. MMM carries a Value Score of D.

Image Source: Zacks Investment Research

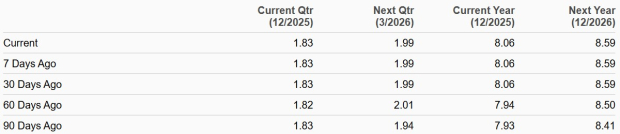

The Zacks Consensus Estimate for MMM’s earnings for 2025 has increased 15.1% in the past 60 days. MMM stock currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Honeywell International Inc. (HON) : Free Stock Analysis Report

3M Company (MMM) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.