Stocks with rising earnings estimates have significantly outperformed the S&P 500 year after year, whereas stocks with falling earnings estimates have underperformed the S&P 500 year after year.

Enter the Zacks Rank.

The Zacks Rank has made the process of identifying stocks with changing earnings estimates easy and very profitable. It’s a reliable tool that helps you trade with confidence regardless of your trading style and/or risk tolerance.

The Zacks Rank uses four factors related to earnings estimates to classify stocks into five groups, ranging from ‘Strong Buy’ to ‘Strong Sell.’ Importantly, it allows individual investors to take advantage of trends in earnings estimate revisions and benefit from the power of institutional investors.

To learn much more about how you can use this proven system for market-beating gains, visit Zacks Rank Education.

Let’s take a closer look at the Zacks Rank in action across several stocks, including beloved NVIDIA NVDA, Deckers Outdoor DECK, and Super Micro Computer SMCI.

NVIDIA

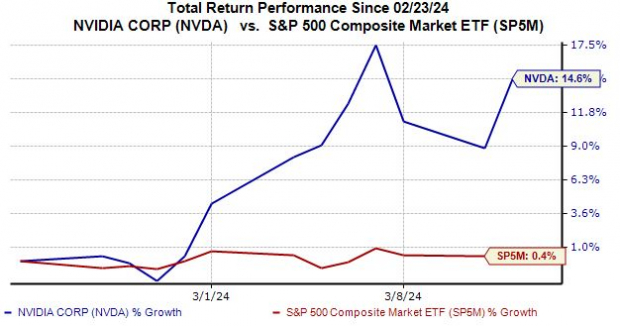

Benefiting massively from the AI-frenzy, NVIDIA shares have moved higher along with earnings estimate revisions, with the stock jumping back into a Zacks Rank #1 (Strong Buy) on Feb. 23rd (just a few days after its blowout quarter). Since then, shares have added a rock-solid 15% in value, outperforming relative to the S&P 500.

Image Source: Zacks Investment Research

The company’s growth has been remarkable, with record Q4 revenue of $22.1 billion climbing 409% year-over-year and driven by unrelenting demand for AI chips.

Deckers Outdoor

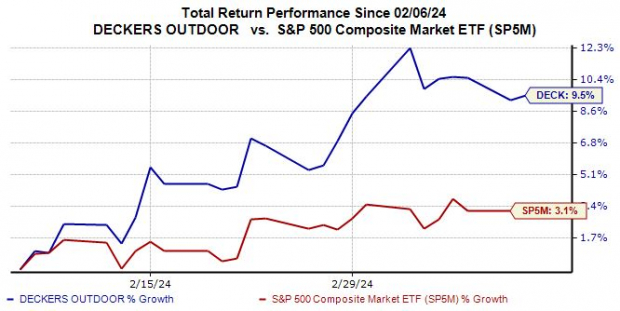

Since becoming a Zacks Rank #1 (Strong Buy) on February 6th, DECK shares have added 9.5%, outperforming the S&P 500’s 3.1% gain.

Image Source: Zacks Investment Research

The upgrade came a few days after better-than-expected quarterly results, with the company giving positive guidance for its current fiscal year and causing analysts to revise their earnings estimates higher. Concerning the release, EPS of $15.11 and revenue of $1.6 million reflected quarterly records, driven by strength across its UGG and HOKA brands.

Super Micro Computer

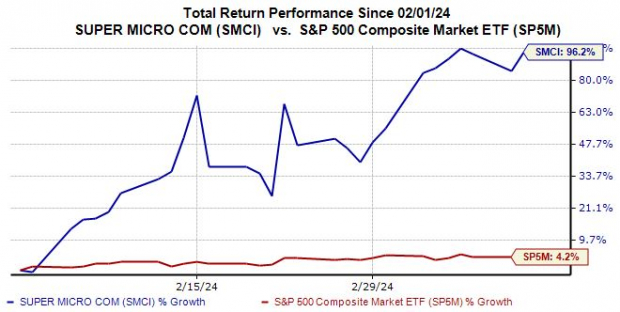

One of the top market-performers overall in 2024, Super Micro Computer shares got upgraded into a Zacks Rank #1 (Strong Buy) on February 1st, with a sizable 96% gain following since. Like those above, positive revisions coincided with better-than-expected quarterly results.

Image Source: Zacks Investment Research

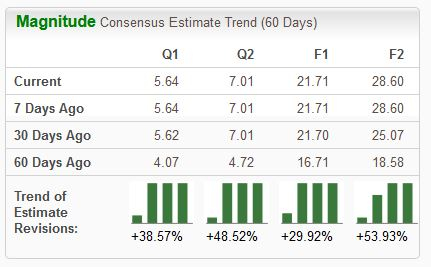

The company’s outlook has turned visibly bright, with earnings expectations melting higher across the board.

Image Source: Zacks Investment Research

Bottom Line

As the examples above show, utilizing the Zacks Rank can consistently result in market-beating gains, as positive earnings estimate revisions provide the fuel needed for shares to move higher.

All three stocks above – NVIDIA NVDA, Super Micro Computer SMCI, and Deckers Outdoor DECK – presently sport a Zacks Rank #1 (Strong Buy), reflecting upward trending earnings estimate revisions.

To learn much more about how you can use this proven system for market-beating gains, visit Zacks Rank Education.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners UpNVIDIA Corporation (NVDA) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.