It’s time to put 2022 in the rearview mirror -- finally. This past year was dominated by controversy, bankruptcies, and some cryptocurrencies even becoming completely worthless.

But now that it seems like the bad actors in the industry have been purged, there is reason for optimism that a sense of normalcy could return in 2023. Barring any other unforeseen catastrophes, here are my top three things to keep in mind for the coming year with three top cryptocurrencies.

1. Bitcoin

The original cryptocurrency is still the most valuable, even if it is down more than 70% from its all-time high. For investors looking for any sign of a bull market returning, there is one crypto and metric that I believe should be kept in focus.

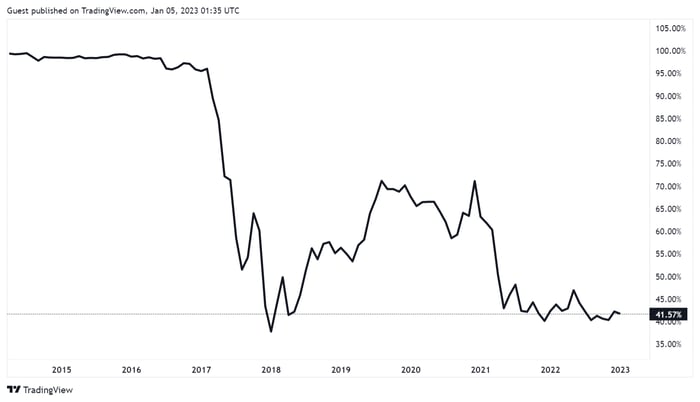

Bitcoin (CRYPTO: BTC) dominance refers to it market cap relative to the entire cryptocurrency market cap. Because Bitcoin was the first and only cryptocurrency for a few years, it made up 100% of all value in the cryptocurrency asset class. But now that there are more cryptocurrencies in circulation, that number has receded to around 41% and hovered there for most of 2022.

Data source: TradingView.

Based on past bear and bull market cycles, it seems that when markets get a little choppy, investors look for safer, less risky plays. My hope is that Bitcoin’s dominance can make its way above 50% and more ideally around 60%. This would reflect the levels of 2018 and 2019 that laid the foundation for Bitcoin to make its massive run to its all-time high of nearly $70,000.

2. Ethereum

Next up is the second-most valuable cryptocurrency, Ethereum (CRYPTO: ETH). After successfully implementing The Merge in the fall, thereby moving from the blockchain from a proof-of-work consensus mechanism to the more energy-friendly proof of stake, 2022 was a relative success, even though its price shed nearly 60%.

Yet there might be more in store for 2023. Ethereum's developers have released the road map for the coming year, and it's chock-full of updates.

Set to go live in March, the Shanghai update will accomplish a few things, but of most importance is that it will allow those who staked their Ethereum on the new blockchain (the one that the old blockchain eventually merged with) to withdraw their funds. As of now, there are mixed opinions as to how this will impact Ethereum’s price. Just because they can withdraw doesn’t necessarily mean they will.

The other, more notable update will likely introduce a highly anticipated feature known as sharding. This new update will make Ethereum one of the fastest blockchains ever. Currently, transactions on Ethereum are processed rather slowly, hovering at only 12 to 24 transactions per second (tps). With sharding, that number could jump to as high as 100,000 tps.

With transaction speeds that fast, Ethereum will transform from a clunky, congested blockchain to a lightning-fast one that can support a near-infinite number of use cases. The goal is for sharding to be implemented sometime in the fall, but it might not happen until 2024.

3. Polygon

Like other cryptocurrencies, Polygon’s (CRYPTO: MATIC) price took a hit, but it still had a magnificent year in terms of making new partnerships. To meet the demands of customers from companies like Starbucks, Meta Platforms, and Coca-Cola (just a few of the companies that selected Polygon as their blockchain of choice), Polygon will need to ensure that it remains nimble.

Boasting some of the fastest transaction speeds, Polygon ascended to fame in 2022 as users looked for alternatives to the costly transaction fees and slow speeds on the Ethereum blockchain. Rather than trying to outdo Ethereum, Polygon acts as a second layer where transactions can be processed and then added to Ethereum’s blockchain at a later date in bundles rather than one by one. And now it looks like it might be making this process even more refined.

Set for release sometime in 2023, a new method to bundle those transactions will be implemented and make Polygon even faster and more attractive. Referred to as zkEVM, this technology will not only streamline the bundling of transactions but will also introduce backward compatibility with Ethereum smart contracts.

Without zkEVM, developers would have to rewrite their smart contracts on Polygon if they wanted to migrate their applications. But with zkEVM, developers can move their applications and code to Polygon and take advantage of those fast speeds and low fees without having to write more code. When this happens, it could lead to a boom in use and popularity of the Polygon blockchain -- possibly followed by a boom in price.

10 stocks we like better than Bitcoin

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Bitcoin wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of December 1, 2022

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. RJ Fulton has positions in Bitcoin, Ethereum, and Polygon. The Motley Fool has positions in and recommends Bitcoin, Ethereum, Meta Platforms, Polygon, and Starbucks. The Motley Fool recommends the following options: long January 2024 $47.50 calls on Coca-Cola and short January 2023 $92.50 puts on Starbucks. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.