As Amazon (NASDAQ: AMZN) approaches its next stock split, there's one question on everyone's mind: Will this operation launch a whole new wave of gains?

Amazon shares have wowed investors over time -- climbing more than 1,500% over the past 10 years. But in recent times, performance has been lackluster. For example, Amazon finished last year little changed.

Amazon isn't new to stock splits. The retail giant actually performed three of them in the past. They were all in a very short period of time nearly two decades ago.

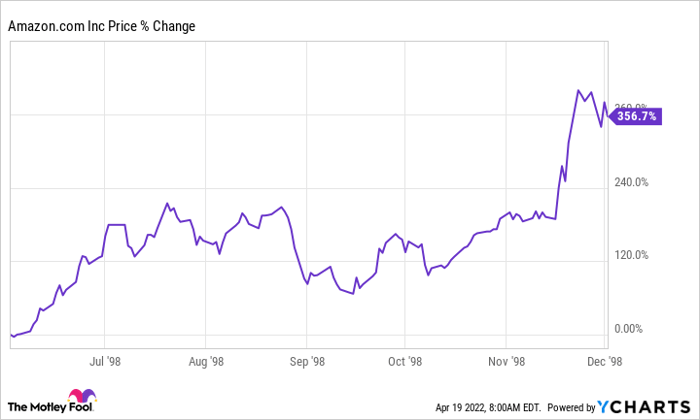

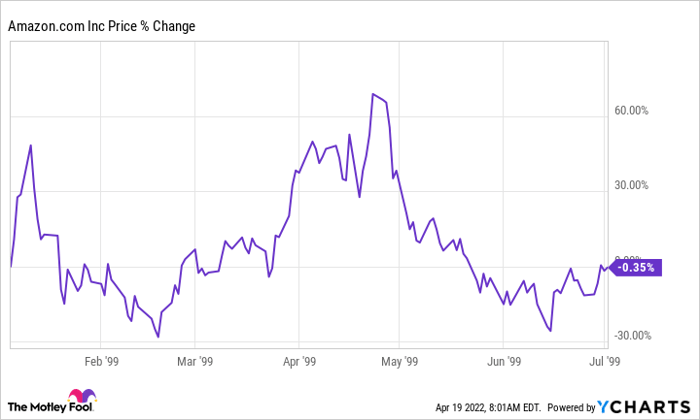

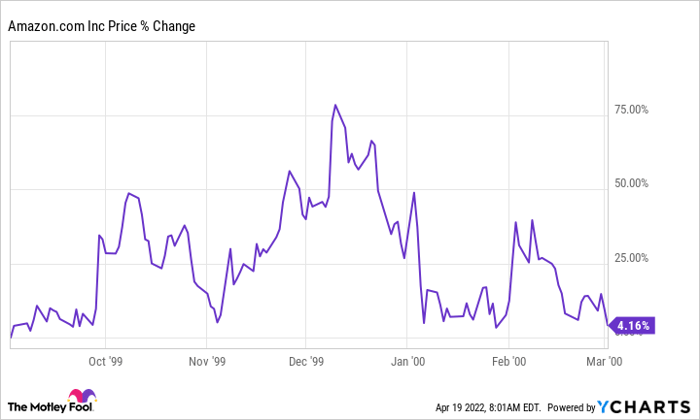

The upcoming stock split is set for early June. For a few clues as to what might happen, let's consider the following three charts. They each track share performance over the six months following the stock splits.

Image source: Getty Images.

First stock split

Our first chart shows Amazon's first stock split, which happened on June 2, 1998. Amazon shares climbed in the three months following the split, then gave back some of the gains before rising further. Over the full six-month period, the stock jumped more than 300%.

Our next chart shows the company's second stock split, which took place on Jan. 5, 1999. The stock immediately climbed -- then sank. It picked up some momentum a few months later, but finished the six months little changed.

Finally, the third chart shows what happened after Amazon's third stock split. This one dates back to Sept. 2, 1999. Following the pattern of the first split, the stock climbed in the first three months after the operation. Then it fell -- and didn't rebound much. By the end of the six-month period, the stock had only increased about 4%.

What does this mean for investors?

After seeing lackluster performance following two of the three past splits, should investors be worried? Not if you're a long-term investor.

The only performance we can truly link to the actual split is in the very short term. That's due to new investors getting in on the stock or current investors adjusting their positions in the days following the split. Beyond that point, any gains or losses aren't due to the stock split itself. Instead, they're most likely linked to company news -- or what's happening in the economy and how that may impact the company.

It's also worth noting that Amazon was a very different company back in the late 1990s and early 2000s. Two key parts of Amazon didn't yet exist. I'm talking about the Prime subscription service and Amazon Web Services. They launched in 2007 and 2006, respectively.

It's a good idea to look at the above charts and understand Amazon's performance following its previous stock splits. It's part of the company's general story, after all. And importantly, it shows us that stock splits don't drive a stock's performance over time.

10 stocks we like better than Amazon

When our award-winning analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Amazon wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of April 7, 2022

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adria Cimino owns Amazon. The Motley Fool owns and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.